Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Saemi, Edaily Reporter] In the biotech and healthcare sector on May 13, shares of some “obesity-themed” stocks stood out. SLS Bio surged to the daily limit, and D&D Pharmatech also traded sharply higher. Tomocube saw gains on expectations that its 3D microscopy technology could become more essential following the U.S. Food and Drug Administration’s (FDA) removal of mandatory animal testing. Meanwhile, ToolGen plunged as a delay in the final ruling on its CRISPR patent dispute added to investor concern.

Obesity drugs still hot: SLS Bio and D&D Pharmatech rally According to KG Zeroin’s MP DOCTOR (formerly Market Point), SLS Bio closed at 2,525 won on May 13, up 585 won (29.85%) from the previous session. The company also hit the daily upper limit just two trading days ago on May 9.

| | (Source=KG Zeroin MP Doctor) |

|

SLS Bio’s trading volume surged from just 71,513 shares on May 8 to over 11.8 million shares by May 12, and then exceeded 25 million shares. Market watchers attribute the surge to growing interest in the blockbuster weight loss drug Wegovy. As SLS Bio handles quality control for Wegovy, expectations of increased demand have likely lifted the stock.

Meanwhile, D&D Pharmatech saw its shares jump 26.34%, closing at 89,700 won, up 18,700 won. The rally came after attention turned to its obesity drug candidates licensed to U.S.-based Metsera, which are nearing clinical trials. Rumors that Pfizer is eyeing Metsera as a potential acquisition target also boosted sentiment.

On May 12 (local time), Metsera reported in its Q1 earnings that its candidates MET-097o and MET-224o are expected to enter Phase 1 trials this year. These investigational drugs are based on D&D Pharmatech’s oral peptide platform, ORALINK. The first four-week dosing results for MET-224o could be available by the end of this year.

Market expectations that Pfizer, having failed twice in developing oral obesity drugs, may be targeting Metsera have further lifted D&D Pharmatech shares. “Metsera is seen as a prime acquisition candidate following Pfizer’s recent comments about bolstering its obesity pipeline,” said Hyunsoo Ha, analyst at Yuanta Securities.

Tomocube benefits from U.S. animal testing policy change? Tomocube’s holographic tomography technology has garnered renewed interest following the FDA’s decision to lift animal testing requirements. The company’s imaging platform enables label-free, live observation of cells, tissues, and organoids without dyes, fixatives, or fluorescent proteins.

Tomocube developed the world’s first second-generation holographic tomography system using LED light. It remains the only company capable of offering a system with 3D imaging, high resolution, multiplex imaging, thick-sample imaging, quantitative analysis, and AI-based analytics in one package. This positions it to become a new standard in biomedical imaging.

As organoids are expected to play a dominant role in preclinical testing under the new policy, demand for 3D microscopes like Tomocube’s could grow. The system enables one-click imaging and analysis of thick organoid samples.

Tomocube is also expanding beyond bio into sectors like semiconductors, OLED, and AR glasses. The company aims to raise its non-bio sales ratio to 20% this year, and expects its non-bio revenues to surpass bio revenues within five years.

Tomocube also reaffirmed its confidence in turning a profit next year. At the time of its KOSDAQ listing, it projected 1.6 billion won in operating profit by 2026. Given its dominant position and lack of competitors, the company expects export demand to rise. “There’s no specific new issue; rather, discussions we’ve had since last year are gaining fresh attention,” said a company representative.

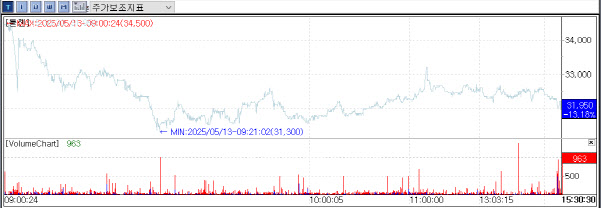

ToolGen drops 15% as U.S. court sends CRISPR patent case back to PTAB ToolGen shares tumbled during trading on Monday, falling as much as 14.95% to 31,300 won before closing at 31,950 won, down 13.18%. The drop came after a U.S. federal appeals court in Washington, D.C., vacated a previous decision by the Patent Trial and Appeal Board (PTAB) and sent the case back for reconsideration.

| | ToolGen’s share price trend on May 13 (Source=KG Zeroin MP Doctor) |

|

The PTAB had ruled in 2022 that the Broad Institute, not the CVC group (University of California, Vienna, and Charpentier), was the first inventor of the CRISPR-Cas9 genome editing technology. However, the appeals court found that PTAB applied the wrong legal standards for assessing “conception” and failed to fully consider key evidence. As a result, the case between Broad and CVC will be reexamined.

This means a final ruling in the CRISPR patent battle will likely be delayed again. Even if the new review is completed faster than the three years it took for the appeal, it may still take several more years before a final decision is reached.

Despite the delay, ToolGen interpreted the ruling positively, emphasizing that CVC did not challenge ToolGen’s status as the “senior party” in a separate interference case.

In that case, PTAB designated ToolGen as the senior party, while Broad and CVC were assigned junior status. While CVC had filed provisional patents as early as March 1 and May 18, 2012, ToolGen’s October 23, 2012 filing was deemed to have better supported claims involving CRISPR gene editing in eukaryotic cells. PTAB found that CVC’s filings focused on prokaryotic systems and lacked sufficient detail for eukaryotic applications.

“What’s important is that PTAB’s finding?that CVC’s P1 and P2 provisionals did not describe CRISPR-Cas9 in eukaryotic systems?has not changed,” a ToolGen official said. “Although the final ruling is delayed, this is still a major win for us.” The company added that it had anticipated this scenario and is fully prepared to address the ongoing legal developments.