Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Seungkwon kim, Edaily Reporter] On October 2nd, stocks of companies in Korea‘s pharmaceutical, biotech, and healthcare sectors surged amid acquisition rumors or news of overseas subsidiary establishments. Companies recognized for their value in each field are showing steady upward trajectories.

Woojung Bio temporarily hit the daily limit after PharmDaily mentioned the possibility of a sale. Biodyne also surged after our publication reported news of its Vietnam subsidiary establishment.

Woojung Bio hits daily limit on HLB sale reports... What are the acquisition possibilities Woojung Bio was reported to be sold to HLB. This content was first reported in PharmDaily’s premium content on October 1st and was displayed for free on the Naver portal on this day. However, both Woojung Bio and HLB completely denied these acquisition rumors.

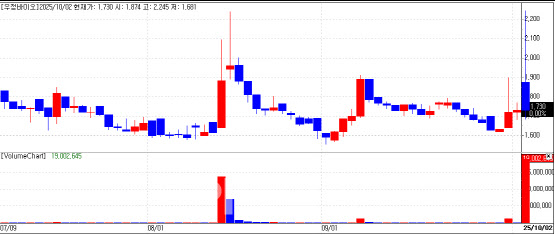

According to KG Zeroin, Woojung Bio‘s stock price traded at 2,245 won early in the session, up 29.77% from the previous day, before declining. This was after the company came forward with clarifications that there was no ongoing acquisition process.

A Woojung Bio representative said, “The acquisition rumors are groundless,” explaining that “Woojung Bio’s recent consecutive announcements of open innovation with artificial intelligence (AI) drug development companies have positively affected the stock price.”

| | Woojung Bio stock trend (Data=KG Zeroin) |

|

However, multiple sources in the capital market related to corporate M&A say that the sale discussions are factual. It is understood that Woojung Bio decided on a management rights sale and company executives have been directly meeting with potential buyers for some time. The sale target includes CEO Cheon Hee-jung‘s shares and shares of Cheon Se-jung (CEO Cheon’s sister), totaling 4,297,224 shares (25.78%). Woojung Bio is reportedly seeking 30 billion won for the 25.78% stake sale.

HLB is among the acquisition candidates being discussed. The acquisition discussions are reportedly being led primarily by HLB Biostep.

However, the company is completely denying this. An HLB representative said, “No behind-the-scenes work related to the acquisition is underway.”

There are reportedly significant differences in valuation between both sides. While Woojung Bio is holding firm on a sale price of around 30 billion won, companies with acquisition interest reportedly consider it too expensive.

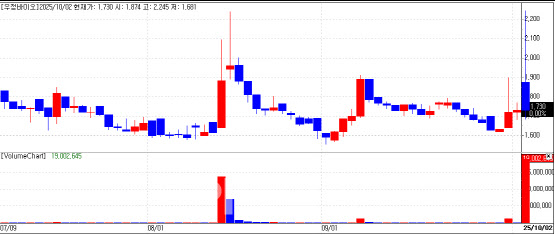

Biodyne surges on Vietnam subsidiary establishment... ToolGen jumps more than double in 3 months The company decided to invest in a Vietnam subsidiary last August and completed a 15,000㎡ factory site contract and Vietnam subsidiary establishment in September at the Clean Industrial Complex in Hung Yen Province near Hanoi, Vietnam (an industrial complex developed by LH Corporation). The Vietnam subsidiary investment is for future production of ‘EarlyPop Brush’ and non-gynecological diagnostic reagents, which are expected to see increased demand.

A company representative said, “We will complete licensing procedures for factory construction within this year, begin construction next year, and enable production from 2027,” adding, “Since the site is large, we plan to execute investments in phases 1 and 2 if product demand increases further.”

| | Biodyne stock trend (Data=KG Zeroin) |

|

Currently, Biodyne has facilities capable of producing EarlyPop Brushes at its Seoul Seongdong-gu headquarters. At maximum capacity with two shifts, 5 million brushes can be produced there immediately. Initial supply is at a manageable level. When the Vietnam factory is completed in 2027, the maximum production capacity for EarlyPop Brushes will expand to 50 million units.

The reason the company quickly secured an EarlyPop Brush production factory is that global launch is scheduled to begin as early as the end of this year. A Biodyne representative explained, “We are currently preparing to launch EarlyPop Brush in Japan and Russia. The launch will begin at the end of this year or early next year.”

The company announced it plans to sell EarlyPop Brushes through existing client companies in Japan and Russia. Since Biodyne‘s Japanese partner for the cervical cancer diagnostic equipment ’PathFinder‘ was Japan Roche, and the Russian partner was BIOLINE, it can be inferred that EarlyPop Brush partnerships were also formed with these companies.

Biodyne has an exclusive contract with Roche for global sales rights of its self-developed cervical cancer diagnostic equipment, with sales beginning this year. The company has selected EarlyPop Brush as its new growth driver following the cervical cancer diagnostic equipment, preparing for a new chapter.

A Biodyne representative said, “EarlyPop Brush is an innovative tool suitable for improving screening efficiency and convenience, but it will be supplied to the market at prices similar to existing products,” adding, “Considering the global market size, we expect 100 million units can be sold by 2030. Based on 100 million unit sales, we anticipate revenues of 150 billion won and operating profit of 70-80 billion won.”

ToolGen’s stock price also jumped significantly. The company‘s stock price rose to 60,600 won on this day, up about 20% from the previous day. Although it was in the 26,000 won range until June, the stock price has more than doubled. Accordingly, the KOSDAQ Market Division of Korea Exchange requested a disclosure inquiry from ToolGen regarding the existence of disclosure targets under the regulations for significant market fluctuations. The response deadline is 6 PM on October 10th.

The background for the stock surge is that confidence in the technology became publicly known after filing patent litigation against global company Lonza. Additionally, news of winning a government project worth 15 billion won for developing gene correction treatments for hereditary retinal diseases reportedly had an impact.

ToolGen CEO Yoo Jong-sang stated, “Through this project selection, we will work closely with Korea’s top researchers to provide innovative treatment options to patients with hereditary retinal diseases who had no treatment alternatives, and furthermore contribute to creating a high-value-added new market estimated at 15 trillion won, thereby enhancing corporate value as well as national bio-competitiveness.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)