Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Song Young Doo, Edaily Repoter] ViGenCell Co., Ltd. continued its rally after reporting successful Phase 2 results for its cell therapy candidate VT-EBV-N, with shares hitting the upper trading limit on the 8th.

Investors grew optimistic about the potential for conditional approval in Korea as early as the first half of next year and the prospect of commercializing the world‘s first NK/T cell therapy.

Samsung Pharm Co., Ltd. also hit the upper limit after acquiring GV1001, a treatment for progressive supranuclear palsy(PSP), from Gemvax & Kael Co., Ltd. DAEHWA PHARMACEUTICAL CO., LTD. also saw a sharp rise on expectations of accelerated entry into the Chinese market.

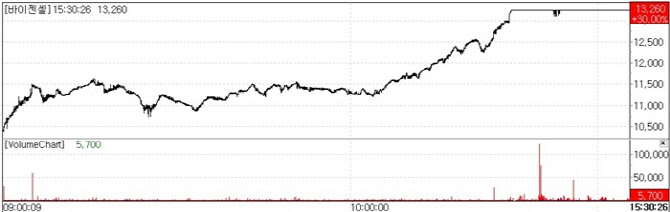

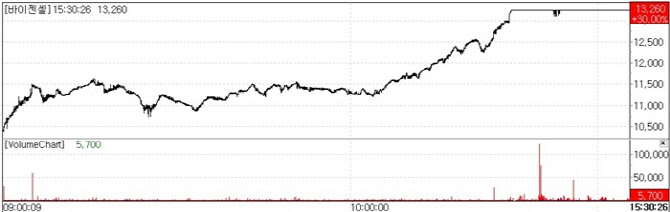

According to KG Zeroin MP Doctor(formerly MarketPoint), ViGenCell closed at 13,260 won on the 8th up 30 percent (3,060 won) from the previous day. The stock has risen for 11 consecutive sessions since November 24 when it closed at 3,270 won, up 140 won. Investor momentum strengthened following the Phase 2 data release, eventually pushing the stock to its daily limit.

On November 25 ViGenCell released top-line results from its Phase 2 trial of VT-EBV-N, an NK/T-cell lymphoma therapy candidate. The trial evaluated two-year disease-free survival(DFS) after treatment completion and demonstrated both clinical efficacy and safety.

The randomized, double-blind study enrolled 48 patients across 13 medical institutions in Korea including Seoul St. Mary’s Hospital. In the primary endpoint of two year DFS, the treatment group achieved 95.0 percent versus 77.58 percent in the control group a statistically significant difference(p = 0.0347).

Only 4.76 percent(one patient) in the treatment group experienced relapse or death, compared with 32 percent(eight patients) in the control group. The findings suggest that VT-EBV-N offers meaningful long-term disease suppression in NK/T-cell lymphoma.

ViGenCell is expected to pursue conditional approval. The therapy received orphan drug designation from the Ministry of Food and Drug Safety(MFDS) in 2019, making it eligible for priority review. If the disease is classified as life threatening and lacking adequate treatment options, conditional approval may also be considered.

Investors are focusing on rapid commercialization and its potential to drive earnings. The company expects more than 100 billion won in annual revenue within five years of launch and aims to resume license out negotiations with Chinese partners.

A company official noted that the recent stock surge reflects momentum from the Phase 2 results, adding that the stock had remained undervalued. “The final clinical study report (CSR) for Phase 2 is expected early next year.

After receiving the CSR, we plan to apply for fast-track designation in the first half and submit a conditional approval application in the second half,” the official said. “If approved VT-EBV-N would become the world‘s first commercial NK/T cell therapy. We expect commercialization in 2027 and about 120 billion won in annual sales by 2031. We also plan to resume license-out negotiations with Chinese companies.”

| | Bigencell share price movement (Source: KG Zeroin MP Doctor) |

|

Samsung Pharm Gains on PSP Drug Acquisition Gemvax & Kael licensed out its PSP therapy candidate GV1001 to Samsung Pharm, granting development and commercialization rights in four major Asian countries for a total of 220 billion won, including an upfront payment of 11.5 billion won.

The deal gives Samsung Pharm two GV1001-based indications—Alzheimer’s disease and PSP while expanding its pipeline across Korea, Japan, India and Indonesia. Shares closed at 1,773 won up 29.99 percent(409 won).

According to Gemvax GV1001 demonstrated good tolerability and signs of slowing disease progression in a Phase 2 study conducted in Korea. In a combined 72 week analysis from the extension trial, the low dose(0.56 mg) group showed statistically significant improvement in PSP-rating scale scores compared with external controls among PSP Richardson syndrome patients.

A Samsung Pharm official said the acquisition strengthens the company‘s expansion into neurological disorders and contributed to strong investor sentiment. Industry observers note that if Gemvax proceeds to a global Phase 3 trial and includes the licensed Asian regions as clinical sites, Samsung Pharm could play a key role in the pivotal study.

DAEHWA PHARMACEUTICAL Surges as Oral Chemotherapy Wins Reimbursement in China DAEHWA PHARMACEUTICAL announced on the 8th that its oral paclitaxel anticancer drug Liporaxel has been added to China’s 2025 National Reimbursement Drug List(NRDL) by the National Healthcare Security Administration(NHSA). The stock surged 21.02 percent(4,030 won) to 23,200 won following the announcement.

A company representative said the share price rose in response to the reimbursement listing. Liporaxel an improved oral formulation of intravenous paclitaxel received Chinese marketing approval for gastric cancer in September 2023.

Although non reimbursed sales began in January the new NRDL listing improves price competitiveness. The reimbursed price is set at 1,208 yuan(about 250,000 won) for the 300mg dose. Analysts expect this to accelerate Liporaxel‘s market penetration in China.

“The NRDL listing validates both the technological strength and therapeutic innovation of Liporaxel in the Chinese healthcare market.”

a company official said “We will work closely with our local partner to strengthen execution in the region and further elevate DAEHWA PHARMACEUTICAL’s position in the global oncology market.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)