Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

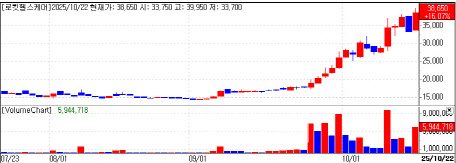

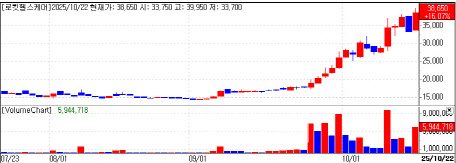

[Seungkwon Kim, Edaily Reporter] Rokit Healthcare’s share price more than doubled over the past month, while SK Chemicals also saw a sharp rise amid renewed optimism across the Korean biotechnology sector. The KOSPI surged another 1.5% on Tuesday to a record 3,883 points, and bio stocks followed the upward trend.

According to KG Zeroin, Rokit Healthcare closed at 38,650 won, up 16% from the previous day. The stock has been on a remarkable climb since early September, jumping from around 14,000 won to the upper 30,000-won range. The rally comes after the company announced that it had received public insurance reimbursement in the U.S. for its diabetic foot regeneration treatment.

| | Rokit Healthcare price (data=KG Zeroin) |

|

Rokit Healthcare said a major tertiary hospital in the U.S. has accepted public insurance coverage for its AI-based regenerative therapy for diabetic foot ulcers. This marks the first case in which AI-driven autologous tissue regeneration has been officially recognized as a medical procedure under the U.S. public insurance CPT system, which the company considers a significant milestone.

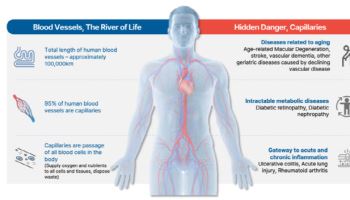

The firm noted that official recognition in the U.S. implies both safety and efficacy validation. This development has sparked expectations that commercialization of Rokit Healthcare’s AI organ-regeneration platform will expand not only across the U.S. but also in Europe and the Middle East. The company combines AI, medical 3D bioprinting, and single-use medical kits to develop regenerative treatments for diabetic patients’ feet. Its technology uses autologous tissue-derived extracellular matrix (ECM) printed into patch form for wound coverage, achieving an average 82% regeneration success rate. Treatment costs are estimated at one-fourth of traditional diabetic foot surgery or wound care methods.

CEO You Seok-hwan stated, “This is the first case of an AI-based regenerative medical procedure being incorporated into the U.S. official insurance system. We expect global insurance approvals to accelerate rapidly. Rokit Healthcare aims to usher in the era of personalized regenerative medicine, moving beyond mass treatment approaches.”

| | T&R Bio (data=KG Zeroin) |

|

SK Chemicals also soared following news that it signed a memorandum of understanding (MOU) with AriBio for expanded development and global commercialization of AR1001 (mirodenafil), an oral Alzheimer’s therapy. AR1001 is based on mirodenafil, originally developed by SK Chemicals and licensed to AriBio in 2011. AriBio is currently conducting Phase 3 global clinical trials across 13 countries to verify the drug’s efficacy and safety.

Under the new MOU, the two companies will collaborate on next-generation formulations of mirodenafil, joint global trials, and AR1001’s commercial manufacturing and export. The agreement reflects their shared confidence in the ongoing Phase 3 program and the drug’s commercialization potential. AriBio’s POLARIS-AD Phase 3 study has enrolled 1,535 patients across the U.S., Europe, Korea, and China. The company plans to complete the trial in the first half of 2026, disclose top-line results, and submit a New Drug Application (NDA) to the U.S. FDA by the end of the same year.

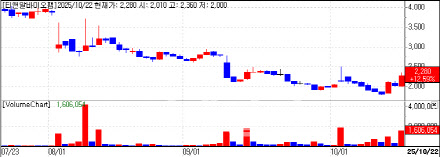

Meanwhile, T&R Biofab closed at 2,280 won, up 13% from the previous session. The company’s rising stock price has been supported by investor confidence in its capital increase and new product outlook. T&R Biofab announced that its rights offering achieved an oversubscription rate of 102.15%, with strong participation from existing shareholders. The offering totaled 15.9 million new shares, with total subscriptions reaching 16.2 million shares. Foreign investors have also been net buyers for five consecutive trading days, accumulating approximately 437,400 shares.

![Alteogen Sees Temporary Dip in Investor Sentiment Market Turns Cautious[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300236b.jpg)

![알테오젠, 일시적 투심하락 관망세 전환…삼양바이오팜 가파른 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300239b.jpg)