Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Shin-Min Joon, Edaily Reporter] On the 19th shares of Korean biopharmaceutical companies Olix and Hanmi Pharmaceutical both developing new drugs for Metabolic Dysfunction-Associated Steatohepatitis (MASH) posted notable gains.

The surge was driven by optimism surrounding the MASH market after global pharma giant Roche announced plans to acquire a MASH drug developer for approximately 5 trillion won. Additionally Ildong Pharmaceutical’s stock rose after a previously paywalled article from Pharmedaily regarding its obesity drug trial was made publicly available.

| | Olix stock trend on Sep 19. (Image=MP Doctor) |

|

Roche to Acquire MASH Drug Developer for 5 Trillion Won According to KG Zeroin’s MP DOCTOR (formerly Market Point), shares of Olix rose 18.46% on the day to 100,100 won. The surge followed news that Roche will acquire 89Bio, a U.S.-based MASH drug developer, for up to $3.5 billion (approximately 5 trillion won), with the deal expected to close in Q4 of this year. After the acquisition, 89Bio will be integrated into Roche’s pharmaceutical division.

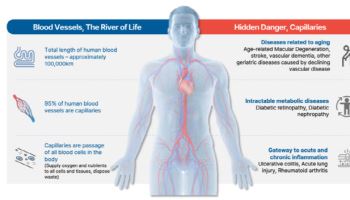

89Bio is currently conducting Phase 3 trials for its MASH drug candidate, pegozafermin. MASH is a chronic liver disease associated with obesity and metabolic disorders, potentially progressing to fibrosis, cirrhosis, and liver-related mortality. In 2023, 89Bio’s Phase 2b trial showed promising results in fibrosis improvement. The company is expected to release Phase 3 results in the first half of 2027.

Olix previously licensed its own MASH and obesity treatment candidate, OLX702A, to Eli Lilly in February for $630 million (approx. 911.7 billion won at the time). OLX702A is based on promising genetic targets identified through genome-wide association studies (GWAS), a method for finding disease-related genes by analyzing genomic variations in large populations.

Preclinical studies demonstrated that OLX702A not only showed efficacy in MASH and liver fibrosis, but also in other cardiovascular and metabolic diseases. Currently, a Phase 1 trial is ongoing in Australia, with the Clinical Study Report (CSR) expected in the first half of next year.

In addition to its MASH drug, Olix is also developing OLX301A for wet age-related macular degeneration and OLX104C for male-pattern hair loss. OLX301A is undergoing Phase 1 trials, with a CSR expected within the year. OLX104C completed its Phase 1a trial in January.

An Olix representative stated, “Roche’s acquisition of 89Bio has increased expectations for the MASH treatment market.”

Hanmi Pharmaceutical’s Triple Agonist Draws Attention Shares of Hanmi Pharmaceutical also jumped 8.42% to 360,500 won. The rally appears to be driven by investor optimism over the company’s MASH drug pipeline. Hanmi currently has two MASH drug candidates under development. One of them, efocipegtrutide, is in Phase 2b trials in both Korea and the United States.

Efocipegtrutide is a long-acting triple agonist that targets glucagon, glucose-dependent insulinotropic polypeptide (GIP), and glucagon-like peptide-1 (GLP-1), enhanced through Hanmi’s LAPSCOVERY platform. It has received Fast Track designation from the U.S. Food and Drug Administration (FDA) based on promising results in preclinical and early-phase trials.

Hanmi also out licensed epinopegdutide to Merck (MSD) in 2020, which is now in Phase 2 trials. Results are expected by year end. Epinopegdutide is a long acting dual agonist targeting GLP-1 and glucagon receptors.

With obesity and diabetes on the rise, the global MASH drug market is expected to expand. Market research firm DataM Intelligence forecasts that the MASH treatment market will grow from $7.8 billion (approx. 11 trillion won) in 2024 to $31.8 billion (approx. 44 trillion won) by 2033.

A Hanmi spokesperson said, “Hanmi is exploring innovative drug development across various therapeutic areas, not limited to specific diseases, and expanding its pipeline accordingly.”

Ildong’s Oral Obesity Drug Raises Hopes Ildong Pharmaceutical shares rose 7.90% to 30,050 won, driven by anticipation over the upcoming topline results of its Phase 1 trial for the oral obesity drug ID110521156. Among Korean companies Ildong is leading in the clinical development of oral obesity drugs. Interim results have already shown competitive weight loss efficacy compared to global players.

A Pharmedaily article released on the day stated that the key lies in high dose data though even low doses have already proven effective. The article suggested that global benchmark results may be attainable.

ID110521156 achieved an average weight loss of 6.9% after four weeks in its Phase 1 interim results. The drug outperformed rivals such as Roche and Viking Therapeutics across both low and high dose groups.

Unlike injectable GLP-1 peptide drugs like Wegovy or Mounjaro ID110521156 is a small molecule GLP-1 agonist enabling better gastrointestinal absorption and higher success potential as an oral formulation.

The drug also showed only mild gastrointestinal side effects. In comparison Viking Therapeutics had a treatment discontinuation rate of 20% due to adverse effects. Ildong is expected to present topline data from the trial during a company presentation (NDR) for institutional investors on the 29th.

Ildong stated in a recent disclosure “We will hold an investor presentation on the 29th for institutional investors and analysts to enhance understanding and boost corporate value” adding “Topline results from the Phase 1 trial of ID110521156 will be revealed during the session.”

![알테오젠, 일시적 투심하락 관망세 전환…삼양바이오팜 가파른 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300239b.jpg)