Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Saemi, Edaily Reporter] On October 14, the bio-healthcare sector saw shares of MYUNGIN PHARM CO., LTD. rebound, while RP Bio Inc. rose sharply on expectations of a corporate value re-rating. In contrast, VIVOZON PHARMACEUTICAL, CO., LTD. plunged after announcing a 50 billion won rights offering for existing shareholders.

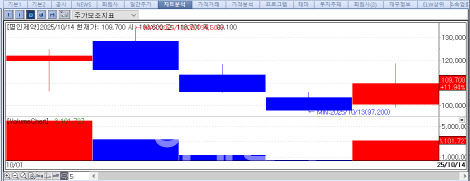

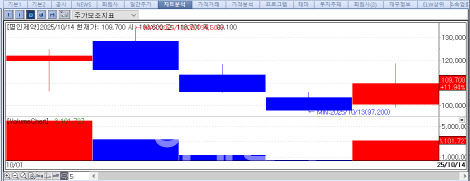

MYUNGIN PHARM rebounds after four sessions amid valuation debate According to KG Zeroin’s MP Doctor (formerly Market Point), MYUNGIN PHARM closed at 109,700 won, up 11,700 won (11.94%) from the previous day.

The company, well known for its gum disease supplement Igatan, had recorded a “double” (stock price doubling from IPO price) on its first trading day on the KOSPI on October 1, but then declined for three consecutive sessions. With today’s rally, MYUNGIN PHARM’s market capitalization reached 1.61 trillion won―below the 1.78 trillion won peak on listing day, but back to levels seen on October 2.

| | Stock trend of MYUNGIN PHARM CO., LTD. after IPO (Source: KG Zeroin MP Doctor) |

|

MYUNGIN PHARM’s debut market cap of nearly 1.8 trillion won drew strong attention from the biopharma sector. On that day, it ranked sixth among KOSPI-listed pharmaceutical companies, following Samsung Biologics, Celltrion, Yuhan Corporation, SK bioscience, and Hanmi Pharm. Co., Ltd.

Some market watchers have raised concerns over possible overvaluation, noting that the company’s 2023 revenue was 269.4 billion won, while Chong Kun Dang―which reported sales exceeding 1.58 trillion won that year―had a market cap of just 1.13 trillion won.

The company stated that there was “no specific reason identified” for the day’s stock surge. A MYUNGIN PHARM spokesperson said, “We are not aware of any particular factor driving today’s increase.”

Separately, the firm disclosed that CEO Haeng-Myung Lee, its largest shareholder, holds 10.776 million shares, representing a 73.81% stake.

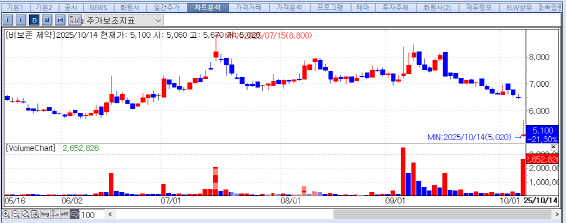

RP Bio Inc. jumps 13% on strong earnings outlook RP Bio Inc. closed at 8,010 won, up 940 won (13.3%)―the largest percentage gain among KOSDAQ―listed pharmaceutical and biotech firms that day.

The rally was likely fueled by an analyst report highlighting strong earnings growth and a potential re-rating of the company’s valuation.

| | KOSDAQ top gainers by share price increase on October 14 (Source: KG Zeroin MP Doctor) |

|

According to researcher Yoon-Seok Chae at the Korea Investor Relations Service, RP Bio recorded an earnings per share (EPS) growth of 603.8%, signaling a clear turnaround in performance. He pointed to new soft capsule formulations and expansion into individually approved functional materials as key drivers of future growth.

Chae noted that since RP Bio’s KOSDAQ listing in September 2022, its price-to-book ratio (PBR) had fluctuated between 0.4x and 1.5x. Based on projected 2025 earnings, its current PBR of 0.6x positions the stock near the lower end of that range.

The company is expected to post 133.8 billion won in revenue this year, up 7.9% year-over-year, and turn an operating profit of 6.1 billion won. The health functional food segment is projected to grow 17.5% year-over-year, accounting for over 63% of total sales.

An RP Bio official commented, “Current valuation indicators such as PBR and PSR do not fully reflect our explosive EPS growth,” adding that the company “plans to accelerate corporate value re-rating by commercializing new formulations and individually approved ingredients.”

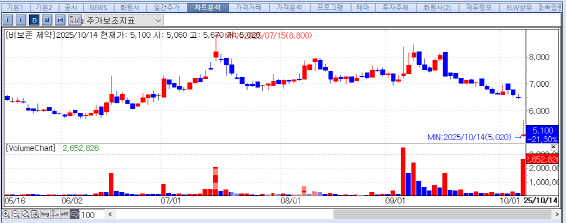

VIVOZON PHARMACEUTICAL tumbles 21% on 50 billion won rights offering In contrast, VIVOZON PHARMACEUTICAL, CO., LTD. tumbled 21.3% to close at 5,100 won, following its announcement of a capital increase.

| | Recent stock trend of VIVOZON PHARMACEUTICAL, CO., LTD. (Source: KG Zeroin MP Doctor) |

|

On October 13, the company disclosed plans for a 50 billion won rights offering through a combination of shareholder allocation and public subscription. The new share issuance totals 10.615 million shares―equivalent to 21.2% of its outstanding 50.1 million shares. Each existing share will be allocated 0.21423 new shares. The underwriter, NH Investment & Securities, will acquire any unsubscribed shares.

VIVOZON’s lead pipeline is Unafra Inj., a non-opioid analgesic that has yet to be commercialized. As a result, the company continues to post net losses and fell into capital impairment earlier this year. However, VIVOZON expects sales contributions from Unafra Inj.―designated as Korea’s 38th innovative new drug―to begin in the second half, improving results.

From next year, the company aims to achieve profitability through full-scale Unafra Inj. commercialization.

VIVOZON stated that the capital increase aims to strengthen business sustainability and improve financial capacity. Of the 50 billion won raised, 23 billion will be used for debt repayment and 25.8 billion for working capital.

Within working capital, 7 billion won will be spent on acquiring exclusive injectable rights for Unafra Inj. from VIVOZON Co., Ltd., the parent company. The total contract value is 11 billion won, excluding royalties, with 2 billion already paid upfront. Additional payments of 1 billion each were made upon Phase 3 approval and marketing authorization submission.

A company official added, “There are no other issues affecting the stock decline apart from the rights offering.”

![인도, 글로벌 저가 제네릭에서 바이오 허브로 탈바꿈[제약·바이오 해외토픽]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020700379b.jpg)