Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

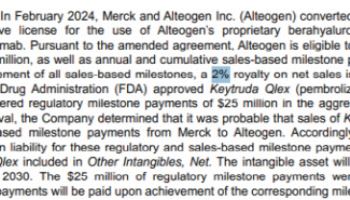

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

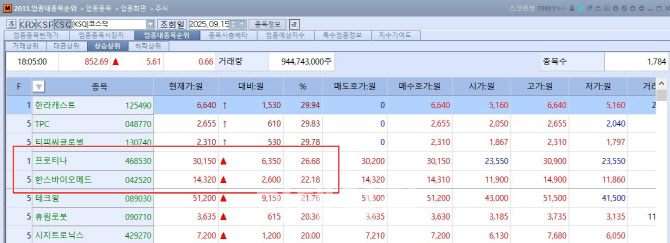

[Kim Saemi, Edaily Reporter] On Sept. 15, Korea’s biotech and healthcare sector saw sharp moves, led by PROTEINA CO., LTD. (Proteina), a protein- protein interaction (PPI) big data company, which soared 26.28% to close at 30,150 won. HansBiomed Corporation (HansBioMed) jumped more than 20%, while L&C BIO Co., LTD. (L&C Bio) and Bio Plus Co., Ltd. (BioPlus) also gained, drawing investor attention to next-generation skin booster makers. By contrast, Syntekabio, Inc. (Syntekabio) plunged on concerns over a planned rights offering.

| | Top Gainers on KOSDAQ, Sept. 15 (Source: KG Zeroin MP Doctor, formerly Market Point) |

|

Investor Frenzy for Post-Rejuran Skin Boosters Shares of HansBiomed, L&C Bio, and BioPlus-companies rolling out novel skin boosters-spiked in tandem. HansBioMed led the rally, finishing at 14,320 won, up 2,600 won (22.18%), according to KG Zeroin’s MP Doctor platform. L&C Bio advanced 9.11%, while BioPlus added 7.14%.

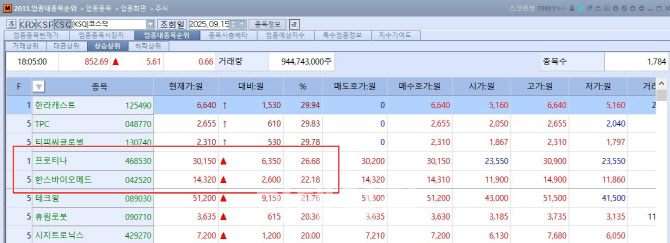

HansBioMed plans to officially launch its extracellular matrix (ECM)-based skin booster CellREDM™ on Sept. 29. Unlike existing skin boosters such as Rejuran, which stimulate collagen production by improving the skin’s environment, CellREDM directly replenishes collagen using human acellular dermal matrix (hADM). The product features ultra-fine 75 μm particles designed to deliver collagen more evenly and richly.

HansBioMed is not the first mover in hADM-based skin boosters. L&C Bio launched Re2O, the world’s first hADM-based skin booster, in Korea last November. Re2O surpassed 1,000 domestic client accounts as of last month and even saw temporary sell-outs on social media, fueling its stock rally. L&C Bio is building an additional production facility for Re2O, aiming for regulatory approval by year-end.

BioPlus, meanwhile, has developed a topical cell booster, Shine+Aura, using its proprietary Anti-Ubiquitination Technology (AUT) to block protein degradation and Bio-Material Transdermal System (BMTS) to improve skin penetration. This enables large-molecule growth factors to permeate deep into the skin. The product incorporates HUGRO, a new ingredient brand combining growth factors such as EGF and IGF with BioPlus’s patented technologies.

“Investors are increasingly searching for a ‘post-Rejuran’ opportunity, fueling interest in differentiated skin boosters,” said a healthcare industry source. “While Rejuran pioneered the market, newcomers are seeking to capture share with novel mechanisms.”

Proteina Rebounds Above 30,000 Won Despite Overhang Risks Proteina surged 6,350 won (26.68%) to close at 30,150 won. At one point during intraday trading, the stock hit the upper limit of 30,900 won, up 29.83%, before easing back in late afternoon.

The company specializes in analyzing PPI through its SPID (single protein interaction detection) platform, quantifying molecular interactions and applying them to drug discovery. Building on its proprietary data, Proteina aims to become the global leader in AI-driven drug candidate identification.

Proteina went public on the KOSDAQ on July 29 via the tech-special listing route. Its shares more than doubled from the IPO price of 14,000 won, but volatility has increased amid overhang concerns. LB Investment cut its stake from 7.98% to 6.22% on Aug. 8, followed by JPMorgan Asset Management trimming from 5.16% to 2.89% on Aug. 10. Additional lock-up expirations loom?1.5 million shares on Sept. 29 and about 2 million on Oct. 29.

Despite these headwinds, Proteina rebounded from the 23,000 won range last week to reclaim the 30,000 won level. Its market capitalization now stands at 327.8 billion won. “We believe the market sees the valuation as still undervalued,” a company official said.

Syntekabio Plunges on $24M Rights Offering Plan Syntekabio tumbled 1,080 won (19.89%) to 4,350 won, making it the worst performer on KOSDAQ, after announcing a large-scale rights issue. The company plans to raise 32.3 billion won ($24 million) through a shareholder-allotted public offering?the largest capital increase since its founding. The allocation ratio is 0.59 new shares per existing share.

| | The top decliner on KOSDAQ on Sept. 15 was Syntekabio. (Source: KG Zeroin MP Doctor) |

|

Of the proceeds, 18.7 billion won will go toward debt repayment, 11.3 billion won to working capital, and 2.3 billion won to facilities. With outstanding bonds totaling 18.7 billion won, the company expects the capital raise to improve its financial structure.

Syntekabio said the rights offering aims to secure long-term growth capacity rather than short-term liquidity, positioning itself as a globally competitive AI drug discovery firm. “This rights issue is about enhancing corporate value in the long run, not just meeting immediate liquidity needs,” a company official said. “We are already generating revenue from contracts with domestic and international partners and expect to deliver stronger results next year.”

![Alteogen Sees Temporary Dip in Investor Sentiment Market Turns Cautious[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300236b.jpg)

![알테오젠, 일시적 투심하락 관망세 전환…삼양바이오팜 가파른 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012300239b.jpg)