Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Shin Min-joon, Edaily Reporter] On the 27th the South Korean pharmaceutical and biotechnology stock market saw notable gains in the share prices of Olipass, Bridge Biotherapeutics, and HLB Therapeutics.

Olipass despite facing the risk of being designated as a management stock, hit the upper price limit following news that the company was considering a capital increase through the issuance of convertible bonds(CB) alongside a change in its largest shareholder.

Bridge Biotherapeutics’stock rose on expectations surrounding the upcoming release of topline results from its Phase 2 global clinical trial for an idiopathic pulmonary fibrosis treatment next month. HLB Therapeutics’ stock saw a positive impact due to the increased potential for technology transfer after completing the final patient dosing and follow up observation for its Phase 3 European clinical trial of a neurotrophic keratitis (NK) treatment.

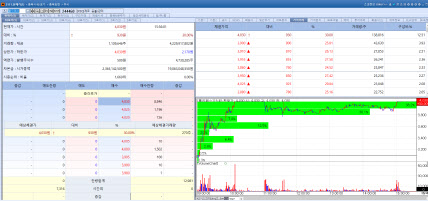

| | Olipass stock trend on Mar 27. (Image=MP Doctor) |

|

Olipass Considers Issuing Convertible Bonds Amid Shareholder Change According to KG Zeroin MP Doctor Olipass’ stock surged 30.00% from the previous day, closing at 4030 won. The rally was attributed to reports that Olipass is undergoing a change in its largest shareholder and considering the issuance of convertible bonds (CB).

Olipass is a drug research and development company focused on RNA based gene therapy, particularly in the development of non opioid analgesics. Although it was listed on the KOSDAQ market in 2019, its research is still in the early Phase 2a clinical stage, with only two technology transfer deals to date one of which was terminated early.

Olipass is expected to be designated as a management stock due to failing to meet last year’s revenue requirements. The company recorded sales of 1.9 billion won in 2023, falling short of the 3 billion won threshold required for KOSDAQ listing maintenance.

Currently, Olipass is conducting a 4 billion won capital increase through a rights offering, which involves a change in its largest shareholder. On March 19, the designated recipient changed from BM Mulsan to Genocure, with the new share issuance price set at 5640 won per share, and payment was due by today.

In an announcement, Olipass stated, “The number of new shares to be issued is 709,220, with the expected listing date set for April 21.”

Genocure reportedly holds an exclusive sales contract with Olipass for polydeoxyribonucleotide (PDRN) pharmaceuticals and cosmetic medical device raw materials. Genocure’s CEO, Oh Bo kyung, and Vice Chairman, Kim Tae hyun, joined Olipass’ board of directors as internal directors during an extraordinary general meeting last November.

Since December of last year, former CEO Jeong shin stepped down from his position, and the company has been led by co CEOs Lee Jin han Lee and Son Hyeong seok. On March 25, Olipass’ stock unexpectedly hit the upper price limit, prompting the Korea Exchange to issue a disclosure inquiry regarding the sharp price movement.

In a disclosure the previous day Olipass stated “We are considering issuing convertible bonds for operational and facility funding however no final decisions have been made yet. The issuance terms and success of investment attraction may change depending on future conditions.”

Bridge Biotherapeutics Focuses on Technology Transfer for Idiopathic Pulmonary Fibrosis Treatment Bridge Biotherapeutics’ stock climbed 10.03% from the previous day to 8230 won. The company is pursuing management normalization through a strategy of selection and focus.

Currently Bridge Biotherapeutics is concentrating all its efforts on the technology transfer of BBT-877, its IPF treatment candidate. BBT-877 works by selectively inhibiting autotaxin, a novel target protein that plays a key role in pulmonary fibrosis development.

BBT-877 was licensed from LegoChem Biosciences in 2017 and is currently undergoing a global multi country Phase 2 clinical trial. Previously, Bridge Biotherapeutics discontinued clinical trials for its non small cell lung cancer treatment (BBT-176) and retinal disease treatment (BBT-212) to focus its resources on its primary pipeline.

The topline results for BBT-877’s Phase 2 trial are expected to be released next month. The company is reportedly conducting due diligence with global pharmaceutical firms under confidentiality agreements.

Since its founding in 2015, Bridge Biotherapeutics has successfully completed two technology transfer deals. In 2018, it transferred its ulcerative colitis treatment candidate (BBT-401) to Daewoong Pharmaceutical for approximately 44 billion won. In 2019, it transferred its IPF treatment candidate (BBT-877) to Germany’s Boehringer Ingelheim for around 1.5 trillion won.

A Bridge Biotherapeutics representative stated “The market’s expectations for the upcoming topline results of BBT-877’s Phase 2 trial, which were discussed during our corporate presentation yesterday, appear to be reflected in the stock price.”

HLB Therapeutics Completes Patient Follow-Up in European Phase 3 Trial for NK Treatment HLB Therapeutics’ stock rose 9.18% from the previous day, closing at 9160 won. The company, through its U.S. subsidiary ReGenTree, has completed final patient dosing and two weeks of follow up observation for its Phase 3 European clinical trial of RGN-259, a treatment for neurotrophic keratitis (NK) and has now entered the final analysis stage.

HLB Therapeutics plans to conduct a data review with clinical sites and relevant institutions before proceeding with data lock and final statistical analysis as soon as possible. The company aims to expedite the most time consuming step the posttrial data review process to swiftly derive topline results for the primary efficacy endpoint.

The European Phase 3 trial for RGN-259 began in June 2023 at 25 hospitals across Spain, Italy, Poland, and Germany. Since the first patient was enrolled in August 2023, a total of 78 patients exceeding the original target participated in the trial over a span of about 20 months. This achievement accelerated the timeline by approximately four months compared to the initial projection.

RGN-259 is expected to be a gamechanger if it obtains marketing approval as an NK treatment due to its high patient convenience compared to existing therapies. Currently, the only globally approved NK treatment is Oxervate, developed by Italy’s Dompe.

While Oxervate requires a long eight week administration period, a complex dosing regimen and is associated with discomfort and various side effects, RGN-259 offers a simpler alternative as a single use eye drop. With a short four week administration period, RGN-259 significantly improves patient convenience.

An HLB Therapeutics representative stated “The final patient dosing and follow up observation for our European Phase 3 trial of the NK treatment have been completed. We will now focus all our efforts on deriving the topline results and securing detailed analysis data as quickly as possible.”

They added “If the anticipated high efficacy of RGN-259 is confirmed, we expect to accelerate licensing out negotiations with global pharmaceutical companies that have been awaiting the results of the European Phase 3 trial.”

![인도, 글로벌 저가 제네릭에서 바이오 허브로 탈바꿈[제약·바이오 해외토픽]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020700379b.jpg)