Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Yu Jin-hee, Edaily Reporter] SEOUL, South Korea-On June 9, the South Korean stock market maintained its bullish tone amid investor optimism over the incoming administration. Among the beneficiaries were undervalued pharmaceutical, biotech, and medical device stocks. Leading the rally were AdBiotech and HK Inno.N, both of which demonstrated strong growth potential and captured market attention. Naturalendo Tech and Cell Bio Human Tech also gained favor from investors, driven by expectations of a turnaround.

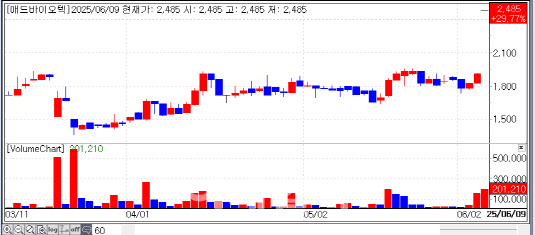

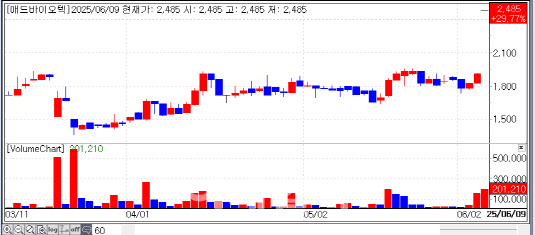

| | Recent stock price trend of AdBiotech. (Source: KG Zeroin MP Doctor) |

|

AdBiotech Hits Daily Upper Limit on New Business Expansion Hopes According to KG Zeroin‘s MP Doctor (formerly Market Point), four biopharma firms made it into the day’s “Top 30 Gainers” list: AdBiotech, HK Inno.N, Naturalendo Tech, and Cell Bio Human Tech. AdBiotech surged 29.77% to close at KRW 2,485, while HK Inno.N gained 14.51% to KRW 46,950. Naturalendo Tech and Cell Bio Human Tech also rose 29.91% and 17.34%, closing at KRW 4,300 and KRW 7,510, respectively.

Investors responded swiftly to favorable developments hinting at sustainable growth. AdBiotech, a company specializing in animal-derived immune antibodies, gained traction on news of new investment. Before the market opened, the company announced plans to issue its 7th round of convertible bonds worth KRW 10 billion, maturing July 3, 2030, with a conversion price of KRW 1,865 per share. GOLix was selected as the bond subscriber.

The funds will support operating costs, including Phase 3 clinical trials of Oregovomab (FLORA-5)-an ovarian cancer immunotherapy project targeting FDA approval.

An AdBiotech representative commented, “While we regret not being able to disclose more details to investors, GOLix was chosen based on its payment capacity and timing, which align with our financing needs.”

The company also plans to grow through various new businesses in 2025. Revenue from its microbial agent for food waste processors will start being recognized from the second quarter. The agent, composed of naturally derived microbes, aids in decomposing food waste and is essential for 4th-generation disposal machines. AdBiotech has secured supply deals with LG Electronics and other mid-sized appliance firms in Korea. Once the business stabilizes, the company expects this segment to account for over 30% of total sales.

Expansion in China is also underway, driven by products targeting swine diseases like PRRS (Porcine Reproductive and Respiratory Syndrome) and PED (Porcine Epidemic Diarrhea). PRRS, often called “swine AIDS,” is one of the most damaging diseases to the global pig farming industry, with an infection rate of 81.3% in Korean farms as of last year. Both PRRS and PED are known to severely impact farm productivity, and current vaccines and treatments are largely ineffective. AdBiotech’s nanobody antibody treatments aim to fill this critical gap.

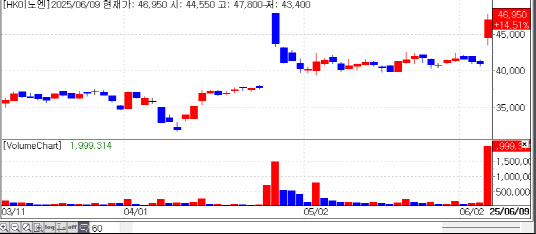

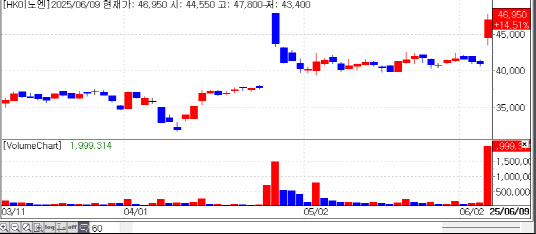

| | Recent stock price trend of HK Inno.N. (Source: KG Zeroin MP Doctor) |

|

HK Inno.N Boosted by U.S. Prospects for ‘K-CAB’ HK Inno.N saw a sharp rise on optimism surrounding the U.S. market entry of its gastroesophageal reflux drug, K-CAB. According to Samsung Securities, concerns about generic competitors diminished after U.S.-based Phantom Pharmaceuticals’ citizen petition to extend exclusivity for its similar product Vocessna was approved, pushing its exclusivity to 2032 from 2027. This lifted investor sentiment around K-CAB’s U.S. commercialization.

HK Inno.N is expected to report detailed results from its global Phase 3 trial and file a New Drug Application (NDA) with the U.S. FDA within the year.

Samsung Securities analyst Seo Geunhee wrote in a note, “The earlier concern over generics caused volatility in Phantom’s share price and weighed on HK Inno.N. However, this approval removes a major overhang and signals potential market share growth in the U.S.”

Naturalendo Tech and Cell Bio Human Tech had no immediate catalysts, but their stocks rose on expectations of second-half earnings improvements.

Naturalendo Tech is regaining trust after distancing itself from the “fake Baeksuo” scandal. On June 3, the Supreme Court ruled that the 2015 announcement by the Korea Consumer Agency lacked credibility. The agency had claimed certain Baeksuo (Cynanchum wilfordii) products, including Naturalendo’s, contained a toxic plant, Cynanchum auriculatum. The news caused the company’s stock to plummet from KRW 86,000 to KRW 8,500 in under a month.

However, the court found the agency’s analysis inconclusive and noted there was no clear evidence of deliberate adulteration. The verdict stated, “The agency’s conclusion-that cost-cutting led to ingredient substitution-was unfounded, and may have exaggerated health concerns over the product.”

A company spokesperson remarked, “With the issue finally resolved, we can now fully focus on our core business and work toward a recovery in performance.”

Meanwhile, Cell Bio Human Tech rallied on expectations of improved performance in its domestic and overseas K-beauty device segments. The company develops mask packs and medical materials using its proprietary cellulose-based technology, aiming to create sustainable, human- and nature-friendly materials.

![에이프릴바이오, 임상 결과 전 내부자 매도…셀비온·뉴로핏은 강세[바이오 맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021100299b.jpg)