팜이데일리 프리미엄 기사를 무단 전재·유포하는 행위는 불법이며 형사 처벌 대상입니다.

이에 대해 팜이데일리는 무관용 원칙을 적용해 강력히 대응합니다.

[Kim Jinsoo, Edaily Reporter] On May 29, among Korea pharmaceutical and biotech stocks, Nibec surged to the daily upper limit following news of a major license-out deal. Olix also gained after analysis suggested a joint research and development(R&D) agreement with another global company is imminent, following its recent licensing deal with Eli Lilly.

L&K Biomed drew investor attention as it secured continuous product approvals in the U.S., one of its key export markets, strengthening its competitive position.

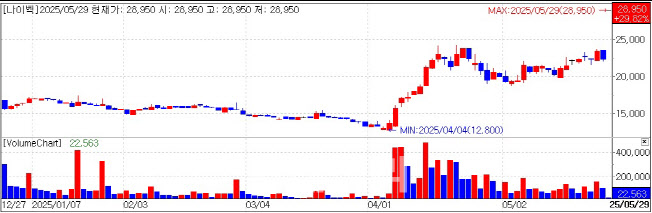

| | Nibec stock. (KG Zeroin MP Doctor) |

|

Nibec Jumps to Daily Limit on $600 Million License-Out Deal According to KG Zeroin MP Doctor (formerly Market Point), Nibec’s shares opened and quickly hit the daily upper limit on May 29. The stock price jumped from 22,300 won the previous day to 28,950 won.

On May 28 after market close, Nibec announced it signed a license-out deal for its peptide-based fibrosis treatment candidate, NP-201. The partner is a U.S.-based pharmaceutical company experienced in R&D and commercialization of idiopathic pulmonary fibrosis(IPF) and pulmonary arterial hypertension(PAH). The total contract value is up to $435 million(about 600 billion won), with an upfront payment of $8 million(approximately 11 billion won). This amount represents roughly 45% of Nibec’s sales last year.

Nibec completed a Phase 1 clinical trial of NP-201 in Australia, demonstrating safety and tolerability. The partner will lead clinical development from Phase 2 onward.

Nibec will receive a 4% royalty on net sales from NP-201. The deal also includes a clause for revenue sharing from milestone and income payments if the partner sublicenses the technology to a third party.

NP-201 features a novel mechanism that promotes tissue regeneration to treat fibrosis, unlike existing fibrosis therapies. It holds potential for expanding indications to hypertension and inflammatory bowel disease.

A separate contract for material supply related to NP-201’s clinical and commercial use is expected to further increase the revenue opportunity from this asset.

A Nibec representative said, “There is no additional information to disclose beyond what was announced.”

Olix Shares Rise on Imminent Global Joint R&D Deal Olix shares closed up 5.92% at 50,100 won, after rising as much as 11.69% intraday to 53,500 won.

The stock had also gained 12.36% on May 27, reflecting growing investor anticipation of an impending joint research and development agreement with a global corporation related to skin and hair regeneration.

Olix CEO Dong-Ki Lee said at the “2025 First Half R&D Day” event on April 29, “Following our licensing deal with Lilly, a global partnership on skin and hair regeneration is expected to be finalized soon.” Given that nearly a month has passed since the announcement, analysts view the contract as imminent.

The likely candidate for the joint R&D deal is OLX104C, a drug designed to treat hair loss by inhibiting androgen receptor(AR) expression, a key cause of androgenic alopecia. Olix submitted an IND in March to conduct Phase 1b/2a clinical trials in Australia for patients with androgenic alopecia.

The joint research agreement is expected to begin as a funded collaboration on skin and hair regeneration, potentially leading to a licensing-out deal.

An Olix spokesperson said, “The recent announcement of an imminent joint R&D deal through multiple channels appears to have boosted the stock price based on investor expectations.”

Olix shares are expected to maintain upward momentum, as there remains potential for expanding the contract with Eli Lilly.

Under the existing contract with Lilly, if Olix develops therapies targeting the MARC1 gene and one or more additional genes simultaneously, Lilly has the right of first negotiation for those treatments. This could lead to added contract value or exclusive negotiations.

An Olix representative noted, “Expansion of the Lilly contract is not imminent at this time.”

L&K Biomed Gains on Continued U.S. Growth, Earnings Expectations L&K Biomed shares jumped nearly 10% early in trading following a PharmEdaily report titled “L&K Biomed Unaffected by U.S. Tariffs…Double-Digit Operating Margin Expected This Year.” The stock later settled up 2.52% at 6,100 won.

L&K Biomed recorded sales of 15.4 billion won in 2021, 19.8 billion won in 2022, and 29.9 billion won in 2023. This year’s sales target is 43 billion won, a 20% increase from last year. Operating margin turned positive in 2023 at 6.8% and is projected to rise to 8.53% in 2024, with hopes of reaching double digits this year.

At the end of April, L&K Biomed received FDA approval for its Pectus implant for chest deformities, increasing the number of FDA-approved products to 15, strengthening its U.S. market competitiveness.

Most of L&K Biomed’s products are classified as essential medical devices directly related to life and health, thus largely exempt from U.S. tariffs. This bodes well for meeting this year’s performance goals.

However, final U.S. tariff rates on L&K Biomed’s products will be decided this July, warranting close attention.

A company representative said, “There is a possibility of some tariffs being applied in the U.S. market starting July. Even if tariffs are applied, products using U.S.-sourced raw materials are eligible for refunds, so the overall impact should be limited.”

![힘스앤드허스 유사품에 노보노디스크·일라이릴리 흔들… 삼일천하(?)[클릭, 글로벌 제약·바이오]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020800574b.jpg)