Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Lim Jeong-yeo, Edaily Reporter] South Korea’s biopharma stock market saw notable moves in the aftermarket on July 10, with Intocell hitting its daily lower limit following news of a license deal termination due to a patent issue. Bridge Biotherapeutics rallied on crypto-related momentum. FutureChem also gained investor attention on its push to obtain domestic marketing authorization for a prostate cancer imaging agent.

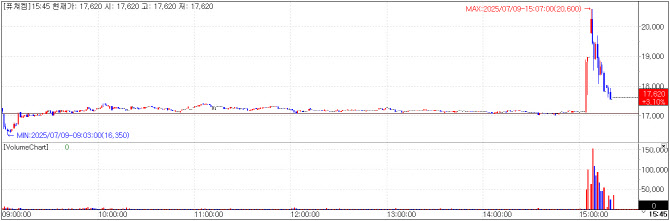

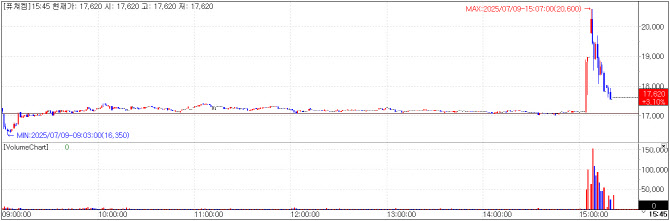

| | Intocell chart on July 9(Credit=KG Zeroin MP Doctor) |

|

Intocell’s Licensing Deal Canceled over Patent Issue Intocell announced that its licensing agreement with ABL Bio, signed last year, was terminated on July 9 due to patent concerns. In after-hours trading, shares plummeted 29.94% to KRW28,900, down from the closing price of KRW38,800, marking a steep one-day fall from the previous session’s KRW41,250.

The company, which went public on KOSDAQ this May, had drawn significant attention for its antibody-drug conjugate (ADC) pipeline and collaboration with Samsung Bioepis in drug development.

According to ABL Bio, the termination was prompted by uncertainties related to Intocell’s Nexatecan platform, specifically, the risk of lacking patent protection or infringing third-party patents.

In response, Intocell stated that NxT3, one of over 30 compounds in the Nexatecan series, was found during recent freedom-to-operate (FTO) analysis to have overlapping structure with a Chinese patent that predated its own. The company explained that this became apparent belatedly, due to the Chinese patent’s 18-month confidential period post-filing.

Intocell plans to continue developing alternative Nexatecan compounds and is also exploring acquisition options for the NxT3 patent. A formal company statement is expected on July 10 following internal discussions.

| | FutureChem chart on July 9(Credit=KG Zeroin MP Doctor) |

|

FutureChem To Pursue Approval for F-18 Florastamin in Korea FutureChem rose 3.10% to close at KRW17,620 after announcing plans to seek domestic approval for its prostate cancer imaging radiopharmaceutical, F-18 Florastamin, based on Phase 3 clinical trial results.

According to disclosures, the trial demonstrated efficacy in patients with recurrent or metastatic prostate cancer. All adverse events were considered unlikely to be related to the drug.

In a head-to-head comparison with MRI, the PET/CT scan using Florastamin showed higher sensitivity, while MRI had superior specificity. A single serious adverse event (0.26% incidence) led to trial discontinuation but was deemed manageable.

The company is preparing to submit for Korean regulatory approval, while Phase 3 trials are ongoing in Europe and China. In the U.S., a Phase 1 trial has been completed, with Phases 2 and 3 in planning.

FutureChem highlighted that the diagnostic market rivals the therapeutic market in size. In the U.S., Lantheus’ F-18 Pylarify (diagnostic) and Novartis’ Lu-177 Pluvicto (therapeutic) generated 1058 million USD and 1392 million USD in 2024 sales, respectively. The company emphasized that diagnostics are crucial from the early stages of disease, often being used in a broader patient population than therapeutics.

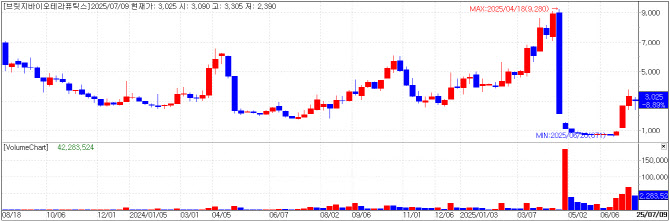

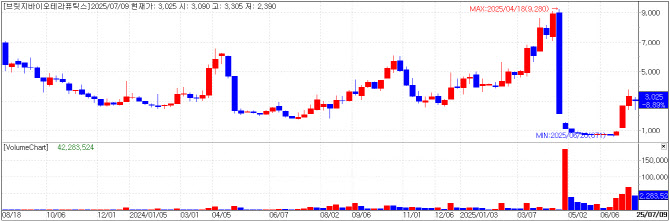

| | Bridge Biotherapeutics chart(Credit=KG Zeroin MP Doctor) |

|

Bridge Biotherapeutics Surges on Increasing Acceptance For Crypto Firms Bridge Biotherapeutics jumped 18.86% to KRW 3025 amid investor enthusiasm over regulatory changes. The South Korean Ministry of SMEs and Startups announced a draft amendment to the Enforcement Decree of the Venture Business Act, which would remove blockchain-based crypto trading and brokerage from the list of restricted industries for venture certification.

Bridge Biotherapeutics, once facing delisting due to failed clinical trials and capital erosion, recently saw a turnaround after being acquired by U.S. hedge fund Parataxis Capital. The firm plans to change its name to Parataxis Korea at a shareholders meeting in August and will amend its articles of incorporation to include crypto trading and transform in to a Bitcoin treasury company.

This development was also previously covered in PharmEdaily’s pay-to-read content

, <브릿지바이오 인수 파라택시스, “한국의 스트래티지 되겠다”>.

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)

![문여정 IMM인베스트먼트 전무 "ADC·DDS·CNS 주목"[바이오 VC 집중조명⑩]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600489b.jpg)

![인도, 글로벌 저가 제네릭에서 바이오 허브로 탈바꿈[제약·바이오 해외토픽]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020700379b.jpg)