Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Shin-Min Joon, Edaily Reporter] On September 29 shares of IlDong Pharmaceutical, AbClon and GL PharmTech(GL Pharm) stood out in the South Korean biopharmaceutical market with notable gains. IlDong Pharmaceutical attracted strong buying interest after reporting meaningful results from a phase 1 clinical trial of its oral obesity and diabetes drug candidate ID110521156. The drug is expected to become a best in class treatment showing superior weight loss effects compared to other oral obesity medications and no serious gastrointestinal or liver related side effects.

AbClon‘s stock rebounded on heightened expectations for the development of its next generation CAR-T cell therapy. Meanwhile GL PharmTech saw its shares rise due to multiple favorable factors, including the upcoming approval of Korea’s first dry eye treatment based on Recoveflavone and a recent reprieve from being designated as an unfaithful disclosure company.

| | IlDong Pharmaceutical stock trend on Sep 29. (Image=MP Doctor) |

|

IlDong Pharmaceutical Soars on Promising Oral Obesity Drug Data IlDong Pharmaceutical‘s stock surged 26.07% to 33,900 won, marking its second consecutive day of gains. The rally followed the release of top line data from the phase 1 clinical trial of its oral obesity and diabetes candidate ID110521156 which demonstrated significant weight loss effects.

ID110521156, a GLP-1 receptor agonist, mimics the GLP-1 hormone that regulates insulin secretion, blood glucose levels, gastrointestinal motility, and appetite suppression.

The phase 1 study conducted in a randomized double blind, placebo controlled format was designed to evaluate the drug’s safety tolerability and pharmacological profile through single ascending dose (SAD) and multiple-ascending dose (MAD) studies.

In the SAD study, the drug maintained effective plasma concentrations for more than 18 hours, with a maximum of 24 hours. The MAD study confirmed favorable pharmacokinetics with no drug accumulation and minimal dietary influence supporting once daily oral dosing.

Conducted on 36 healthy adults, the MAD trial divided participants into three cohorts (50mg, 100mg, 200mg), each receiving the drug daily for 28 days. Weight reduction was dose dependent, with average reductions of 5.5%, 6.9% and 9.9% observed in the 50mg, 100mg, and 200mg groups, respectively. The maximum weight loss in the 200mg group reached 13.8%.

Over 5% weight loss was observed in 87.5% of the 200mg cohort compared to 66.7% and 55.6% in the 100mg and 50mg cohorts while the placebo group showed no such outcome. IlDong aims to begin global phase 2 trials next year and is actively pursuing licensing deals to commercialize the drug.

“This study confirms ID110521156’s strong weight loss efficacy and favorable safety profile making it a competitive candidate in the GLP-1 class,” a company official said.

“Despite being orally administered, the drug shows excellent absorption and stable blood concentration without accumulation along with efficient manufacturing and cost advantages that support commercialization.”

AbClon Rebounds on CAR-T Therapy Expectations AbClon’s shares climbed 13.89% to 17,880 won. The company is accelerating development of its CAR-T cell therapy candidate, Nespesel (AT101), which recently received designation as an advanced biopharmaceutical for expedited review by the Ministry of Food and Drug Safety (MFDS).

Nespesel a next generation CAR-T therapy for blood cancers uses AbClon’s proprietary humanized antibody h1218 to target the membrane proximal region of the CD19 antigen. This confers rapid binding and dissociation properties.

The fast track designation allows priority review shorter evaluation times, and exemptions from some clinical trial data requirements. Nespesel is currently in phase 2 trials and is aiming for regulatory approval by next year.

In May interim phase 2 data showed an objective response rate (ORR) of 94% and complete response rate (CRR) of 63%, outperforming existing CAR-T therapies such as Kymriah (ORR 50%, CRR 32%) and Yescarta (ORR 72%, CRR 51%).

“It’s unusual for fast track approval to be granted just two months after application” a biotech industry source commented. “Nespesel is especially promising for high risk patients unresponsive to existing CAR-T therapies raising hopes for commercialization.”

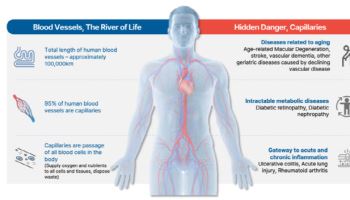

GL PharmTech Rises on Dry Eye Drug and Regulatory Relief GL PharmTech’s stock rose 7.42% to 1,158 won. The company in partnership with Aju Pharm is preparing to submit a New Drug Application (NDA) for Korea’s first dry eye treatment based on lecithin derived compound Recoveflavone, aiming for market launch next year.

The investigational drug GLH8NDE demonstrated both safety and efficacy in phase 3 trials showing statistically significant improvement in primary and secondary endpoints compared to placebo. No significant adverse events were reported.

GLH8NDE, which originated from DongA ST and was licensed in by GL PharmTech in 2017 underwent formulation enhancements to improve ocular absorption supported by two composition patents.

The dry eye market in Korea is estimated at 500 billion won and growing. GLH8NDE’s superior efficacy and lower risk of side effects position it as a strong new treatment option.

GL PharmTech was also recently granted a reprieve from being designated an unfaithful disclosure firm following a canceled merger with its wholly owned subsidiary GL Pharma. The cancellation was due to regulatory code conflicts and the potential for added costs related to product disposal.

“We plan to revisit the merger after regulatory systems are improved” a company representative said.

![Alteogen Sees Temporary Dip in Investor Sentiment Market Turns Cautious[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300236b.jpg)

![알테오젠, 일시적 투심하락 관망세 전환…삼양바이오팜 가파른 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300239b.jpg)