Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Jinsoo, Edaily Reporter] On Nov. 14, shares of Seers Technology and DRTECH jumped sharply after both companies posted stronger-than-expected earnings. PeopleBio, which announced a change in its largest shareholder and a transfer of management control the previous day, continued its upward momentum.

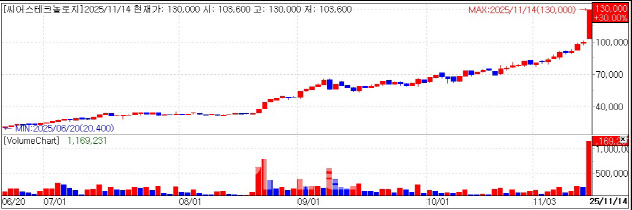

| | Seers Technology stock trend. (KG Zeroin’s MP Doctor) |

|

Seers Technology Emerges as a Leading Medical AI Stock According to KG Zeroin’s MP Doctor (formerly MarketPoint), Seers Technology’s share price climbed steadily throughout the day and hit the upper trading limit shortly before the market closed. The stock rose 30,000 won to finish at 130,000 won.

Seers Technology shares have gained 43.81% this week alone. On Oct. 30, the company surpassed the 80,000-won level and crossed a 1-trillion-won market capitalization; within just two weeks, its valuation has soared to 1.64 trillion won, surpassing Lunit’s 1.116 trillion won and establishing itself as a top player in Korea’s medical AI sector.

The rally was driven by the company’s strong third-quarter results. Seers Technology reported 157 billion won in revenue and 68 billion won in operating profit, far exceeding market consensus estimates of 149 billion won and 37 billion won, respectively. Compared with its first profitable quarter in Q2, revenue surged 98% and operating profit jumped 357%, marking the highest quarterly performance in the company’s history. Analysts say the results effectively confirm Seers Technology as the first Korean medical AI firm to achieve full-year profitability.

The company continues to stand out as the only medical AI business in Korea generating consistent profits. Its AI-based inpatient monitoring platform “Think” delivered 141 billion won in Q3 revenue, driving overall performance. Seers Technology has accumulated more than 17,000 orders and secured reference sites covering more than 6,000 hospital beds. As major tertiary hospitals begin full-scale adoption, revenue has accelerated sharply. With the platform currently applied to only about 2% of Korea’s 700,000 total hospital beds, analysts expect significant growth ahead.

The company’s wearable ECG analysis solution “Mobicare” also maintained strong momentum, posting 14 billion won in Q3 revenue. Mobicare has already matched last year’s full-year revenue of 3.7 billion won within the third quarter. The number of tests performed has surpassed 580,000, and the solution has been adopted by more than 1,000 medical institutions. Revenue from health-screening centers grew 88% year-over-year and 133% on a cumulative basis. With Q4 typically the peak season for health screenings, Mobicare’s performance is expected to accelerate further.

A Seers Technology official said, “Order volumes have increased sharply, which helped drive the strong results,” adding that the company expects 35~40% operating margins going forward as product supply continues to expand.

DRTECH Targets Full-Year Profit Shares of DRTECH rose 9.42% to close at 2,115 won. The stock gained traction after the company also reported stronger-than-expected quarterly results.

DRTECH posted 340 billion won in third-quarter revenue, up 28% from a year earlier and the highest quarterly figure in its history. Operating profit turned to a 17-billion-won profit from a 2.5-billion-won loss last year. The company attributed the performance to solid sales across its portfolio, including dental dynamic detectors, surgical C-arm systems, breast cancer diagnostic systems, and industrial detectors.

To expand its global presence, DRTECH is strengthening strategic B2B partnerships with major international customers. It has relocated and expanded its U.S. and European subsidiaries and significantly scaled up production facilities.

A DRTECH official said, “We are on track to surpass 1 trillion won in annual revenue this year,” adding, “Since we turned profitable from the second quarter, we are targeting full-year profitability as well.”

PeopleBio Jumps 16% on Strengthened Financial Position PeopleBio briefly hit the upper trading limit in the morning after touching the limit the previous day but later pared gains to close up 16.61% at 2,015 won. The rally is attributed to improved financial stability following a new investment deal.

On Nov. 13, PeopleBio announced it had secured 36 billion won in strategic investment from Eastern Networks and RealityGen to strengthen its capital structure and develop new growth drivers. The investment includes 27 billion won in perpetual convertible bonds and 9 billion won in a third-party paid-in capital increase.

With the deal, Eastern Networks became the company’s largest shareholder and assumed management control. CEO Kang Sung-min will remain on the board, but other directors will be replaced at next year’s general shareholders’ meeting with nominees from Eastern Networks.

The investment provides PeopleBio with a 40-billion-won capital boost, significantly improving its financial stability. The company’s debt ratio had deteriorated from 251.9% in June 2023 to 639.3% in the first half of 2024. PeopleBio was designated an “investment warning” issue due to a 62.8% capital impairment ratio in June and risked being placed under management controls if the issue was not resolved by year-end.

A PeopleBio official said, “This investment will allow us to significantly strengthen our financial structure and focus on stable business execution,” adding that the company plans to leverage Eastern Networks’ AI capabilities to expand beyond dementia diagnostics into a comprehensive platform for early detection and prevention of dementia.

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)

![힘스앤드허스 유사품에 노보노디스크·일라이릴리 흔들… 삼일천하(?)[클릭, 글로벌 제약·바이오]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020800574b.jpg)