Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Jinsoo, Edaily Reporter] On the 25th, Pharmicell’s stock surged nearly 20%, driven by expectations of continued strong earnings in the second quarter following a record-breaking Q1 performance. Meanwhile, Bridge Biotherapeutics, ABION, and Telcon RF Pharmaceutical continued their upper-limit rallies fueled by news of a management buyout and technology export deals.

In contrast, Daewoong Pharmaceutical and its holding company Daewoong declined due to emerging rebate allegations related to a new drug.

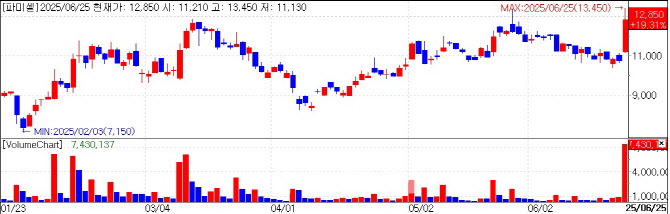

| | Pharmicell‘s stock trend. (KG Zeroin) |

|

Pharmicell Soars Nearly 20% on Record Earnings Outlook Pharmicell’s stock closed at 12,850 KRW, up 19.31%, after hitting an intraday high of 13,450 KRW, marking a 52-week high. The rise reflects optimism about the company‘s second-quarter and full-year earnings. In Q1 alone, Pharmicell posted 27 billion KRW in revenue and 8.4 billion KRW in operating profit already surpassing last year’s full-year operating profit of 4.7 billion KRW.

Market tracker FnGuide forecasts Pharmicell to record 123.9 billion KRW in annual revenue and 41.6 billion KRW in operating profit in 2024 representing a 2x increase in revenue and nearly 9x in profit year-over-year.

This growth is attributed mainly to the biochemical division, which focuses on nucleosides, PEG derivatives, and flame retardants used in electronic materials and fine chemicals. Pharmicell has worked with Doosan Electronic BG for over a decade on developing resins and curing agents. Since December, it has begun full-scale supply of high-performance specialty curing agents used exclusively in NVIDIA’s Blackwell AI accelerators.

It’s also reported that Doosan is conducting exclusive quality tests for NVIDIA’s next-generation AI chip, Vera Rubin, which may lead to further supply deals boosting market attention on Pharmicell.

A Pharmicell official commented, “Our stock price hadn’t fully reflected our solid earnings until now, but with Doosan’s growing partnership with NVIDIA, investor interest and expectations are finally translating into our share price.”

Limit-Up Rallies: How Long Can They Last? Bridge Biotherapeutics, ABION, and Telcon RF Pharmaceutical all hit their daily upper limit again. Bridge Biotherapeutics gained 473 KRW to close at 2,065 KRW, ABION rose 1,750 KRW to 7,600 KRW, and Telcon RF jumped 1,830 KRW to 7,960 KRW.

Bridge Biotherapeutics announced a sale of management rights to U.S.-based cryptocurrency investment firm Parataxis last Friday. This news triggered three consecutive upper-limit trading days from Monday (23rd) through Wednesday (25th).

This rally echoes similar moves seen in companies like AdBiotech, which also posted three straight limit-up days following news of a major shareholder change.

ABION hit its limit-up after announcing a $1.315 billion technology export deal for its antibody drug program, ABN501, which targets Claudin-3 (CLDN3) overexpressed in solid tumors. The deal includes $25 million upfront ($5 million per target for 5 targets), with additional upside possible from 3 more antibody targets under a priority negotiation clause.

A company spokesperson stated, “We have exclusive negotiation rights for 3 additional antibody targets beyond the 5 included in this deal. If successful, the total contract value could increase further.”

Telcon RF Pharmaceutical, a major shareholder of ABION, also hit the upper limit due to its indirect benefit from ABION’s announcement.

Daewoong and Daewoong Pharmaceutical Decline on Rebate Allegations Daewoong Pharmaceutical closed down 3.77% at 145,500 KRW, while holding firm Daewoong fell 1.94% to 22,750 KRW. This follows media reports that a whistleblower submitted a report to Korea’s Anti-Corruption and Civil Rights Commission in April last year, alleging that from Jan 2022 to Dec 2023, over 130 sales reps provided illegal rebates to approximately 200 doctors across 380 clinics and hospitals in exchange for drug prescriptions.

Although police initially closed the case in April 2024 due to difficulties in verifying the whistleblower’s identity, the rebate report has recently resurfaced, prompting renewed investigations.

Daewoong Pharmaceutical responded: “We strictly follow the Pharmaceutical Affairs Act and fair trade guidelines. All promotional events are transparently executed per internal regulations. The so-called ‘report’ is merely a personal memo exaggerated by an employee to overstate their performance.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)