Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Jinsoo, Edaily Reporter] On Nov. 17, several Korean biotech and healthcare stocks including Rokit Healthcare, L&C Bio, and HansBioMed drew strong investor interest. Rokit Healthcare surged to the upper trading limit after securing a key foothold for entry into the Chinese market, one of the world’s largest healthcare markets.

L&C Bio climbed on strong earnings driven by its ECM-based skin booster, often described as a “game changer.” HansBioMed also rose sharply on expectations of improved results.

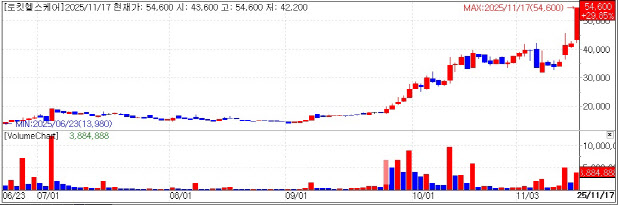

| | Rokit Healthcare stock trend. (KG Zeroin’s MP Doctor) |

|

Rokit Healthcare Hits Limit-Up According to KG Zeroin’s MP Doctor (formerly MarketPoint), Rokit Healthcare shares soared early in the session and eventually hit the upper trading limit, closing at 54,600 won. The sharp rally followed news that the company secured a core patent in China.

Rokit Healthcare said it received a notice of patent approval in China for its “bio-printer using cryogenic crosslinking of biomaterials and the cryogenic crosslinking method.” With this, the company has secured the intellectual property and technological foundation necessary for entering the Chinese regenerative treatment market, particularly for its diabetic foot ulcer (DFU) regenerative patch.

The DFU regenerative patch uses extracellular matrix (ECM) harvested from the patient’s abdominal fat and is custom-printed using Rokit’s 3D bio-printer Dr. INVIVO, which employs AI to analyze the wound’s size, depth and volume. The company reports that a single application of the patch enables approximately 82% wound regeneration within 12 weeks.

Investor expectations are especially high because China is the world’s largest diabetes market. According to the International Diabetes Federation (IDF), China has 147.98 million adult diabetes patients in 2024. Studies show that about 8% of Chinese diabetics develop diabetic foot ulcers meaning roughly 12 million patients could be potential users of Rokit’s DFU patch.

Rokit Healthcare had been cautious about China due to IP protection concerns. But with its foundational patent secured, the company is expected to pursue Chinese market entry more aggressively.

A Rokit Healthcare official said, “In China, diabetic foot complications including foot amputations are driving a steep rise in social and healthcare costs,” adding that the patent provides core IP infrastructure enabling a ‘China-tailored, long-term DFU regeneration solution.’

L&C Bio Turns Profitable; HansBioMed Follows L&C Bio shares rose 11.71% to close at 56,300 won. The rally followed a strong third-quarter performance.

The company reported cumulative Q3 consolidated revenue of 60.8 billion won, up 15% year-over-year and the highest since its 2018 IPO. Quarterly revenue also reached a record 22.6 billion won. Operating profit came in at 2.5 billion won, reversing first-half losses and returning the company to profitability.

L&C Bio’s strong earnings were driven by the ECM-based skin booster “Lituo,” which has been rapidly gaining market share due to its differentiated composition.

An L&C Bio official said, “We expected full-year profitability in Q4, but performance improved faster than anticipated, leading to a turnaround by Q3.”

The company expects even stronger growth next year as it expands ECM skin booster production lines and increases exports of Megacarti, its medical device for osteoarthritis treatment.

HansBioMed which sells its own ECM-based skin booster, CellerDM also attracted investor attention. Its shares jumped 20.93% to 34,950 won.

HansBioMed’s fiscal year runs from October to the following September, and it will report first-quarter earnings next February. Since CellerDM sales began in October, the company’s Q1 earnings are expected to improve sharply. HansBioMed forecasts 108.8 billion won in revenue and 4.7 billion won in operating profit next year up 22% and 235% year-over-year, respectively.

Both L&C Bio and HansBioMed are preparing to enter the Chinese market, which is expected to fuel further growth. China’s skin booster market was estimated at 2.5 trillion won last year 25 times larger than Korea’s roughly 100 billion won market. Top industry player PharmaResearch already generates 35~45% of quarterly revenue from China, underscoring the importance of the market.

An L&C Bio official added, “Due to regulatory restrictions, human tissue-derived products cannot be exported directly to China. Lituo must be converted into a medical device, and development is ongoing. Since the process is still in its early stages, entry into China will take more time.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)