Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Yu Jin-hee, Edaily Reporter] SEOUL, South Korea-On September 12, South Korea’s stock market saw biotech names surge, led by L&C Bio and Medipost. With L&C Bio poised to reclaim the 60,000 won level and Medipost buoyed by expectations of a major catalyst, investor attention is expected to remain focused on their corporate value trajectories in the near term.

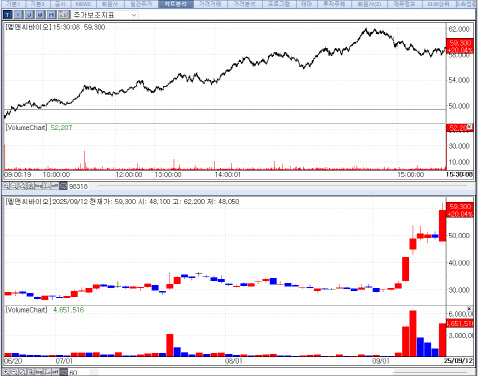

| | Recent stock price trend of L&C Bio. (Source: KG Zeroin MP Doctor) |

|

L&C Bio Doubles Market Value in September Alone According to KG Zeroin’s MP Doctor (formerly MarketPoint), L&C Bio, Medipost, and Caregen ranked among the top 20 gainers in the Korean market, closing up 20.04% (59,300 won), 19.26% (14,430 won), and 14.39% (62,000 won), respectively.

The spotlight was firmly on L&C Bio, which has risen in seven of the past ten trading sessions, sending its market capitalization soaring 101.7% so far this month. Analysts suggest further upside remains.

The company’s momentum stems from its skin booster “Elravie Rituo” (Rituo), launched domestically in February. The product replenishes extracellular matrix (ECM) components such as collagen, elastin, fibronectin, laminin, tenascin, growth factors, and matrix metalloproteinases (MMPs) to stimulate cell regeneration. Its key raw material, human acellular dermal matrix (hADM), is approved by the Ministry of Food and Drug Safety.

Skin boosters-injectable formulations that deliver nutrients and active ingredients directly into the dermis-are increasingly popular globally, especially amid rising trust in K-beauty exports. Rituo has already seen supply shortages due to demand, with expectations that sales expansion could push L&C Bio’s annual revenue above 100 billion won for the first time next year. The company plans to double its distribution network from 1,000 clinics to more than 2,000 by year-end.

Market growth also looks robust. Grand View Research projects the global skin booster market will expand from $1.08 billion in 2023 to $2.1 billion in 2030. L&C Bio says it is responding to demand by introducing two-shift manufacturing and constructing new facilities, with raw materials secured for more than two years.

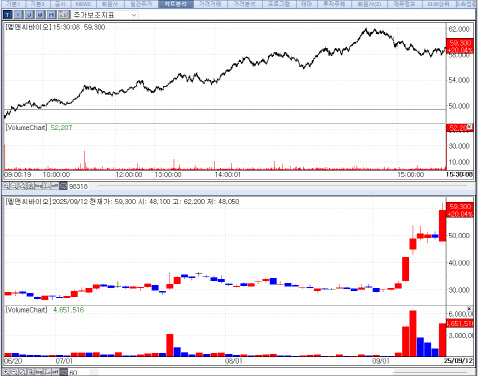

| | Recent stock price trend of Medipost. (Source: KG Zeroin MP Doctor) |

|

Medipost Rallies on Capital-Raising Prospects Medipost also attracted investor enthusiasm, with analysts expecting sustained value creation rather than a one-off surge. Driving the stock’s rally was the prospect of raising more than 250 billion won to fund U.S. Phase 3 clinical trials for its knee osteoarthritis stem cell therapy, Cartistem.

The company has established itself as a rare biotech that combines profitability with a promising pipeline. Medipost surpassed 70 billion won in revenue last year on the back of its cord blood business and is on track to reach 80 billion won this year. If Cartistem enters the U.S. market, some analysts believe Medipost could break into the KOSDAQ’s top 10 by market capitalization.

The fundraising outlook is seen as a green light for Cartistem’s U.S. development, with FDA discussions ongoing regarding trial protocol. Meanwhile, the company has completed patient dosing in its Japanese Phase 3 trial, with one-year follow-up already finished for many participants.

A Medipost spokesperson commented, “Our stem cell therapy and cord blood businesses are delivering stable results. We will leverage this to accelerate global expansion and next-generation drug development.”

Also making gains was Caregen, which announced a $7.6 million (106 billion won) supply agreement with Turkish biotech Atabay for three functional food products-Coglutaide, Myoki, and Progisterol.

The deal will begin with hospital channel test marketing over two years before expanding into a broader, long-term supply contract across online and offline distribution. Turkiye has one of Europe’s highest diabetes prevalence rates, with 9.6 million adults affected, and high obesity rates, making it an attractive market.

“Partnering with Atabay, which has nationwide distribution and sales networks, will accelerate our market entry,” a Caregen official said. “We will continue to globalize our proprietary peptide platform across metabolic, muscle, and obesity-related functional foods.”

![Alteogen Sees Temporary Dip in Investor Sentiment Market Turns Cautious[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300236b.jpg)

![알테오젠, 일시적 투심하락 관망세 전환…삼양바이오팜 가파른 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300239b.jpg)