Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Seok Ji-hoen, Edaily Reporter] Shares of GC Holdings‘ preferred stock (GC Holdings 2 Preferred) hit the upper limit on Wednesday amid investor optimism over potential revisions to the Commercial Act, which are expected to boost the valuation of holding companies. GC Holdings’ common shares also rallied more than 8%. Peptron rebounded briefly following a company clarification but closed lower.

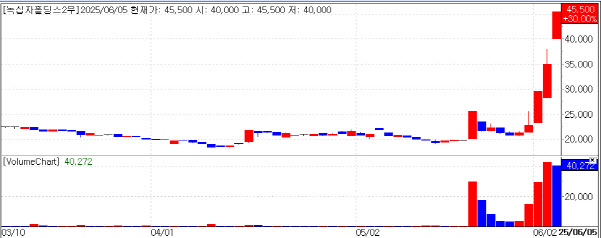

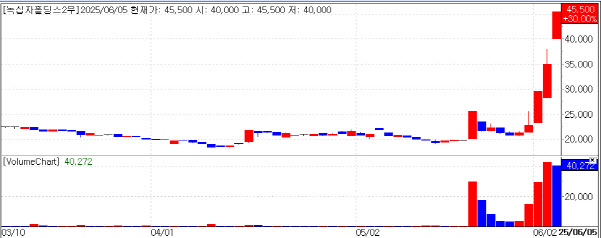

Holding Companies in Focus According to MP DOCTOR (formerly Market Point) under KG Zeroin, GC Holdings 2 Preferred (005257) surged 30.00% or 10,500 KRW to close at 45,500 KRW. The rally is attributed to expectations that the incoming administration under President Lee Jae-myung will push ahead with revisions to the Commercial Act and other capital market reforms, potentially leading to a revaluation of holding companies. GC Holdings (005250) also rose 8.31% to end at 16,160 KRW.

| | GC Holdings 2 Preferred Share Price Trend (Source: KG Zeroin MP Doctor) |

|

Since President Lee’s inauguration on June 4, stocks seen as beneficiaries of the proposed Commercial Act revision have risen sharply. Hanwha Holdings soared 20.98%, Wonik Holdings jumped 15.01%, SK Square gained 13.06%, and HiteJinro Holdings climbed 12.98%. GC Holdings 2 Preferred and its common shares rose 18.44% and 2.33%, respectively.

Yang Ji-hwan, an analyst at Daishin Securities, said, “Expectations around passage of the Commercial Act revision, forced cancellation of treasury shares, governance reform, and normalization of PBR (price-to-book ratio) to resolve the Korea discount are being priced in following President Lee’s election.”

Park Geon-young, an analyst at KB Securities, added, “Policies to strengthen minority shareholder protection are expected to continue, and if realized, they could help resolve longstanding conflicts of interest between controlling and minority shareholders that have contributed to NAV (net asset value) discounts at holding companies.”

A GC Holdings spokesperson said, “Strong Q1 earnings have driven sustained gains in both GC and GC Holdings common stock this year. The preferred shares are likely moving in tandem. Since the trading volume of preferred shares is low, price fluctuations can be exaggerated. There are no company-specific events.”

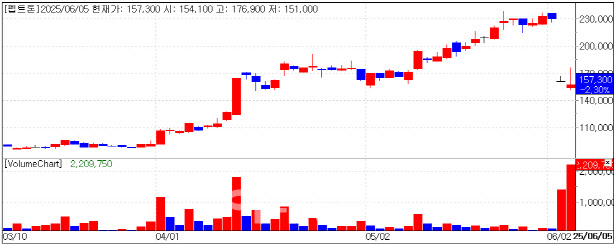

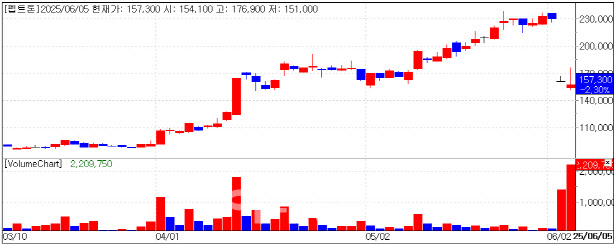

Peptiron Slides Despite Company Statement Shares of Peptron closed at 157,300 won on June 5, down 3,700 won or 2.3% from the previous session, following a lower limit plunge the previous day. Investor sentiment remained cautious after U.S. pharma giant Eli Lilly signed a license-out deal with Swedish biotech Camurus, raising concerns about Peptron‘s own ongoing evaluation with Lilly.

| | Peptiron Share Price Trend (Source: KG Zeroin MP Doctor) |

|

PEarlier, Lilly signed a license agreement with Camurus for its long-acting injectable drug delivery platform FluidCrystal®, valued at up to $870 million (approximately 1.19 trillion won). Peptron also owns a long-acting formulation platform called SmartDepot®, which is currently undergoing technical evaluation by Lilly.

Lilly’s move to secure another long-acting technology sparked speculation in the market that a co-development agreement or license-out deal between Lilly and Peptron may now be unlikely. Peptron shares plummeted 30% on June 4 when the Lilly’s Camurus deal was announced.

In response, Peptron issued a statement on its website on June 5, saying: “We are disclosing this following official confirmation from Lilly. The drugs currently under evaluation with Peptron do not completely overlap with those involved in Lilly’s agreement with Camurus.” The company added, “Camurus’ technology is entirely different in mechanism from Peptron’s SmartDepot platform and cannot be considered a direct competitor. Our evaluation with Lilly is progressing smoothly.”

In fact, industry sources note significant differences between the two technologies. Camurus’ FluidCrystal® forms a gel in the body after injection, releasing the drug over weeks or months. It can be delivered via pre-filled syringes or pen injectors. In contrast, Peptron’s SmartDepot® is a microsphere-based technology produced as a powder through spray-drying.

Despite Peptron’s clarification quoting Lilly, the stock struggled to recover. Although Peptron shares surged over 9% in early morning trading, they ultimately closed lower.

“The evaluation with Lilly is proceeding without issue, and discussions are continuing as planned,” Peptron said.

DreamCIS Rises on G2GBIO IPO News Shares of DreamCIS, a global contract research organization (CRO), rose 310 won or 9.69% to close at 3,510 won on the same day. Although there was no company-specific news, investor interest spiked after G2GBIO, a biotech firm backed by DreamCIS over the past three years, received preliminary approval for a public listing.

| | DreamCIS Share Price Trend (Source: KG Zeroin MP Doctor) |

|

According to DreamCIS’s most recent quarterly filing, the company initially invested 1.5 billion KRW in G2GBIO in November 2022. With subsequent purchases, the book value of its holdings has reached approximately 2.5 billion KRW.

G2GBIO is a developer of drug delivery technologies. Though still in early stages with limited revenue, it has demonstrated global competitiveness. In February, the company signed a co-development agreement with Germany’s Boehringer Ingelheim for a long-acting injectable treatment.