Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Lim Jeong-yeo, Edaily Reporter] Stocks of Helixmith, CorestemChemon, and Curiox Biosystems posted gains in the Korean pharmaceutical and biotech stock market, Tuesday. Helixmith drew attention as expectations mounted over its flagship pipeline Engensis’ potential approval in China. CorestemChemon shares recovered from the recent slump following news of a rights offering. Curiox Biosystems also showed strong momentum despite its second-largest shareholder’s plan to sell shares.

| | (Cred=MP Doctor) |

|

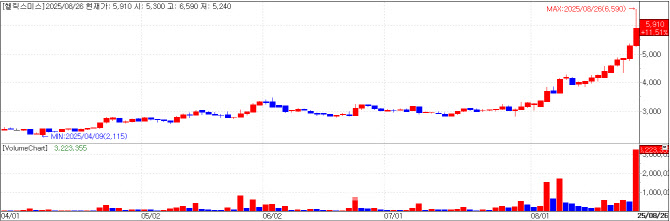

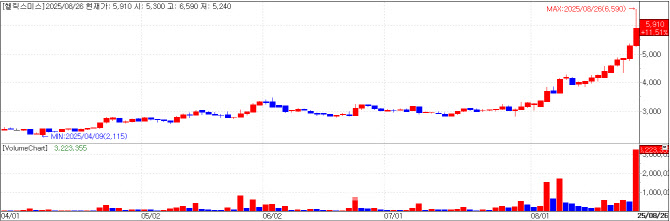

Helixmith: Engensis Nears China Approval According to KG Zeroin MP Doctor, shares of drug developer Helixmith on Tuesday closed at 5,910 won, up 11.51% (610 won) from the previous day, giving it a market capitalization of 272.4 billion won. The surge came amid investor anticipation that Engensis (NL003), Helixmith’s key pipeline, is close to receiving regulatory approval in China.

Edaily’s corporeal paper on this day ran a story on how Helixmith’s candidate therapy for critical limb ischemia (CLI) is on the verge of winning the green light in China. The same news had first been published on August 18 through PharmEdaily, Edaily’s premium pharma-biotech content service.

Engensis’ China approval will be a success in 20 years’ waiting, as Helixmith had licensed out the pipeline to China’s Northland Biotech in 2004. Internally, the company expects a regulatory decision between September and December. Following approval, Helixmith plans to expand global clinical trials through license-out deals or joint venture partnerships.

Helixmith’s upward momentum began since BioSolution became its largest shareholder in December 2023.

A BioSolution official said, “Helixmith aims to reduce its annual loss to 5 billion won this year and may even surpass that goal. The compnay has undergone restructuring and is now focusing commercialization efforts on the CLI therapy, which we believe has the highest success potential.” The official added, “If any tangible asset sales potentially materialize, both Helixmith and BioSolution could swiftly swing to profitability.”

| | (Cred=MP Doctor) |

|

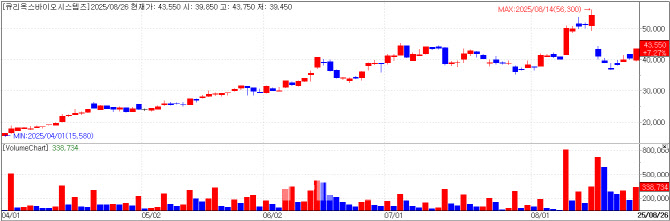

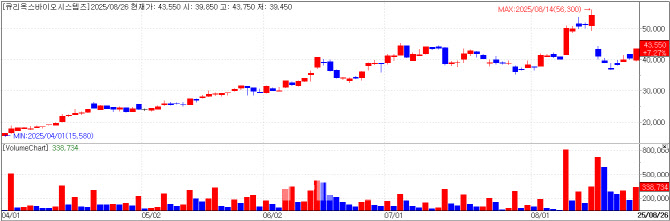

Curiox Biosystems: Resilient Despite Stake Sale by Second-Largest Shareholder Curiox Biosystems, a developer of next-generation biotechnology research equipment, closed at 43,550 won on Tuesday, up 7.27% (2,950 won) from the previous day, with a market capitalization of 734.9 billion won, according to KG Zeroin MP Doctor.

The company is focusing on driving revenue from its new product Pluto HT, which development was completed in June. While not yet reflected in second-quarter earnings, sales from overseas clients such as IMU Biosciences are expected to show starting in the third quarter.

Curiox has previously guided that it expects to reach breakeven in 2025. On August 14, however, the company cautioned on its bulletin board that achieving the previously forecasted annual business plan in full may prove difficult, citing weak investor sentiment in upstream markets as a barrier to new technology adoption.

Although no clear driver for the stock rally was reported this day, significant volumes of Curiox shares appear to be circulating in the market. Singapore-based investor ZIG Ventures, a founding-stage second-largest shareholder, disclosed plans to sell 345,000 common shares between August 21 and September 19 at 41,900 won per share, totaling 144.5 billion won. As a result, ZIG Ventures’ stake in Curiox will fall from 12.12% to 9.99%.

Edaily sought comment from Curiox Biosystems but did not receive a response.

| | (Cred=CorestemChemon) |

|

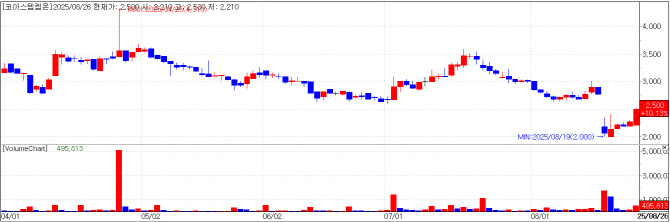

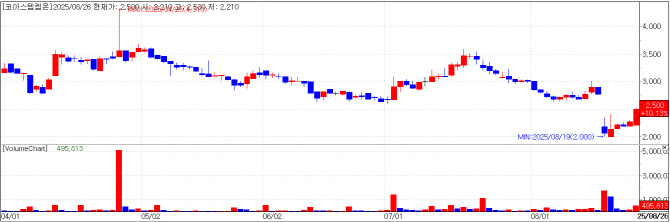

CorestemChemon: Stock Rebounds After Dilution-Driven Slump Stem cell therapy and preclinical CRO developer CorestemChemon on Tuesday saw its shares close at 2,500 won, up 10.13% (230 won) from the prior session, for a market capitalization of 82.2 billion won.

The stock had plunged after the company announced a 37.8 billion won rights offering on August 18, but it has since entered a recovery phase. Of the proceeds from this rights offering, CorestemChemon plans to use 24.3 billion won for debt repayment and 12.4 billion won for operating expenses, primarily to fund costs associated with filing a U.S. FDA Phase 3 trial and marketing authorization application for its ALS therapy Neuronata-R inj.

The company plans to hold a Type C pre-meeting with the FDA by year-end and submit a formal application in the third quarter of next year.

CorestemChemon shares collapsed in December 2023 after Neuronata-R failed to meet statistical significance in its Phase 3 trial. However, after narrowing the trial population to slow-progressing ALS patients, the company achieved statistical significance in topline data. Based on this, it filed for a label amendment with the Korean Ministry of Food and Drug Safety in April 2024. The regulator has requested additional data, which the company plans to submit by September 1.

Regardless of the MFDS decision on conditional approval, CorestemChemon intends to pursue an FDA application and expand into global markets.

Edaily attempted to reach the company for comment but was unsuccessful.