[By Yoo Sung, Head of Bio-Platform, PharmEdaily] SEOUL, June 11 (PharmEdaily).

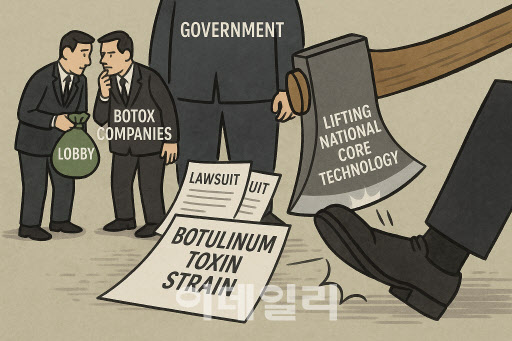

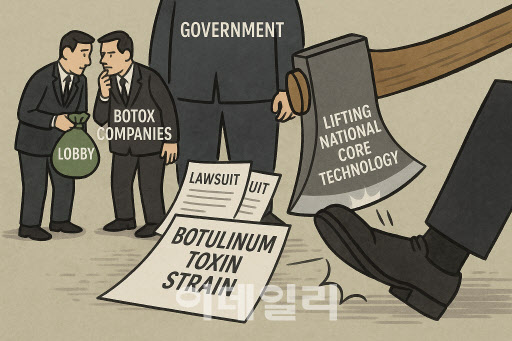

A new controversy is unfolding in South Korea’s botulinum toxin industry that could shake the foundation of its biotech ambitions. A faction of companies is lobbying the government to remove botulinum strain and toxin production technologies from the list of national core technologies, a designation meant to safeguard assets vital to economic and national security.

Their argument: the strain has little remaining technological value, and its designation hampers overseas expansion due to burdensome export requirements. In response, the Ministry of Trade, Industry and Energy is reportedly reviewing the possibility of delisting botulinum-related technologies from the national core list.

South Korea’s national core technologies are defined under the Act on Prevention of Divulgence and Protection of Industrial Technology. These technologies are deemed essential for national defense or economic growth, and their unauthorized transfer abroad could cause significant harm. More than 70 technologies currently hold this designation including those in semiconductors, biotechnology, and electronics.

The production strain and process for botulinum toxin are included due to their high strategic and commercial value. Exporting or transferring this technology, or even conducting M&A activities involving it, requires prior approval from the ministry.

| | Image by ChatGPT |

|

Beyond commercial importance, botulinum toxin poses a dire security risk. A single gram of purified toxin has the potential to kill millions making it one of the most potent biochemical agents known. South Korea’s National Intelligence Service and its counterparts in the U.S., Europe, and Japan enforce strict controls for this reason.

Despite the dangers, some Korean firms are pushing to remove these protections, citing barriers to exports and global competitiveness. However, critics argue that this would amount to a strategic blunder effectively disarming one of K-Bio’s most successful sectors.

Supporters of the status quo say that national safeguards enabled Korean firms to secure global competitiveness in record time. South Korea now boasts over 20 botulinum toxin manufacturers, the largest number worldwide aggressively expanding into the U.S., China, and other major markets. In contrast, the U.S., which holds roughly 50% of the global market, only has two to three such companies.

Removing the national core designation, they warn, could expose Korean firms to hostile takeovers from capital-rich foreign players, particularly China, which has shown consistent interest in acquiring domestic biotechs.

Moreover, given ongoing lawsuits over strain theft among Korean firms, opponents caution that the push to delist could be a veiled attempt by tainted players to reset the rules in their favor.

A more balanced solution, they suggest, would be to streamline export procedures and bolster government support, rather than dismantle the very framework that fostered K-Bio’s global rise.

The debate underscores a deeper tension within South Korea’s biotech ecosystem between unbridled globalization and safeguarding the homegrown assets that enabled its success.

![i-Sens Soars 23% on EU CGM Expansion [K-bio pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021300327b.jpg)

![냉탕 온탕 오간 에이프릴바이오…실적 호조에 로킷·휴젤 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021200275b.jpg)

!["美진출하려면 中임상해도 美환자 최소 20% 참여해야"[제약·바이오 해외토픽]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021400157b.jpg)