Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Saemi, Edaily Reporter] On the 26th, shares of NIBEC Co., Ltd. surged 15 percent in the biopharma and healthcare sector after uncertainty over ‘NewCo’ eased, drawing investor attention back to the company. In contrast, stocks of extracellular matrix (ECM)-based skin booster players such as L&C BIO Co., LTD (L&C Bio) and HansBiomed Corporation (HansBiomed) plunged as the government moved to regulate the use of donated human tissue in cosmetic and plastic surgery procedures.

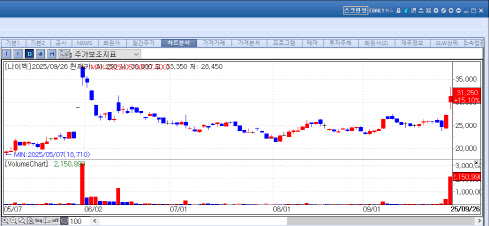

NIBEC Gains on Eased NewCo Concerns According to MP Doctor (formerly Market Point) data, NIBEC closed at 31,250 won, up 4,100 won (15.1 percent) from the previous session.

| | NIBEC Stock Trend (Source: KG Zeroin MP Doctor) |

|

The rally followed Pfizer’s acquisition of Metsera, which had licensed platform technology from D&D Pharmatech. This validated the NewCo model and dispelled doubts around NIBEC. Hye-min Heo, an analyst at Kiwoom Securities, noted, “Considering Metsera initially operated in stealth mode without even a homepage, investors should understand that many NewCo firms tend not to disclose much in the early stages.”

Back in May, NIBEC signed a $435 million (595.3 billion won) license-out deal with a U.S.-based biopharma company, though it has withheld the partner’s name. “The lack of disclosure on the partner and the absence of sufficient clinical data to verify the efficacy of NIBEC’s key pipelines mean the company still needs to secure greater market trust,” Heo added.

Skepticism is expected to be dispelled once NP-201 enters Phase 2 trials, which will be led by NIBEC’s partner. Since U.S. clinical trial databases identify trial sponsors, the partner will effectively be revealed when the trial begins.

NIBEC also plans to present an obesity-related poster at the Peptide Therapeutics Symposium on October 22, and will share data on its blood-brain barrier shuttle platform at the CNS Drug Delivery Summit on December 10.

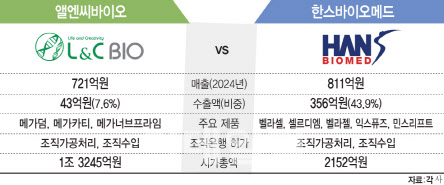

Regulatory Risk Cools ECM Skin Booster Stocks Investor enthusiasm for ECM-based skin booster stocks, which had been running hot, cooled sharply after the Ministry of Health and Welfare raised concerns about the use of donated human tissue (skin) in non-therapeutic cosmetic and plastic procedures. Officials said such use could discourage public donation and pledged to work with the Ministry of Food and Drug Safety to prepare regulatory measures.

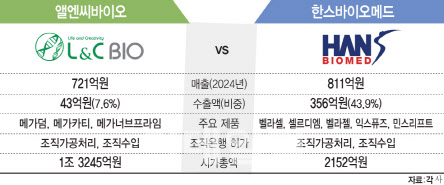

L&C Bio’s shares plunged 16.89 percent, or 10,200 won, closing at 50,200 won, the second steepest decline on KOSDAQ. HansBiomed, a smaller-cap rival, was hit even harder, sinking 27.25 percent, or 4,930 won, to 13,160 won―the biggest fall on KOSDAQ that day. HansBiomed’s heavier blow was partly attributed to its smaller market capitalization of 244.7 billion won as of September 25, just 16.5 percent of L&C Bio’s 1.49 trillion won.

| | Comparison of L&C Bio and HansBiomed [Graphic by Kim Ilhwan, Edaily] |

|

HansBiomed recently fast-tracked its entry into the ECM skin booster market with the early launch of “CellDM” on the 22nd. The company has established overseas subsidiaries in the U.S., Thailand, and the U.K., with exports of 25.2 billion won in the first half accounting for 38.2 percent of sales. It plans to leverage its existing sales network to accelerate domestic and global market penetration.

L&C Bio pioneered the Korean ECM skin booster market with “Ellavie ReDeux,” launched in November last year, the first to use human acellular dermal matrix (hADM). With more than 1,000 client clinics, the product has gained traction rapidly. Its domestic partner, Humedix, has strong networks in dermatology and plastic surgery.

Industry insiders believe the regulatory risk will have limited direct impact, since both companies rely mainly on imported human tissue. L&C Bio sources over 95 percent of raw materials from U.S. tissue banks, while HansBiomed imports 100 percent. The proposed regulation specifically targets the use of domestically donated tissue for non-therapeutic purposes.

“The ECM skin booster market is still in its early stages, so the regulatory framework is incomplete,” said an industry source. “This should be seen as part of the process of legal and regulatory refinement. At this stage, enforcement will likely be advisory rather than mandatory, and we don’t see an immediate direct impact on ECM skin booster sales.”

LigaChemBio Falls Again; Dismisses Rumors Separately, LigaChem Biosciences Inc. (LigaChem Bio) fell for a third straight session, prompting the company to address market speculation.

LigaChem Bio’s shares had climbed to 167,700 won intraday on the 23rd, but then dropped for three consecutive days: down 3,800 won (-2.37 percent) on the 24th, 9,800 won (-6.26 percent) on the 25th, and 4,300 won (-2.93 percent) on the 26th, closing at 142,400 won.

In a statement on the morning of the 26th, LigaChem Bio said, “Due to macroeconomic factors and related supply-demand impacts, our stock price fell sharply yesterday, which appears to have fueled unfounded concerns about the company in the market. These concerns are baseless, and both our R&D and business development operations are progressing smoothly.”

Still, the downward trend persisted. A company official emphasized, “Our ongoing clinical programs―including HER2-ADC, ROR1-ADC, and TROP2-ADC―are all progressing well. Recently, the Phase 1 trial for HER2-ADC in China was completed. While we cannot specify the timing of a license-out deal, multiple discussions are underway without disruption.”

![Alteogen Sees Temporary Dip in Investor Sentiment Market Turns Cautious[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300236b.jpg)

![알테오젠, 일시적 투심하락 관망세 전환…삼양바이오팜 가파른 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300239b.jpg)