Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Song Young-doo, Edaily Reporter] With the KOSDAQ market rebounding for the first time in a while, the pharmaceutical and biotech sector broadly gained ground. Leading the surge was Biobijou, which debuted with a bang, hitting the upper price limit on its first trading day. CorelineSoft also soared on news of a potential equity investment from the top U.S. imaging analytics firm. In contrast, SamchundangPharma continued its decline for a third consecutive session.

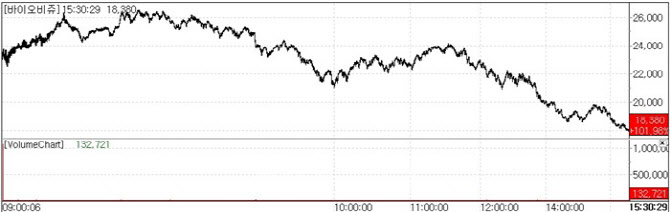

| | iobijou stock performance on May 20. (Source: KG Zeroin MP Doctor) |

|

Biobijou, Upper Limit on IPO Debut According to KG Zeroin’s MP Doctor(formerly Market Point), Biobijou, which went public on May 20, closed at 18,380 KRW up 101.98% from its IPO price. This marks the second consecutive day a newly listed biopharma company hit the upper limit on debut, following Immuneoncia, which rose 108.33% on May 19.

Investor enthusiasm for Biobijou is largely driven by optimism surrounding the booming aesthetic medical field. The company develops, manufactures, and sells a variety of medical aesthetic products including skin boosters and HA fillers. A key strength is its integrated business model that encompasses the entire production chain. Since its founding, Biobijou has focused on global markets and already has distribution channels in 21 countries including China, Southeast Asia, Europe, the CIS region, and the Middle East.

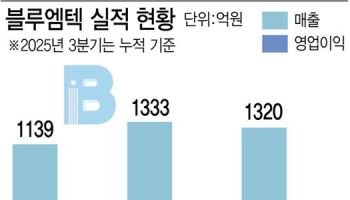

Unlike traditional biotech firms that require long timelines to generate revenue from drug development, Biobijou is already posting solid sales and operating profits. From 2021 to 2024, the company’s compound annual growth rate(CAGR) for revenue was 50.2%, and 187% for operating profit. In 2023, consolidated sales reached 29.6 billion KRW with an operating profit of 9.2 billion KRW.

The core revenue driver is its skin booster line, including products like Candour Serum and Athenart, which accounted for 49% of 2023 revenue. Its HA filler product “Corena” made up another 23%. Biobijou’s products are significantly more cost-competitive?skin boosters are up to 8 times cheaper(120,000 KRW vs. 970,000 KRW), and fillers are 4 times cheaper than competitors. Moreover, its skin boosters have a two-year longer shelf life and sustain treatment effects for up to 12 months, with minimized side effects due to its patented crosslinking agent removal technology.

Funds raised through the IPO will be used to expand a second GMP facility and invest in R&D and new product development. Once complete, annual production capacity for aesthetic products such as skin boosters and fillers is expected to exceed 8 million units?about 3.3 times current levels. The company also plans to expand into North and South America through its U.S. subsidiary, established last year.

“We’ve achieved strong results globally thanks to our differentiated technology and international market experience,” said Biobijou Vice President Kim Young-je. “Through this IPO, we aim to enhance our production capacity and market responsiveness to become a leader in the global medical aesthetics market.”

CorelineSoft Surges on Equity Deal Talks with U.S. Firm RadNet AI medical imaging company CorelineSoft jumped 13.86% to close at 6,900 KRW, even hitting the upper limit intraday. The rally followed exclusive reporting by PharmEdaily that Coreline is in discussions with RadNet, the leading U.S. imaging analysis firm, for a potential equity partnership.

According to PharmEdaily exclusive report titled “[Exclusive]Coreline CFO, ‘Discussing Equity Investment and Expanded Partnership with U.S. RadNet’” Coreline Soft is actively considering various forms of collaboration with RadNet, leveraging 18 billion KRW in capital reserves.

Nasdaq-listed RadNet has been aggressively expanding through acquisitions, most recently merging breast cancer AI developer iCAD with its subsidiary DeepHealth. The firm is reportedly considering an equity stake in Coreline as it accelerates its push into AI-driven imaging analysis.

Coreline has also made inroads into Europe, recently registering its solution with France’s national public procurement agency. The company says it is well positioned to become the exclusive supplier for the French government’s upcoming national lung cancer screening pilot. In Germany, it has partnered with Bayer to tap into a large sales network and has already supplied its solutions to 6 out of the country’s top 10 hospitals. Coreline sees these developments as a foothold for broader European market penetration.

“Our global expansion of the AI-based chest imaging solution ‘AVIEW LCS Plus’ aligns with our ongoing strategic discussions, including with RadNet,” CFO Jeong Woo-seok told PharmEdaily. “Coreline’s technological edge is translating into real opportunities in the global standardization of AI medical image reading.”

Samchundang Weakens on S-PASS Patent Concerns SamchundangPharma continues to slump, contrasting with the upward trend among obesity drug developers such as Peptron, InventageLab, D&D Pharmatech. The downturn is attributed to growing uncertainty around the S-PASS platform, the company’s core technology for oral diabetes and obesity drug delivery. From 151,000 KRW on May 15, shares dropped for three straight sessions, closing at 130,900 KRW on May 20?a 13.31% decline.

On May 16, PharmEdaily published [Exclusive]Core S-PASS Technology Deemed Non-Innovative 5 Years Ago, followed by [Exclusive]Samchundang Withdraws S-PASS Patent Filing, Follow-up Patents Uncertain on May 19. The articles revealed that although Samchundang has promoted its oral delivery platform S-PASS as central to its business strategy, the foundational technology had been previously deemed non-patentable and the company withdrew its patent filing without further action. The reports also called for greater transparency from the company toward investors.

In response, Samchundang posted a notice on its website stating “Due to confidentiality surrounding the S-PASS technology, we cannot disclose details at this time” and added, “We are already pursuing multiple patent filings in close cooperation with our partners, and rumors of failed patent registrations are baseless.” Despite speculation, PharmEdaily has confirmed that the company has not formally requested a correction to the articles.