Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Song Young Doo, Edaily Rporter] Rokit Healthcare shares surged after the company’s regenerative therapy was officially recognized as a medical service in the United States. The recognition in the world’s largest healthcare market raises expectations that regenerative medicine may soon enter institutional healthcare systems globally. Huons Global also advanced on strong foreign investor buying, while Sears Technology rose on optimism surrounding its inpatient monitoring platform.

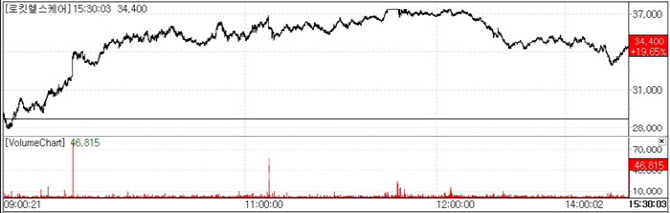

| | Rokit Healthcare stock trend (Source: KG Zeroin MP Doctor) |

|

According to MP Doctor(formerly Market Point) under KG Zeroin, Rokit Healthcare closed at 34,400, up 19.65%(5,650) from the previous day near its 52 week high of 37,350. The sharp rise followed the company’s announcement that it had received public insurance reimbursement from a major U.S. tertiary hospital for its AI-based diabetic foot regenerative treatment.

Rokit Healthcare explained that this represents the official recognition of its AI-driven autologous tissue regeneration therapy under the U.S. public insurance system(CPT code), marking a meaningful milestone for AI-based regenerative medicine.

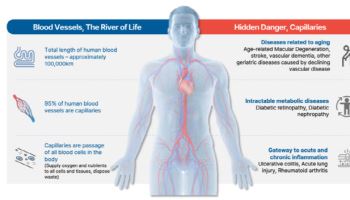

The company emphasized that official recognition as a medical procedure in the United States also implies validation of both efficacy and safety. This milestone is expected to accelerate institutional adoption of AI regenerative platforms?covering skin, cartilage, and kidney regeneration?across the U.S., Europe, and the Middle East. Rokit Healthcare combines AI, medical 3D bioprinting, and single-use surgical kits to develop a proprietary organ regeneration platform for diabetic foot treatment.

The company’s diabetic foot therapy uses a 3D bioprinted patch made from the patient’s own adipose-derived extracellular matrix(ECM) to regenerate damaged skin. The treatment has achieved an average regeneration success rate of 82% with a single procedure, and reduces costs to roughly one-fourth of traditional methods such as amputation or wound management.

CEO Yoo Suk-hwan stated, “This marks the first case of AI-based regenerative medicine being integrated into the U.S. official insurance system, which will accelerate global insurance approvals. Through our AI-autologous regeneration platform, we aim to usher in the transition from ‘mass treatment’ to ‘personalized regeneration.’”

Huons Global Gains on Subsidiary Potential and Foreign Buying Huons Global also saw a sharp rally, rising 19.14%(9,400) to close at 58,500. After a month-long correction phase its share price was 44,950 on September 16 the stock rebounded strongly from October 15 onward.

Company officials said the surge was not driven by a single event but by foreign investors’ interest in the growth potential of its subsidiaries. Foreign investors were net buyers of 102,408 shares that day, increasing their holdings from 917,284 to 1,044,763 shares, pushing their ownership above 8%.

Market observers attribute the foreign interest to growing attention on Huons Lab, a Huons Global subsidiary developing human hyaluronidase(HLB3-002) a technology that enables conversion of intravenous(IV) drugs into subcutaneous(SC) formulations. This field is currently dominated by Alteogen and Halozyme, whose technologies are already used in blockbuster drugs such as Keytruda to develop self-injectable SC versions.

Huons Lab began developing human hyaluronidase in December 2019, initiated Phase 1 clinical trials last year, and plans to seek Korean Ministry of Food and Drug Safety(MFDS) approval next year. If commercialized, analysts believe HLB3-002 could emerge as a new global growth driver.

Another subsidiary, PanGen a biosimilar and CDMO company will be responsible for manufacturing Huons Lab’s hyaluronidase. PanGen shares also rose 4.8%(290) to close at 6,330.

Sears Technology Rallies on ‘Think’ Platform Momentum Sears Technology gained 7.48%(5,100) to finish at 73,300, buoyed by growing expectations for its inpatient monitoring platform “Think.”

The rally followed a PharmEdaily feature titled “[Medical AI Dark Horse] Sears Technology’s ‘Think’ Platform on Track for Record Performance (Part 4)” published earlier in the day. According to the article, since its launch in 2021, Think expanded from 40 beds in 2022 to 90 in 2023, then to 840 beds last year, and already to 3,000 beds in the first half of 2025.

Sears Technology expects the adoption rate to accelerate in the second half of the year, with 13,000 new bed installations already secured. A company official noted, “Following completion of 3,000 beds in the first half, we secured an additional 13,000 in the second half, and will continue expanding through active sales efforts in Q4.”

As a result, the company’s annual revenue forecast has been revised upward from 30 billion to nearly 40 billion, reflecting rapid growth momentum in hospital AI monitoring adoption.

![Alteogen Sees Temporary Dip in Investor Sentiment Market Turns Cautious[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300236b.jpg)

![알테오젠, 일시적 투심하락 관망세 전환…삼양바이오팜 가파른 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300239b.jpg)