Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Jinsoo, Edaily Reporter] Shares of South Korean biopharmaceutical firm Celltrion rose Friday on expectations of robust second-quarter earnings. Organoid-related companies, including OrganoidScience, also surged following news of product validation, while MedPacto jumped amid reports of a possible stake sale by its largest shareholder.

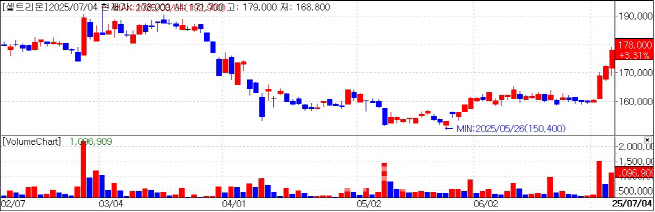

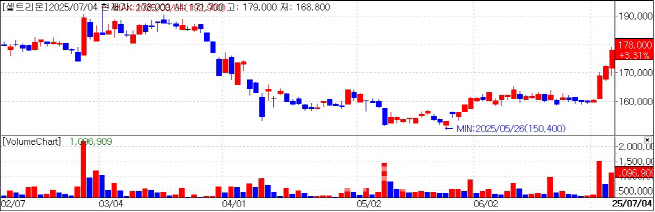

| | Celltrion stock trend. (KG Zeroin) |

|

Celltrion Climbs 11% This Week on Earnings Momentum Celltrion shares gained 3.31% to close at 178,000 won, according to KG Zeroin’s MP DOCTOR platform. The stock has climbed 11.32% over the past week on expectations that second-quarter results will reflect growing biosimilar sales and post-merger synergies.

Market tracker FnGuide projects Celltrion will post revenue of 1.0064 trillion won and an operating profit of 250.6 billion won in Q2, up 15.1% and 245.7% year-over-year, respectively. The company hit 1 trillion won in quarterly revenue for the first time in Q4 2023, and analysts expect it to maintain this level going forward.

Full-year sales are projected to reach 4.35 trillion won, with operating profit exceeding 1.1 trillion won potentially marking the company’s first year to break the 1 trillion won threshold in profits.

Wi Hae-joo, an analyst at Korea Investment & Securities, said the firm will begin to benefit from margin improvements and sales growth from newly launched biosimilars in the second half of the year.

Key biosimilar products are seeing strong momentum: Yuflyma(autoimmune) 120 billion won in Q2, up 50% YoY ; Begzelma(breast cancer): 65 billion won, up 60% ; Zympentra(inflammatory diseases): Q2 revenue projected at 40-45 billion won, up from 13 billion in Q1.

Celltrion also plans to launch biosimilars in North America and Europe this year, including Stekima(Stelara), Izelden(Eylea), Aptosma(Actemra), Omriclo(Xolair), and Stoboclo(Prolia).

The company declined to comment on its stock performance.

Organoid Stocks Rally on Product Validation Shares of Kangstem Biotech rose 2.85% after the company announced that its skin organoid model had proven useful in evaluating new treatments for atopic dermatitis. The news sparked a 10.41% surge in shares of OrganoidScience, a peer company with a focus on organoid-based solutions.

Kangstem said its model, which mimics human skin layers more accurately than conventional organoids, demonstrated that balancing skin microbiota can help prevent and treat dermatitis. The model allows for evaluation of topical and intravenous therapies and could be used as a new platform for efficacy screening.

OrganoidScience, which closed at 36,600 won, offers a platform called ODISEI, used to evaluate new substances and drugs without animal testing. The company has signed more than 50 deals with domestic and international pharma firms and is collaborating with Severance Hospital to assess tumor response to immunotherapies.

OrganoidScience reported 2 billion won in revenue last year and aims to reach 10 billion won by 2026.

A company spokesperson said there was no internal news to explain the stock’s surge, adding that recent buying by institutional and foreign investors likely fueled the gain.

MedPacto Gains on Stake Sale Talks MedPacto shares jumped 9.66% to 4,200 won after local media reported that Theragenetax, its largest shareholder, is in talks to sell its 14.65% stake to a strategic investor.

Theragenetax announced the potential sale last November, citing the need to realize long-term gains and improve its financial position. Although no buyer had been found for months, multiple biotech firms and domestic conglomerates are reportedly now in discussions, according to a report from PharmEdaily.

The stake sale is expected to take the form of a direct investment into MedPacto. A company representative said there were no updates beyond the news on the stake sale, and that clinical development and licensing activities were proceeding as planned.