Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Song Young Doo, Edaily Reporter] Shares of South Korean pharmaceutical and biotech companies advanced broadly as the KOSDAQ index climbed above the 1,000point mark.

MediPost surged to its daily upper limit after its Japan expansion plan drew a valuation in the trillions of won while Hyundai BioScience jumped on news that global experts had shown direct interest in its research on rheumatoid arthritis and prostate cancer. Samyang Biopharm also gained on expectations surrounding its new drug development pipeline.

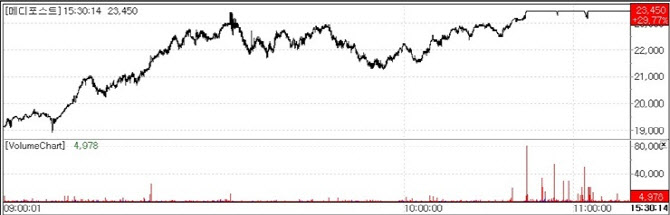

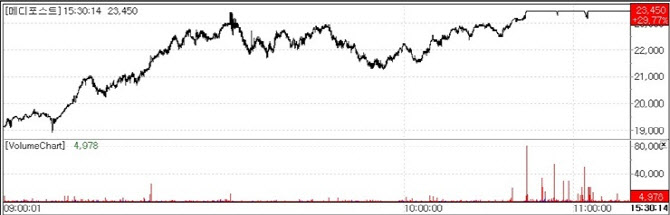

| | Medipost stock trend.(Source=KG Zeroin MP Doctor) |

|

Cartistem‘s Japan market value estimated at around 700 billion won According to KG Zeroin’s MP Doctor (formerly MarketPoint), MediPost closed at its daily upper limit on the day. The stock rose 29.77% (5,380 won) from the previous session to 23,450 won, marking a new 52week high.

The sharp rise was driven by renewed attention on the value of Cartistem, MediPost‘s knee osteoarthritis treatment currently undergoing a Phase 3 clinical trial in Japan. Notably Japanese pharmaceutical company Teikoku Pharma entered into an exclusive sales agreement for Cartistem in Japan even before the completion of the Phase 3 trial.

Under the agreement, MediPost received an upfront payment of 11.8 billion won ($8 million) upon signing, and will receive an additional milestone payment of 14.8 billion won upon regulatory approval from Japan’s Pharmaceuticals and Medical Devices Agency (PMDA).

Founded in 1848, Teikoku Pharma is a long-established pharmaceutical company with strengths in transdermal drug delivery technologies, particularly patches and opioid based pain management products. Market observers attribute Teikoku‘s early commitment to high confidence in Cartistem’s clinical success and strong unmet demand for knee osteoarthritis treatments in Japan.

Analysts estimate the economic value of the Japan deal at nearly 700 billion won on a present value basis. Wi Hae ju an analyst at Korea Investment & Securities said “The present value of revenue attributable to MediPost from the Japan contract is estimated at 689.1 billion won using a discounted cash flow (DCF) model.”

He added that the estimate assumes Cartistem‘s sales trajectory in Japan mirrors that of South Korea while factoring in drug prices roughly six times higher and a patient population about three times larger than Korea’s.

Teikoku is reportedly planning to hire around 100 specialized sales and marketing personnel in preparation for Cartistem‘s commercialization raising expectations that sales growth in Japan could be steeper than initially projected.

Wi noted that MediPost’s share price had not risen meaningfully following the contract announcement, suggesting that the market had underestimated the value of Cartistem in Japan.

“Near term catalysts include the completion of the Japanese Phase 3 trial in the first quarter and the release of results in the second quarter.” he said “Given the high probability of success, the opportunity outweighs the risks.”

He also pointed to the planned initiation of a U.S. Phase 3 trial for an injectable new drug candidate this year which could make MediPost eligible for funds specializing in late stage clinical assets.

Cartistem is administered via microfracture surgery to patients with severe cartilage defects. Despite the procedural complexity, the treatment has seen strong uptake since receiving approval in South Korea in 2012, with approximately 40,000 procedures performed last year alone.

Hyundai Bio rallies on Pentrium platform expectations Hyundai BioScience also hit its daily upper limit, rising 29.97%(1,870 won) to close at 8,110 won. Shares of its subsidiary, Hyundai ADM Bio, gained 13.56%(375 won) to 3,140 won.

The two companies held the “2026 Pentrium Global Symposium” in Seoul where they unveiled their global clinical strategy for Pentrium, a platform drug candidate designed to soften the extracellular matrix(ECM) surrounding rigid tumor tissues.

The mechanism is intended to reduce structural barriers in the tumor microenvironment allowing existing anticancer drugs to penetrate tumors more effectively.

The company announced the simultaneous initiation of clinical trials targeting prostate cancer and rheumatoid arthritis. Cho Won-dong, chairman of Hyundai ADM Bio, said the strategy aims to address two major intractable diseases with a single drug. He added that the trials will involve world-renowned experts including rheumatology specialist Professor John Isaacs and prostate cancer authority Professor Frederick Millard.

According to the company, both professors expressed strong interest in data presented by Hyundai ADM Bio at the American Association for Cancer Research(AACR) meeting in October last year. The data showed notable efficacy across cancer and four autoimmune diseases rheumatoid arthritis multiple sclerosis, Crohn‘s disease and psoriasis based on a shared mechanism.

Cho said Hyundai BioScience will lead the prostate cancer trials, while Hyundai ADM Bio will oversee the rheumatoid arthritis program targeting the estimated 200 trillion won global autoimmune disease market.

The company added that it has been preparing for Pentrium’s development over the past three to four years including establishing an AI driven drug discovery team in 2023 and securing dozens of core patents in collaboration with major law firms in the U.S. and South Korea.

Samyang Biopharm gains on SENS delivery platform value Samyang Biopharm, spun off from Samyang Holdings through an equity carve-out last November, also rallied as investors refocused on the value of its proprietary gene delivery platform, SENS. The company‘s market capitalization stands at around 800 billion won, roughly double that of its parent holding company.

Samyang Biopharm shares rose 19.56%(17,800 won) to close at 108,800 won, approaching its 52week high of 113,700 won. The gains were attributed to growing recognition of SENS as a core technology asset.

The company is developing an mRNA-based treatment for idiopathic pulmonary fibrosis(IPF) using the SENS platform, which enables selective delivery of RNA therapeutics including siRNA and mRNA to specific organs such as the liver, lungs and spleen.

The research has been selected for the “2025 Second National New Drug Development Project” led by the Korea Drug Development Fund(KDDF). Through the project, Samyang Biopharm aims to develop a preclinical candidate that delivers an mRNA based regulator targeting pulmonary fibrosis pathology directly to lung tissue. KDDF will provide research funding over the next two years.

IPF is a chronic, progressive lung disease characterized by excessive fibrotic tissue replacing healthy lung tissue, leading to declining respiratory function. An estimated 3 million patients worldwide are affected. The global IPF treatment market was valued at $3.29 billion last year and is projected to reach $6.07 billion by 2034.

A Samyang Biopharm official said the company had long been undervalued under the holding company structure, but added that the spin off has allowed the market to more properly assess the value of its new drug development business.

![Celemics hits limit before after hours filing[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020400292b.jpg)

![김경민 용인세브란스 교수 "GLP-1 비만약, 복합제보다 투약 주기 관건"[전문가 인사이트]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020301154b.jpg)

![상한가 먼저, 공시는 밤에…셀레믹스, 최대주주 변경[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020400290b.jpg)

!['텐배거 신화'에서 '마지막 증자' 시험대 오른 서범석 루닛 대표[화제의 바이오人]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020100441b.jpg)