Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Seungkwon Kim, Edaily Reporter] Shares of several Korean biopharmaceutical companies rocketed Friday after clinical-trial milestones and a high-value license-out agreement ignited buying across the sector.

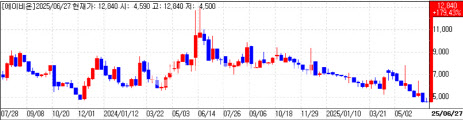

Key drivers behind Eutilex sudden surge Eutilex Co. hit its 30 percent daily trading limit, closing at 2,140 won, up 491 won, valuing the cell-therapy developer at 78.8 billion won ($58 million). Investors piled in ahead of an interim Phase 1 readout for its CAR-T therapy EU307, scheduled for next month at the Asia-Pacific Primary Liver Cancer Expert meeting (APPLE) in Kobe, Japan.

PharmEdaily first reported the pending data release in a June 22 pay-to-read article titled “Eutilex’s Solid-Tumor CAR-T to Show Interim Data in Japan Next Month,” which was later distributed free on major portals. The report, traders said, helped fan anticipation of positive results.

| | Eutilex daily share-price trend (Data: KG Zeroin) |

|

EU307 is designed to attack glypican-3, an antigen highly expressed on hepatocellular carcinoma cells but absent from healthy liver tissue. Unlike the six CAR-T therapies cleared by the U.S. Food and Drug Administration all for blood cancers EU307 aims to conquer the long-standing challenges of solid tumors.

Eutilex obtained Korean Phase 1 clearance in 2023 for an open-label study of up to 12 patients with relapsed or refractory liver cancer. About half the cohort has been dosed. Yonsei University’s Prof. Kim Do-young will present safety and early efficacy findings in Kobe, the company said.

“APPLE will showcase EU307’s potential,” CEO Yoo Yeon-ho said, noting that Eutilex has strengthened its R&D bench with industry-seasoned leaders.

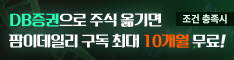

Abion’s antibody deal electrifies trading Abion Co. also closed at its daily ceiling for a third straight session, ending 30 percent higher at 9,880 won. The oncology firm disclosed this week a license-out agreement for ABN501 an antibody targeting claudin-3 and four other proteins with an undisclosed partner.

Total deal value could reach $1.32 billion, including an upfront payment of $25 million and development milestones of up to $290 million. Commercial milestones may add another $1 billion.

| | Abion weekly share-price trend (Data: KG Zeroin) |

|

Molecular diagnostics company Genecurix Ltd. jumped 29.8 percent to 2,355 won after announcing a strategic partnership with German diagnostics heavyweight Qiagen. Genecurix will be the first official developer under Qiagen’s QIAcuityDxFour digital-PCR platform, extending its reach into global precision-medicine markets.

“This partnership is a pivotal marker in Genecurix’s global expansion, following our recent commercialization pact in Japan with Hitachi High-Tech,” CEO Cho Sang-rae said, pledging further collaborations to drive growth.

![[옥석 가리는 AI의료]김영웅 디지털헬스산업협회장 "AI의료 옥석가리기 시대, 역량 강화가 생존 열...](https://image.edaily.co.kr/images/vision/files/NP/S/2025/09/PS25091700181b.jpg)

![[옥석 가리는 AI의료]루닛 이후 2세대 기업도 1조 클럽 가능…뜨는 다크호스는](https://image.edaily.co.kr/images/vision/files/NP/S/2025/09/PS25091700167b.jpg)

![[단독]디앤디파마텍 “MASH藥 DD01, 24주차 투약군서 체중·당화혈색소 감소 확인”](https://image.edaily.co.kr/images/vision/files/NP/S/2025/09/PS25091800495b.jpg)