팜이데일리 프리미엄 기사를 무단 전재·유포하는 행위는 불법이며 형사 처벌 대상입니다.

이에 대해 팜이데일리는 무관용 원칙을 적용해 강력히 대응합니다.

[Seungkwon kim, Edaily Reporter] On March 19, South Korea’s pharmaceutical, biotech, and healthcare stocks saw gains, particularly for companies expecting financial improvement or increased overseas sales. Clinomics, Mico BioMed, and T&R Biofab were among the biggest gainers. However, Clinomics‘ high volatility raises investor caution.

Other stocks that surged for different reasons included Olipass, Noom, and Kainos Med.

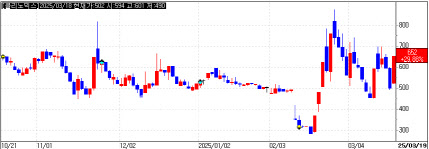

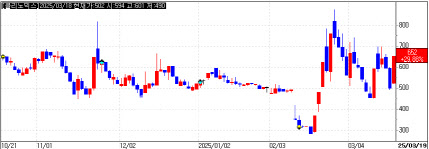

Clinomics: Wild Price Swings Raise ConcernsAccording to KG Zeroin MPDOCTOR, Clinomics closed at KRW 652, up 29.9% from the previous day, nearly doubling from its February low of KRW 283. The company specializes in liquid biopsy and diagnostic kits.

Clinomics’ stock has been highly volatile. It hit a high of KRW 878 on February 25 before plunging to KRW 480 over eight sessions. After briefly hitting the upper limit, it declined again. On March 18, the stock dropped 17%, only to surge back to the daily limit-up on March 19.

| | Clinomics Recent Stock Trend (Data = KG Zeroin)) |

|

Due to such fluctuations, the Korea Exchange (KRX) assigns warning labels to stocks: Investment Caution, Investment Warning, and Investment Risk. Clinomics has already been designated an Investment Caution Stock in the past due to concentrated trading by a few accounts. This year, it has oscillated between Investment Warning and removal from the list, underscoring its volatility.

The recent rally appears driven by expectations of financial improvement and a company name change. Clinomics plans to rebrand as Celestra Inc. following a shareholder vote. The company also announced plans to issue KRW 5.5 billion (approx. $4.1 million) in convertible bonds, issuing 8.25 million new shares. Initially, the company aimed to raise KRW 10 billion ($7.5 million) but revised the issuance to KRW 5.5 billion to focus on a single investor, Dominate.

Structural Improvement Will Take Time; T&R Biofab Aims for KRW 30B SalesDespite the rally, analysts warn that Clinomics still faces challenges, including the risk of delisting due to poor financials.

A company representative said, “We carefully selected investors based on their intent, financial capacity, and timing to ensure quick fundraising.”

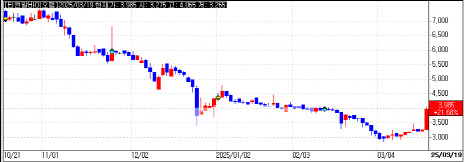

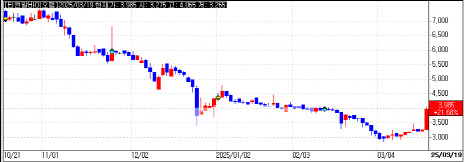

Meanwhile, T&R Biofab also saw its stock rise, closing at KRW 3,985, up 21.68%. The jump was linked to the company’s entry into the U.S. cosmetic market. T&R Biofab projects KRW 30 billion ($22.5 million) in revenue for 2024, a sixfold increase from KRW 4.9 billion ($3.7 million) in 2023.

| | T&R Biofab Stock Showing a Downward Trend (Data = KG Zeroin) |

|

The company developed a new multi-balm skincare product designed for elasticity and hydration. T&R Biofab recently secured a U.S. supply contract, expecting revenue from May.

However, T&R Biofab faces regulatory issues. The Ministry of Food and Drug Safety (MFDS) imposed a one-month, seven-day production suspension for violations of the Medical Device Act. The suspension runs from March 12 to April 18.

Authorities found pigskin residues in filtration systems and rust on mesh jigs in the company’s cleanroom. Regulators criticized T&R Biofab for failing to maintain hygienic production facilities, a requirement under medical device regulations.

![엑셀세라퓨틱스, 대만發 호재에 상한가 직행... 셀레믹스·쿼드메디슨도 강세 [바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600363b.jpg)