Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Lim Jeong-yeo, Edaily Reporter] On the 11th, the Korean biopharma stock market spotlighted Pharos iBio, U2BIO, and G2GBIO. Pharos iBio drew license-out expectations following news that it listed its lead pipeline’s substance name in the official global registry. U2Bio continued to attract investor attention after it exchanged equities with Socar. G2GBIO saw trading volume rise after completing a bonus issue.

| | Pharos iBio chart(Cred=KG Zeroin MP Doctor) |

|

Pharos iBio rallies on license-out push for PHI-101 AI-driven drug developer Pharos iBio closed at 6,740 won, up 29.87% (1,550 won) from the previous day. The jump is seen as driven by the company’s announcement that it has officially registered the international nonproprietary name (INN) “lasmotinib” for acute myeloid leukemia (AML) therapy ‘PHI-101’ with the World Health Organization (WHO).

With no revenue to date since 2023, Pharos iBio is now expected to make active attempts at license-out deals.

PHI-101, discovered through Pharos iBio’s “Chemiverse” platform, showed safety and efficacy in a global phase 1 trial in patients with relapsed/refractory AML harboring FLT3 mutations. It is poised to enter a global phase 2 study, and the program is also being expanded to recurrent ovarian cancer, for which a domestic phase 1 is underway.

Pharos iBio, listed on South Korea’s tech-friendly secondary bourse Kosdaq since July 2023, specializes in AI-enabled innovative drug R&D and is developing lasmotinib (PHI-101) and PHI-501. Upon listing, the company guided that both pipelines would be licensed out in 2025 to generate revenue.

In a call with Edaily, CFO Moon Seong-won said: “Due to the recent residents’ strike, we couldn’t enroll new patients, which pushed the trials back and our business plan by a year. We’re now moving into full-fledged attempts at license-out deals. The PHI-101 clinical trial was completed in July and a CSR has been issued, and PHI-501 received IND clearance from the MFDS for phase 1 trial, with dosing to start in November. We expect to have PHI-501 data in time; while multiple pharmaceutical companies are already reviewing lasmotinib.”

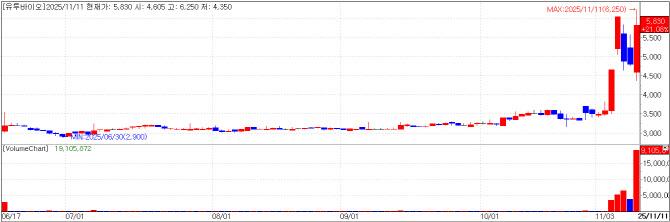

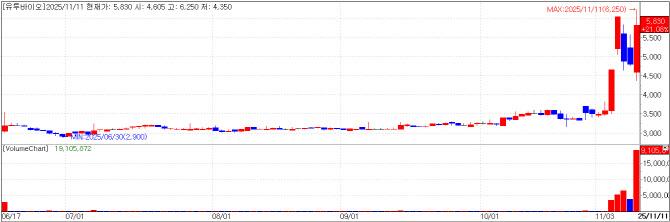

| | U2BIO chart(Cred=KG Zeroin MP Doctor) |

|

U2BIO teams up with Socar Diagnostics firm U2BIO ended at 5,830 won, up 21.08% (1,015 won). This follows the recent equity trade with Socar, a car-sharing platform service company.

Socar CEO Lee Jae-woong on Nov. 7 drew attention by acquiring 2.57 million newly issued U2BIO shares for 9 billion won. Specifically, U2BIO’s paid-in capital increase swapped those new shares for 778,276 existing Socar shares worth about 9 billion won held by Lee -- effectively a share-swap tie-up between the companies. Lee had already held 316,382 U2BIO shares valued at roughly 1.5 billion won, suggesting he has tracked the company for a long time.

U2BIO was founded in January 2009 by CEO Kim Jin-tae. Kim had previously co-founded Ubicare, a leader in Korea’s electronic medical record (EMR) market. U2BIO listed on Konex market in 2015 and moved to Kosdaq in October 2023.

It is to be noted that U2BIO’s largest shareholder shifted from Kim to NDS in July 2021. NDS’s largest shareholder is Mega Mart, creating a chain of control that flows from Mega Mart to NDS to U2BIO. Previously, NDS held 30.13% and CEO Kim 16.41%; the latest new-share issuance diluted those stakes. The new cap table shows NDS at 25.1%, Socar CEO Lee at 18.9%, and Kim at 9.5%.

NDS appears to have opposed bringing Lee in as a new shareholder, seeking an injunction to block the new share issuance. The Seoul Eastern District Court dismissed the application on the 6th, raising the possibility of a longer-term management dispute.

| | G2GBIO chart(Cred=KG Zeroin MP Doctor) |

|

G2GBIO jumps after bonus issue Long-acting formulation developer G2GBIO finished at 89,600 won, up 19.95% (14,900 won). The surge is partly attributed to increased trading volume after a recently completed bonus issue expanded the free-float.

On the 6th, G2GBIO carried out a bonus issue granting two new shares per existing share. Although G2GBIO went public in August, its total share count had been about 5.34 million; the bonus issue lifted that to roughly 16.02 million.

G2GBIO has garnered high expectations from investors after signing multiple co-development agreements on long-acting microparticle drugs with global big pharma companies. Since its first such deal in 2023, it has also entered a contract development (CDO) agreement with another big pharma. This year it signed two agreements with Boehringer Ingelheim, in January and July, and recently struck another co-development pact with a Europe-based big pharma.

The company has reportedly also scheduled plant inspection with another big pharma early next year, raising the likelihood of yet another collaboration. PharmEdaily previously introduced these developments as premium content

[단독]지투지바이오, 새 빅파마와 공장실사 돌입…추가 기술이전 청신호.

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)

![힘스앤드허스 유사품에 노보노디스크·일라이릴리 흔들… 삼일천하(?)[클릭, 글로벌 제약·바이오]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020800574b.jpg)