Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Song Young Doo, EDaily Reporter] Even as the KOSPI and KOSDAQ drifted lower overall, several healthcare names outperformed. G2GBIO rallied on expectations for a license-out of its core long-acting platform, while GemVax & KAEL jumped ahead of imminent Phase 2 data for its Alzheimer’s candidate. AI drug developer Oncocross also extended gains after being named to a government program.

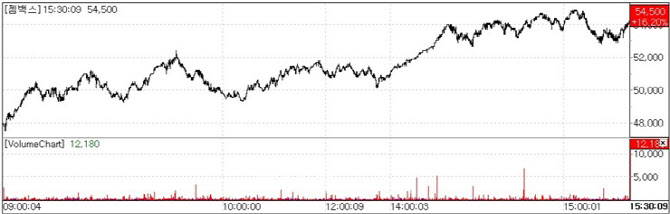

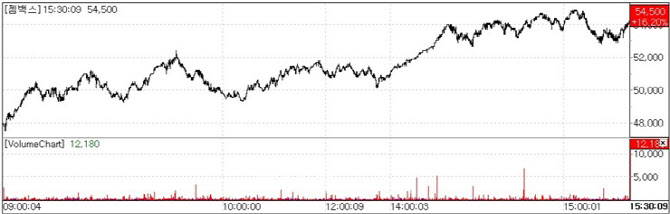

| | GemVax & KAEL share-price trend(Source: KG Zeroin MP Doctor) |

|

According to KG Zeroin’s MP Doctor(formerly MarketPoint) on the 7th, GemVax & KAEL shares were strong from the open and finished higher, closing up 16.20%(7600 won) at 54,500 won. It was the first close above the 50,000 won level since Oct. 2, when the stock hit 50,700 won.

The uptrend followed the morning publication on portal sites of two PharmEdaily premium biotech stories on GemVax: “GemVax GV1001: Two Critical Clues Ahead of Phase 2 Alzheimer’s Readout” and “PSP Treatment Shows Light Prof. Lee Ji-young: ‘GemVax GV1001, the First Drug to Change CSF.’”

As reported by PharmEdaily, Lee Ji-young, neurologist at Seoul Metropolitan Boramae Hospital and principal investigator for GV1001 in progressive supranuclear palsy(PSP), recently presented results from the trial. PSP occurs roughly 20 times less frequently than Parkinson’s disease, affecting about 5~7 people per 100,000. It is a tauopathy in which neurons in the midbrain and basal ganglia degenerate and pathology gradually spreads throughout the brain.

The Phase 2a study enrolled 78 PSP patients across five centers, including Seoul National University Hospital, and randomized them to GV1001 0.56 mg, GV1001 1.12 mg, or placebo for about six months. Patients treated with GV1001 showed no decline in overall function, and the drug also suppressed worsening in oculomotor function as well as speech and swallowing.

“PSP patients typically lose about five points of functional capacity over six months, but we saw almost no change this time,” Lee said. “That’s not just a statistical figure?it means patients maintained the ability to walk unaided or carry on daily conversation for longer.”

GemVax is also developing GV1001 for Alzheimer’s disease, with global Phase 2 results scheduled for early next month. The 50-week study enrolled 199 patients with mild-to-moderate disease across 43 sites in seven countries in the United States and Europe, and early indicators suggest a potential for success.

On the primary endpoint, the Severe Impairment Battery(SIB), the GV1001 1.12 mg arm showed a 7.11-point advantage versus a control arm receiving donepezil alone. “We confirmed a remarkable improvement in the GV1001 arm,” said Ko Sung-ho, neurologist at Hanyang University College of Medicine who participated in the trial, adding that “the effect was clearer among patients who adhered closely to the protocol.”

Investigators also detected tau proteins moving out of the brain into the cerebrospinal fluid among GV1001-treated patients a biomarker signal interpreted as toxic, misfolded tau being cleared during therapy. If the Phase 2 study succeeds, industry observers expect GemVax could pursue a license-out deal.

G2GBIO rallies on long-acting platform’s global interest G2GBIO closed at 65,100 won, up 9.78%(5800 won) from 59,300 won the prior session. After a stock split record date on the 5th reset the reference price to 61,700 won from 185,000 won on the 4th, shares dipped on the 6th before rebounding above 60,000 won in a single day.

The advance was attributed to growing expectations for a license-out following partnering meetings at multiple international conferences. G2GBIO is developing obesity and dementia therapies using “InnoLAMP,” a microsphere-based long-acting depot platform that extends drug exposure. In obesity, where standard treatments require weekly dosing, InnoLAMP could enable once-monthly, once-every-two-months, or even once-every-three-months dosing an innovation in a crowded field.

The company recently participated in BioJapan(Oct. 8~10), the Partnership Opportunities in Drug Delivery(PODD) conference(Oct. 27~28), CPHI Frankfurt(Oct. 28~30), and BIO-Europe(Nov. 3~5). It held numerous partner meetings, with strong interest in the three-month formulation technology based on InnoLAMP. G2GBIO says it conducted partnering meetings with roughly 70 companies at CPHI and BIO-Europe combined.

A company official said: “By attending global conferences like BioJapan and PODD back-to-back, we confirmed strong interest from multinational firms in our long-acting technology. After presenting data on formulations that maintain efficacy for one to three months using InnoLAMP, a global big pharma agreed to conduct due diligence. We believe these developments affected the share price.”

At PODD, G2GBIO first unveiled three-month pharmacokinetics for semaglutide, drawing attention alongside three-month formulations for dementia and schizophrenia. The firm’s differentiated platform supporting high drug loading and scalable high-dose manufacturing?has gained visibility since its listing. It also held discussions with multinational innovators developing peptide and small-molecule drugs.

The company added that interest in its high drug-loading technology rose across MENA, Europe, and Asia at CPHI and BIO-Europe. Meetings were also held with fill-finish specialists for microsphere products, covering the end-to-end workflow. Follow-up talks are under way with firms targeting launches in the United States and Europe, and the company expects tangible progress.

Elsewhere in AI-driven drug discovery, Syntekabio and Oncocross also rallied. Syntekabio climbed 11.51%(510 won) to 4940 won, while Oncocross rose 9.84%(1000 won) to 11,160 won. While neither company had stock-specific catalysts, investors pointed to increased interest in AI-related sectors around the APEC leaders’ meeting.

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)

![힘스앤드허스 유사품에 노보노디스크·일라이릴리 흔들… 삼일천하(?)[클릭, 글로벌 제약·바이오]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020800574b.jpg)