Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Seok Jihoen, Edaily Reporter] South Korean biotech stocks rallied sharply Wednesday, buoyed by news of potential tariff relief on pharmaceutical imports. The KRX Healthcare Index, which tracks 71 pharmaceutical and biotech stocks, surged 5.43%, with 70 of the 71 constituents closing higher.

3billion which generates over 70% of its revenue overseas, saw its stock jump more than 10%, driven by optimism that U.S. tariffs on drug imports may be deferred. Shares of Prestige BioPharmaalso gained over 10%, with investors hopeful the company’s essential drugs would remain shielded from trade friction. PeopleBio surged more than 12% after unveiling promising research on a blood based dementia diagnostic test.

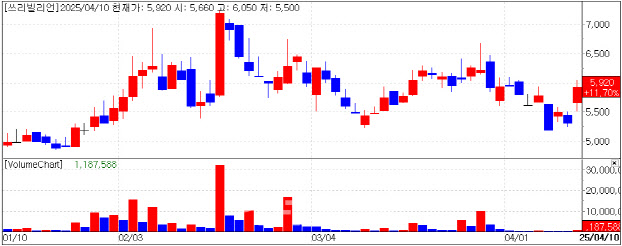

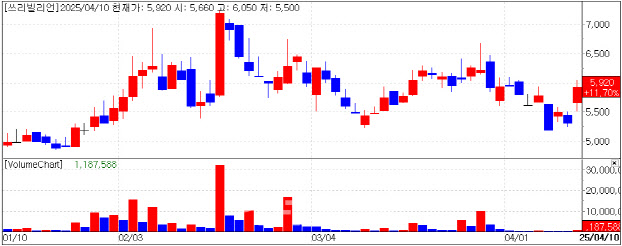

| | Recent Stock Performance of 3billion. (KG Zeroin’s MP Doctor) |

|

“Growing Regardless of Tariff Policy” According to MP Doctor, a stock analysis platform run by KG Zeroin, shares of 3billion closed at 5,920 won, up 620 won or 11.7% from the previous day. The company had not released any new announcements, but the rally was largely attributed to investor relief over the U.S. administration’s softened stance on drug import tariffs.

CEO Changwon Keum told Edaily, “I believe the rebound was driven by easing concerns surrounding U.S. tariffs, which had previously weighed on the stock.” He added, “With more than 70% of our sales coming from overseas and a U.S. subsidiary already in place, our growth in the U.S. market is largely insulated from tariff risks.”

Founded in 2016 as a spin-off from Macrogen, 3billion specializes in rare disease genetic testing powered by artificial intelligence. The company currently operates in more than 70 countries and plans to expand to 100 nations this year. Its AI platform analyzes 100,000 genetic variants in under five minutes with 99.4% accuracy.

Overseas revenue accounted for 75% of total sales this year, up from 70% last year, fueled by rapid growth in North America and Asia. 3billion is also moving into AIbased drug discovery, with several candidates currently undergoing early-stage biological validation.

“Alongside growth in diagnostics, our drug development pipeline will be another key point of interest for investors,” Keum said.

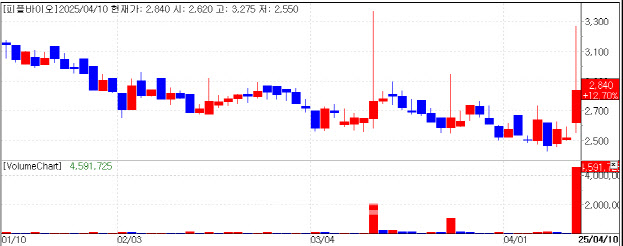

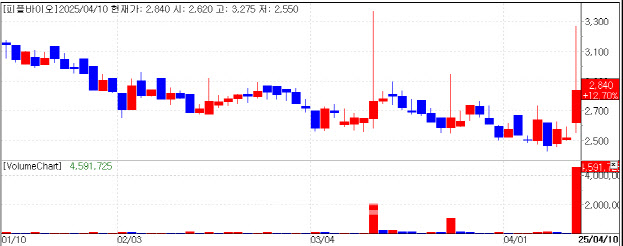

| | Recent Stock Performance of Prestige Biopharma. (KG Zeroin’s MP Doctor) |

|

Prestige BioPharma Seen as “Tariff-Safe” Shares of Prestige BioPharma surged 12.3% to close at 13,700 won. The company is developing a novel pancreatic cancer therapy for the U.S. market, and sentiment was lifted by expectations that essential drugs like cancer treatments will be exempt from new tariffs proposed under the Trump administration.

A company spokesperson said, “We don’t believe even Trump would go so far as to block cancer medications. Moreover, our biosimilar business stands to benefit from policies that aim to lower drug prices.”

Industry officials widely expect essential medicines will be excluded even if drug tariffs are enforced. One source familiar with discussions with the U.S. Food and Drug Administration (FDA) said the agency is not anticipating tariffs on essential pharmaceuticals.

Prestige BioPharma’s pipeline is heavily focused on cancer treatments. Its pancreatic cancer antibody drug PBP1510 is currently undergoing a Phase 1/2a clinical trial in the U.S. The company plans to apply for the FDA’s Fast Track designation upon completion to accelerate the development and approval process.

The group is also pursuing U.S. current Good Manufacturing Practice (cGMP) certification through its CDMO arm, Prestige Biologics, which is preparing to launch the Avastin biosimilar HD204 in the U.S. The company obtained EU-GMP certification in 2022, and expects to secure U.S. cGMP approval this year through its state of the art single use manufacturing system.

| | Recent Stock Performance of PeopleBio. (KG Zeroin’s MP Doctor) |

|

Dementia Test Boosts Shares PeopleBio stock rose 12.7% to 2,840 won after the company revealed new data on a blood-based diagnostic test for neurodegenerative diseases at the ADPD 2025 conference in Vienna, Austria.

The test detects TDP-43 protein oligomers, a pathological hallmark of frontotemporal dementia (FTD) and amyotrophic lateral sclerosis (ALS). TDP-43 is also known to cause LATE (Limbic-predominant Age-related TDP-43 Encephalopathy), a condition often misdiagnosed as Alzheimer’s disease due to overlapping symptoms.

Unlike monomeric forms of the protein, TDP-43 oligomers are pathogenic. PeopleBio has developed a monoclonal antibody called 1T47 that selectively identifies these harmful aggregates. The test showed statistically significant results in patients with semantic dementia (SD)-a subtype of FTD marked by language deficits-offering potential for early diagnosis.

FTD accounts for approximately 5-10% of all dementia cases, but up to 20-50% of early-onset dementia. The company emphasized that its findings support the potential of TDP-43-targeted blood diagnostics. Further clinical validation is planned with the goal of commercialization.

CEO Seongmin Kang attributed the stock rally to “renewed investor interest amid a generally improving market sentiment.”

![2% Royalty Shock at Alteogen Ripples Through Korean Biotech[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012200181b.jpg)

!['2% 로열티'가 무너뜨린 신뢰…알테오젠發 바이오株 동반 하락[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012201091b.jpg)