Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Seok Ji-hoen, Edaily reporter] On May 19, shares of ImmuneOncia, a subsidiary of Yuhan Corporation, more than doubled on their first day of trading, highlighting strong investor enthusiasm. Elsewhere, infection-related biotech stocks such as Sugentech and Genexine surged on concerns about the Nipah virus. NeoImmuneTech also ended sharply higher after reporting promising clinical results.

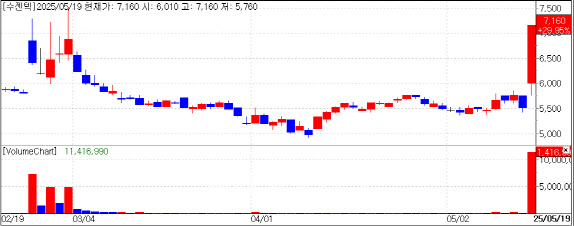

| | ImmuneOncia stock quote screen (Source: KG Zeroin MP Doctor) |

|

The “Next Leclaza” Candidate Enters the Market According to Zero-In MP Doctor (formerly Market Point), ImmuneOncia closed at 7,500 won, up 3,900 won or 108.33% from its IPO price.

Founded in September 2016 as a joint venture between Yuhan Corp. and Sorrento Therapeutics in the U.S., ImmuneOncia develops antibody-based immuno-oncology therapies. Yuhan owns a 67.2% stake.

During the public subscription period on May 7~8, ImmuneOncia attracted 3.76 trillion won in deposits with a retail competition rate of 913 to 1. Its institutional bookbuilding earlier drew a 897.45 to 1 bid-to-cover ratio, with the IPO price set at the top of the expected range (3,000?3,600 won).

The company is developing immune checkpoint inhibitors targeting T cells and macrophages. Its lead pipeline candidate, IMC-001, is expected to have a completed Phase 2 clinical study report (CSR) by next month. Based on this data, the company plans to file for Orphan Drug Designation (ODD) with South Korea’s Ministry of Food and Drug Safety later this year. It aims to out-license the drug globally by 2027 and commercialize it domestically by 2029.

Another candidate, IMC-002, was licensed to China’s 3D Medicines in 2021 with exclusive rights for Greater China. Additional license-out deals are targeted for 2026.

Prior to the IPO, PharmEdaily had profiled ImmuneOncia in interviews such as CEO Kim Heung-tae: “First-in-class cancer drugs; tech transfer by 2026” and “Prepared” ImmuneOncia CEO: “Confident in becoming the next Leclaza.”

CEO Kim said, “Starting with global licensing in 2026, we will create meaningful milestones every year,” adding that the company plans to present promising clinical data at ASCO 2025.

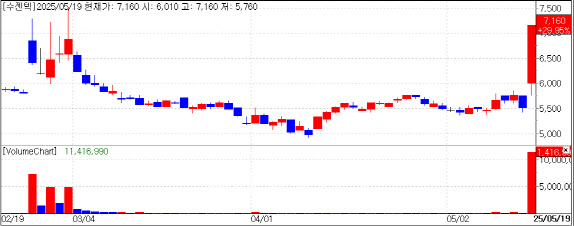

Pandemic Flashback? Shares of Sugentech, Genexine, GeneMatrix, and AccessBio rose sharply amid fears over the Nipah virus. Sugentech hit the daily upper limit of 29.95%, closing at 7,160 won. Genexine gained 20.09%, GeneMatrix 9.55%, and AccessBio 7.27%.

| | Sugentech stock trend (Source: KG Zeroin MP Doctor) |

|

South Korea’s Centers for Disease Control and Prevention announced that Nipah virus infection could be classified as a first-grade nationally notifiable disease as early as July. If so, it would be the first such designation since COVID-19 in 2020.

The Nipah virus, originating from bats, is a zoonotic disease that can infect both animals and humans. Early symptoms include high fever, headache, and muscle pain, followed by neurological symptoms such as dizziness, confusion, seizures, and encephalitis. In severe cases, patients can fall into a coma within 24 to 48 hours. The mortality rate can reach up to 75%. There is currently no approved vaccine or treatment, and therapy is limited to symptom management.

Outbreaks have occurred annually in regions such as India and Bangladesh, resulting in over 220 deaths to date. No cases have been reported in South Korea yet, but public health officials emphasized the need for preemptive measures due to increased international travel and ecological changes.

Under Korean law, notifiable infectious diseases are classified into four categories based on infectivity, fatality, and likelihood of outbreaks. Grade 1 includes high-risk diseases such as Ebola, SARS, MERS, anthrax, and plague. If Nipah virus is added, the total number of Grade 1 diseases will rise to 18.

However, none of the companies associated with infection-related stocks issued public statements. A Genexine official said, “The company has no comment on today’s stock price movement.”

“Major Breakthrough” for NeoImmuneTech NeoImmuneTech shares surged 18.68%, closing at 1,525 won. The company released topline data from a combination trial of its lead candidate NT-I7, a T cell amplifier, with CAR-T therapies.

| | NeoImmuneTech stock trend (Source: KG Zeroin MP Doctor) |

|

In the trial’s high-dose group, 17 patients showed an objective response rate (ORR), including six complete responses (CRs, 75%) and two partial responses (PRs, 25%). These results improve on previous ORR (82%) and CR (64%) data shared at ESMO 2023.

According to the company, 88% of responders (7 out of 8) maintained the therapeutic benefit beyond six months. One patient initially classified with a PR later achieved a CR, demonstrating the combination’s potential for long-term efficacy.

Safety data were also encouraging. No cases of cytokine release syndrome (CRS) or immune cell-associated neurotoxicity syndrome (ICANS) were reported?serious complications commonly associated with CAR-T treatment.

The study involved 17 patients with relapsed or refractory large B-cell lymphoma (LBCL) who had received Novartis‘ Kymriah, Gilead’s Yescarta, or BMS’s Breyanzi. NT-I7 was administered as a single dose on Day 21 post-CAR-T infusion.

A NeoImmuneTech representative said, “These results demonstrate significant progress in maintaining CAR-T efficacy and safety, reflecting heightened market expectations. We will accelerate follow-up development and global partnerships.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)

![힘스앤드허스 유사품에 노보노디스크·일라이릴리 흔들… 삼일천하(?)[클릭, 글로벌 제약·바이오]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020800574b.jpg)