Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[NA Eun-kyung, Edaily Reporter] On July 18, among the pharmaceutical, biotech, and healthcare stocks listed on the Korean stock market, only two logged double-digit share price changes: Organoid Sciences and Voronoi.

Organoid Sciences, a newcomer now in its third month of listing, closed at 40,200 won, up 91% from its IPO price of 21,000 won. The sharp rally followed its disclosure of U.S. business plans via PharmEdaily. Voronoi also extended its steady upward trend, fueled by hopes of a partnership with Daiichi Sankyo.

Meanwhile, Alteogen, which recently secured a U.S. substance patent for its hyaluronidase ALT-B4, continued its five-day winning streak. The stock soared to touch 508,000 won, marking a new 52-week high.

Organoid Sciences Rallies on U.S. Subsidiary Plans Organoid Sciences, which debuted on Korea’s KOSDAQ last month via the technology exception route, posted the biggest gain (12.29%) among pharma and biotech stocks on July 18. It was also the only one of the recently listed biotech trio―Organoid Sciences, IntoCell, and GC Genome―to close higher. Trading volume surpassed 4 million shares, drawing market attention.

The rally followed a PharmEdaily report earlier in the day titled “

Organoid Sciences to Establish U.S. Subsidiary This Year―What’s Next?”, which disclosed details of the company’s American expansion strategy.

According to the report, Organoid Sciences plans to set up a U.S. subsidiary within the year to launch clinical trials for its organoid-based therapeutics. The company is reportedly in talks with public agencies in Texas, which would serve as its global operations hub once the subsidiary is established.

The first clinical candidate is expected to be ATORM, the company‘s organoid-based regenerative therapy, with ATORM-C―aimed at treating refractory intestinal ulcers ? leading the pipeline. The therapy promotes tissue regeneration in damaged areas caused by inflammation.

Organoid Sciences intends to lead clinical trials up to Phase 2 on its own before seeking licensing deals.

“We plan to establish our U.S. subsidiary this year and begin preparing for global clinical trials and overseas marketing,” CEO Yoo Jong-man told PharmEdaily.

Voronoi Nears 3 Trillion won Valuation on Out-Licensing Hopes Voronoi, a drug discovery firm that designs small molecule drug candidates using AI, was listed on KOSDAQ as a projected ?500 billion unicorn in 2022. While it posted modest licensing revenues initially, the company has reported zero sales since 2023, focusing instead on advancing its lead candidates VRN10 and VRN11 through clinical trials.

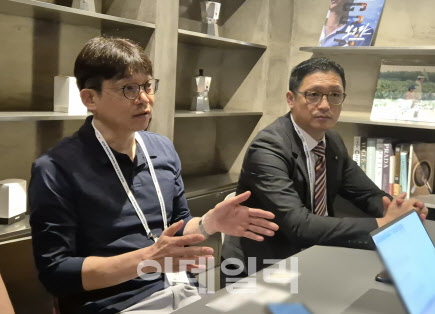

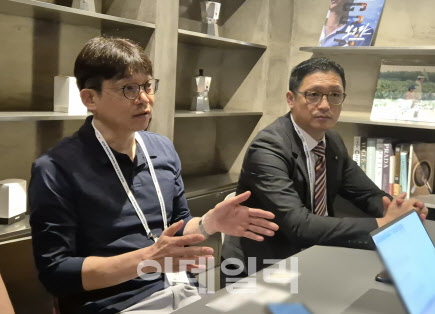

| | Voronoi CEO Kim Dae-kwon(left) speaks in a joint interview with Kim Sung-hwan, head of Voronoi Research Institute(right), following the conclusion of the Asian Oncology Society International Congress 2025 (AOS 2025) held on July 3 at COEX in Seoul’s Samseong-dong. (Photo by Sae-mi Kim, Edaily) |

|

Despite the lack of revenue, investor expectations remain high. As of July 18, Voronoi’s market capitalization stood at around 2.6 trillion won, amid speculation that the company may strike a mega-deal after boosting the value of VRN10 and VRN11.

PharmEdaily earlier reported on Voronoi’s strategy, citing CEO Kim Dae-kwon, who said the company plans to pursue follow-up trials for its lead assets itself rather than opt for early licensing deals.

VRN11 is being developed as a second-line treatment for non-small cell lung cancer patients resistant to AstraZeneca’s Tagrisso. The candidate has demonstrated high blood-brain barrier (BBB) permeability in both mice and rats―a critical factor for treating or preventing brain metastases in lung cancer.

As for VRN10, industry insiders speculate on a potential collaboration with Daiichi Sankyo. CEO Kim hinted at ongoing discussions, stating,

“We are in talks with Daiichi Sankyo on combining VRN10 with Enhertu. Once dosing is established in VRN10’s Phase 1b trial, we expect to launch combination studies immediately.”

Enhertu, developed by Daiichi Sankyo, is the world’s top-selling ADC. However, resistance remains a concern, prompting multiple firms to explore combination therapies to enhance efficacy.

Alteogen Breaks Past Previous High Alteogen, a KOSDAQ blue chip, set a new 52-week high by hitting 508,000 won intraday on July 18, briefly lifting its market capitalization beyond 27.16 trillion won. The stock eased back slightly to close at 490,000 won, up 0.31% on the day.

The rally followed the July 16 announcement that the U.S. Patent and Trademark Office (USPTO) had granted substance patent protection for ALT-B4, Alteogen’s hyaluronidase for subcutaneous injection conversion. The patent is valid until early 2043 and is expected to strengthen Alteogen’s hand in its ongoing IP battle with Halozyme.

Analysts noted that this patent may not directly impact the current inter partes review proceedings involving Merck(MSD) and Halozyme, as Alteogen is not a party to that challenge. Nevertheless, if MSD secures a favorable outcome, Alteogen’s licensing prospects for ALT-B4 could expand significantly. The review process is expected to conclude around June 2026.

An Alteogen spokesperson commented, “We have already out-licensed our Hybrozyme platform to six global pharmaceutical companies, enabling them to convert IV drugs to SC formulations. With this new U.S. patent, ALT-B4 now enjoys enhanced exclusivity in the American market. We will continue to strengthen our IP strategy to protect and extend our monopoly rights for existing and potential partners.”

ALT-B4 is a formulation platform that allows drugs originally administered via intravenous injection to be delivered subcutaneously―a change that can extend patent life and reduce side effects.

Alteogen has signed technology transfer deals with MSD, Daiichi Sankyo (in November 2024), and AstraZeneca. Cumulatively, Alteogen has achieved technology transfer deals worth 9 trillion won through ALT-B4 alone.

| | Exterior view of Alteogen‘s headquarters and research center |

|