Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Shin-Min Joon, Edaily Reporter] On April 18 shares of D&D Pharmatech and SG Healthcare posted notable gains on the Korean biopharma stock market. D&D Pharmatech rose on investor expectations surrounding its MASH (metabolic dysfunction associated steatohepatitis) therapy candidate,while SG Healthcare surged on progress toward entering the North American dental imaging device market.

Meanwhile Bridge Biotherapeutics continued its slide for a fourth consecutive day following a failed clinical trial for its key pipeline drug, casting uncertainty over its listing status on the KOSDAQ.

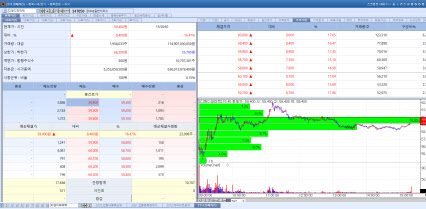

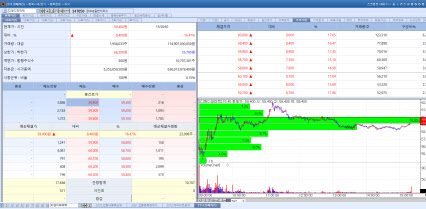

| | D&D Pharmatech stock trend on Apr 18. (Image=MP Doctor) |

|

D&D Pharmatech Gains on MASH Drug Development Hopes According to MP Doctor (formerly Market Point) by KG Zeroin, shares of D&D Pharmatech jumped 16.47% to close at 54,700 won. The rise was attributed to optimism over DD01, a metabolic disease-related steatohepatitis therapy under development by the company. D&D Pharmatech recently completed 12-week dosing for all patients in its U.S. Phase 2 clinical trial.

The company has now begun analyzing key data, including the primary endpoint MRI-PDFF (proton density fat fraction). D&D Pharmatech plans to announce results from this primary endpoint by June.

DD01 is a long acting dual agonist that simultaneously targets the GLP-1 (glucagon-like peptide-1) and glucagon receptors developed in-house by D&D Pharmatech. In a U.S. Phase 1 trial DD01 showed a 52.2% average reduction in liver fat in the high dose group among MASLD patients with obesity and type 2 diabetes.

Based on the 12week data, D&D Pharmatech plans to accelerate global strategic partnerships and is already in early discussions with multiple global pharmaceutical companies. Simultaneously dosing will continue through the 48-week mark with completion expected by year end. The company aims to evaluate and disclose results from biopsy based primary endpoints required for potential FDA approval in the first half of next year.

A company spokesperson commented “The 12week data from the Phase 2 trial will mark an important milestone in MASH treatment development. DD01 has so far demonstrated a favorable safety profile compared to competing drugs.”

The spokesperson added “Recent blinded data also showed a high proportion of patients experiencing significant fat reduction, fueling expectations for the upcoming June results. Once we secure strong primary endpoint data we will advance global partnerships and further accelerate clinical development.”

The company also emphasized its commitment to addressing the unmet medical need in MASH with a novel therapeutic option.

SG Healthcare Nears Entry into North American Dental Imaging Market Shares of SG Healthcare climbed 15.46% to 4,295 won. The company’s new dental CT product, HASLA, was officially listed in the U.S. Food and Drug Administration’s medical device directory. This listing marks a crucial step toward entering the North American dental imaging market.

HASLA is a next generation dental CT scanner known for its high-resolution imaging and user-friendly interface. It reduces scan time and radiation exposure, enhancing both patient safety and diagnostic efficiency. The device is applicable across various dental and oral surgery fields, including implant procedures.

FDA listing is considered a key step for medical device distribution and adoption in U.S. hospitals and clinics. SG Healthcare will now begin forging partnerships with local distributors and hospitals to expand HASLA’s reach. The company also plans to improve the product based on clinical use and feedback from the U.S. market, customizing it for broader global deployment.

SG Healthcare currently offers a full product lineup ranging from digital X-ray systems to AI-powered MRI machines and helium-free MRI models under the INVICTUS brand.

An SG Healthcare official said “HASLA’s FDA listing signifies that our product meets the technical and safety standards recognized by the agency. With listing code D565480 we can now begin marketing in the U.S.” The official added that the company plans to expand its global presence in regions including North and Latin America, Europe, and the Middle East.

Bridge Biotherapeutics Slides for Fourth Day After IPF Drug Failure Failure Shares of Bridge Biotherapeutics plunged 29.87% to close at 2,160 won. marking the fourth consecutive trading session of losses. The downturn followed disappointing results from a Phase 2 trial of its idiopathic pulmonary fibrosis (IPF) candidate, BBT-877 which failed to demonstrate a significant treatment effect.

IPF is a chronic progressive lung disease that leads to fibrosis and loss of lung function often resulting in death. On April 14 the company announced that BBT-877 had failed to meet its primary endpoint in the Phase 2 topline results. At Week 24 the forced vital capacity (FVC) in the BBT-877 group was -75.7 versus -50.2 in the placebo group with a p-value of 0.385, indicating no statistical significance.

Bridge Biotherapeutics is considering new indications for BBT-877 and plans to reprioritize its pipeline. Additional analysis of the IPF trial results is underway and the company is likely to continue nonclinical development for other potential indications.

There is also speculation that the company will pivot to its next lead candidate BBT-301. In December 2023, the FDA allowed Bridge Biotherapeutics to skip Phase 1 trials and proceed directly to Phase 2 for BBT-301, following a successful pre-IND meeting.

Although the Phase 2 trial was initially scheduled to begin in late 2024 it has yet to commence. The company plans to quickly reassess pipeline priorities and determine a new timeline for the trial.

Bridge Biotherapeutics now faces uncertainty over its KOSDAQ listing status. It was recently flagged as an under review company due to cumulative net losses exceeding 50% of equity capital in two of the past three fiscal years.

“We are exploring revenue generation strategies, including early license-outs of three clinical-stage pipeline assets” a company representative said. “We’re determined to overcome this crisis by aggressively cutting costs and pursuing all available fundraising options.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)