Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

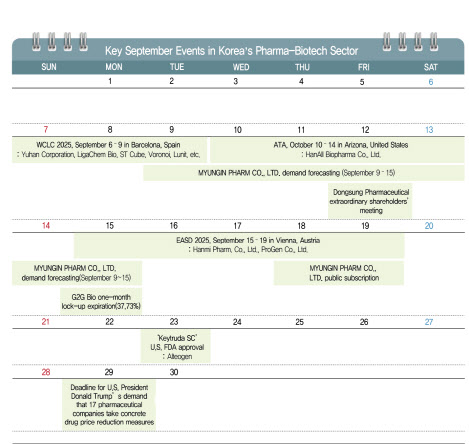

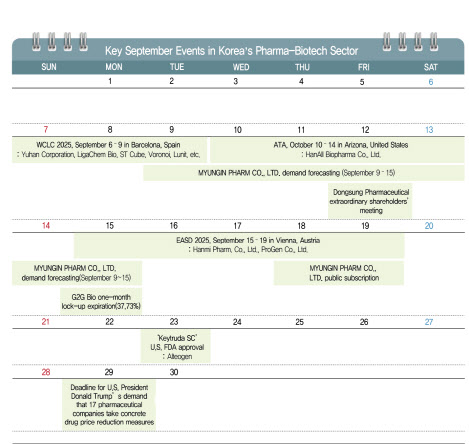

[Kim Saemi, Edaily Reporter]The most anticipated event in the Korean bio industry this September is the U.S. FDA approval of ‘Keytruda SC’. This is not just another new drug approval but could become a turning point that reshapes the global oncology market.

| | [Graphics by Lee Mina] |

|

Keytruda SC FDA Approval: A Global Oncology Game-Changer? Earlier this year, Merck (MSD) applied for FDA approval of Keytruda SC, aiming for a launch in October. The decision on the approval of Keytruda SC will be made by September 23. Last year, Keytruda generated $29.48 billion in sales, making it MSD’s largest revenue source and a mega-blockbuster drug.

With Keytruda‘s patent set to expire in 2028, MSD is preparing for a soft landing by incorporating Alteogen’s ‘ALT-B4’ platform technology. The strategy is to transition Keytruda from intravenous (IV) to subcutaneous (SC) injection, increasing patient convenience and minimizing revenue decline.

For Alteogen, this represents the first global commercialization of its ALT-B4 platform, boosting its corporate value. Moreover, it will break into the global SC market, previously dominated by Halozyme, proving its technology to global pharmaceutical companies. This could also clear up patent-related uncertainties that arose late last year. As demand from big pharma increases, further partnerships are expected.

Alteogen is set to receive milestone payments of up to 1.3 trillion KRW as part of the commercialization of Keytruda SC, along with royalties from sales. With royalty rates estimated at 4-5%, Alteogen expects annual profits in the range of hundreds of billions to trillions of KRW. Once the commercialization of Keytruda SC stabilizes, Alteogen plans to list on the KOSPI.

The FDA approval of Keytruda SC is also seen as a significant milestone for the domestic bio industry. It will mark the first instance of Korean biotechnology being applied and commercialized in a global blockbuster, which could enhance trust in the entire Korean bio sector.

In addition, Alteogen’s partner, Daiichi Sankyo, plans to start Phase 1 clinical trials for ‘Enhertu SC’ by September 30. The expansion of ALT-B4’s application to ADCs will likely be assessed by 2026.

EASD 2025: The Obesity Treatment Battle From September 15 to 19, the ‘European Association for the Study of Diabetes (EASD 2025)’ in Vienna will be a key battleground for the next-generation obesity treatments from Eli Lilly and Novo Nordisk. Korean pharmaceutical and bio companies’ research on obesity treatments will also be noteworthy.

At EASD 2025, Eli Lilly will present Phase 3 clinical data (ATTAIN-1) for its oral obesity treatment, ‘Orforglipron’. Despite showing a lower average weight loss rate of 12.4%, compared to the market forecast of 15%, Orforglipron still holds commercial potential. Detailed data will shed light on its market competitiveness.

Novo Nordisk will hold an obesity symposium and update on its next-generation obesity treatment, ‘CagriSema’. CagriSema is a combination of Wegovy and the amylin analogue cagrilintide, which achieved a 22.7% average weight loss at 68 weeks in its Phase 3 trial (REDEFINE-1), but fell short of its 25% target.

Hanmi Pharm. Co., Ltd. will also participate in EASD 2025, presenting six preclinical studies on next-generation obesity treatments, including the triple-action drug ‘HM15275’, the new obesity treatment ‘HM17321’, and the oral obesity treatment ‘HM101460’. Of particular interest is HM17321, which has shown significant improvements not only in weight loss but also in muscle, blood sugar, and cardiovascular health in obesity-prone primates.

ProGen Co., Ltd. will present three research outcomes on its dual-action GLP-1/GLP-2 candidate drug ‘PG-102’ at EASD 2025. PG-102, developed based on ProGen’s NTIG platform, is currently in Phase 2 trials for obesity and type 2 diabetes. The company will emphasize that PG-102 exhibits a differentiated weight and blood sugar control profile compared to existing GLP-1 drugs.

The World Lung Cancer Congress (WCLC) will take place in Barcelona from September 6 to 9. Companies such as Yuhan Corporation, LigaChem Biosciences Inc. (hereafter LigaChem Bio), ST Cube, and Voronoi will present their new drug achievements, while AI firm Lunit will showcase its biomarker platform, ‘Lunit Scope’, in research studies.

MYUNGIN Pharma IPO, G2G Bio Shares Unlock MYUNGIN PHARM CO., LTD., seen as a ‘major IPO candidate’, will conduct demand forecasting from September 9 to 15, with public subscription on September 18-19. Founded in 1985, MYUNGIN is known for its gum disease treatment ‘Igatan’ and constipation drug ‘Meikin’. On August 21, MYUNGIN submitted its securities report to the Financial Services Commission, starting the process for listing on the Korea Stock Exchange (KOSPI).

G2G Bio, which listed on the KOSDAQ via a technology special listing on August 14, will see the expiry of its one-month lock-up period on September 15. The unlocked shares amount to 2,105,770 shares, or 47.3% of the total shares issued, increasing the available shares to 3,651,506, or 68%. Analysts warn of potential stock price volatility due to the large-scale share release.

On September 29, the 60-day deadline for U.S. President Donald Trump’s demand for 17 major pharmaceutical companies to lower drug prices in the U.S. to the level of international prices will expire. If the U.S. drug price reduction policy is implemented, global pharmaceutical companies may delay or exclude the introduction of new drugs in Korea due to the country’s lower drug prices. Industry insiders warn that the U.S. drug price reduction could lead to restrictions on the domestic introduction of new global drugs, which could reduce treatment opportunities for patients, calling for a swift government response.

![Hyundai Pharma Surges on Misplaced Hair Loss Hopes...NanoEntek Hits Limit Up[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/12/PS25121000269b.jpg)

![장원석 세브란스병원 교수 "소아 뇌 수술시간 대폭 줄어…카이메로는 혁신"[전문가 인사이트]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/12/PS25121000483b.jpg)

!['상장 첫날 시총 2.8조' 에임드바이오, 코스닥 다크호스 급부상 [바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/12/PS25120500172b.jpg)