Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Shin-Min Joon, Edaily Reporter] On May 21 the Korean biopharmaceutical stock market saw notable gains in OrganoidSciences, Bluemtech and Humedix. OrganoidSciences shares surged on growing expectations for the adoption of animal free testing in Korea following a similar trend in the U.S. OrganoidSciences is developing treatments for intractable diseases using organoid technology which involves culturing stem cells into structures mimicking human organs.

Bluemtech a digital drug distribution platform rallied on optimism surrounding its domestic distribution of the antiobesity drug Wegovy. Humedix’s rise was fueled by expanding dermal filler exports and the growth potential of a new skin booster based on acellular human dermis.

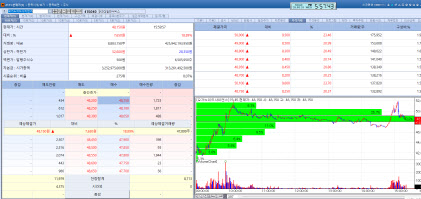

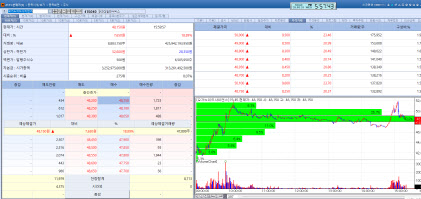

| | OrganoidScience stock trend on May 21. (Image=MP Doctor) |

|

OrganoidScience Rallies on Hopes for Animal Free Testing Expansion in Korea Following U.S. Momentum According to KG Zeroin’s MP DOCTOR (formerly Market Point) OrganoidSciences closed at 48,150 won, up 18.89% from the previous day. OrganoidSciences shares surged to 52,000 won during intraday trading, marking a new 52week high.

The spike reflects heightened expectations for domestic policy shifts favoring animal free testing. Democratic Party presidential candidate Lee Jae myung pledged to enact legislation supporting animal free testing, stating via social media that the move would help reduce the sacrifice of laboratory animals. His broader platform includes enacting a basic animal welfare law, establishing a national institute for animal welfare, easing pet care costs, restricting animal ownership for abuse offenders and regulating quasi-shelters.

This comes after the U.S. FDA signaled plans to phase out animal testing requirements for certain drugs including monoclonal antibodies. The agency unveiled a roadmap last month promoting alternatives such as organoids and AI based models fueling bullish sentiment for the organoid sector.

OrganoidSciences specializes in culturing stem cells in three dimensional environments to mimic human organs and develop regenerative therapies for rare diseases. Its lead pipeline candidate Atom-C is designed to regenerate damaged intestinal tissue in patients with refractory ulcerative colitis. The company uses a combination of high-density stem cell organoids, endoscopic delivery and proprietary extracellular matrix materials to advance the therapy toward commercialization.

OrganoidSciences’s organoid regenerative therapy technology was designated as a national strategic technology in 2023 under Korea’s Special Act on National High Tech Strategic Industries. The global organoid market is projected to grow from $2.5 billion(3.26 trillion won) in 2022 to $12.2 billion(15.86 trillion won) by 2030, according to The Insight Partners.

OrganoidSciences spokesperson noted “The increased interest in animal-free testing in Korea following developments in the U.S. is likely contributing to the positive market response. We are actively expanding into global markets with subsidiaries in Germany, Vietnam, and the U.S. targeting Europe, North America and Southeast Asia.”

Bluemtech Rises on Surging Wegovy Distribution Revenues Bluemtech’s stock rose 10.23% to close at 7,110 won. The rally is attributed to investor enthusiasm surrounding the company’s role in distributing the anti obesity drug Wegovy in Korea. Industry sources say Bluemtech received the largest allotment of wholesale Wegovy supply from distributor Zuellig Pharma Korea among domestic firms.

The company’s revenue from Wegovy distribution soared to won 6 billion ($4.4 million) in March alone six times higher than February’s figure of 1 billion won.

To drive hospital and pharmacy adoption Bluemtech is offering incentives such as membership and deposit points. It also operates a rapid delivery network, with next day nationwide delivery and same day service in Seoul. As seasonal demand for weight-loss treatment increases in the summer, the company anticipates further sales growth in the second half.

Bluemtech is also expanding in the flu vaccine space. In August last year it signed a co promotion agreement with Sanofi Korea to distribute two quadrivalent influenza vaccines Vaxigrip Tetra (for individuals aged 6 months and older) and Efluelda Tetra Prefilled Syringe (targeting those aged 65 and older). These products are being sold via Bluemtech’s BluePharmKorea platform.

As COVID-19 cases spike in Greater China and flu activity increases during the seasonal transition, demand is expected to rise. According to the Korea Disease Control and Prevention Agency flu incidence reached 13.1 per 1,000 outpatient visits as of May 3 exceeding the epidemic threshold of 8.6.

Bluemtech official said “We are committed to ensuring stable supply and innovative service for Wegovy as demand grows in the summer.”

Humedix Jumps on Filler Export Outlook and Skin Booster Momentum Humedix closed at 51,200 won, up 12.53% from the previous day. The market responded to growing expectations for expanded dermal filler exports. A subsidiary of Huons Group, Humedix operates across pharmaceuticals, medical devices, cosmetics, and health supplements. The company recently received marketing authorization for new filler products in Q1, and approvals are anticipated later this year for body fillers in Brazil and facial fillers in Vietnam.

Also driving momentum is strong interest in ElravieRe2O, a skin booster co developed with L&C Bio that uses human acellular dermal matrix (hADM) to promote skin regeneration. Humedix secured exclusive domestic distribution rights through a partnership signed last November.

Interest in hADM based injectables has grown following U.S. media reports that Hollywood celebrities like Lindsay Lohan and Anne Hathaway are using Renuva, a filler made from purified fat of deceased donors. Unlike conventional fillers that degrade over time, Renuva stimulates the body’s natural fat production at the injection site enabling long term volume restoration. Renuva was FDA approved in 2021.

Humedix representative said “The stock gain appears to reflect both optimism around filler export growth and increased attention to ElravieRe2O.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)

![힘스앤드허스 유사품에 노보노디스크·일라이릴리 흔들… 삼일천하(?)[클릭, 글로벌 제약·바이오]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020800574b.jpg)