Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Jiwan, Edaily Reporter] On September 2, the domestic pharmaceutical and biotech sector saw strong momentum driven by clinical results, global pharma collaborations, and technology commercialization.

Olix hit the daily upper limit and marked a new 52-week high on expectations for its wet age-related macular degeneration therapy OLX301A and potential big-pharma partnerships.

KoBioLabs surged by double digits after announcing that its obesity-targeted strain KBL983 has secured international patent registration in the U.S., reinforcing prospects for strain-based GLP-1 therapeutics.

Geninus jumped sharply as expectations for additional contracts of its spatial-omics AI solution IntelliMed triggered a 1,300% spike in trading volume.

Olix: New 52-week high, OLX301A expectations rekindled Olix hit the daily upper limit after a combination of brokerage analysis pointing to extreme undervaluation and a paid news report by Pharm E-Daily. The outlet headlined its report: “Olix takes on next-generation platforms for obesity, muscle, and CNS drug development.”

| | Dong-Ki Lee, CEO of OliX (Photo = OliX) |

|

Shares rose by KRW 17,600 (29.93%) to KRW 76,400, setting a new 52-week high.

Shinhan Investment’s Min-Yong Um noted, “Among domestic biotechs, only four firms;Alteogen, LegoChem Bio, ABL Bio, and Olix have signed final contracts with big pharmas. Should Olix secure further deals, the stock’s extreme undervaluation will become self-evident.” He added, “The upcoming readout of the OLX301A phase 1a/1b results in September and concurrent phase 2 initiation will enhance its negotiating leverage with global players. The current price range should be viewed as an opportunity, with upside potential from clinical data and deal announcements.”

Pharm E-Daily also highlighted that existing partnerships with Eli Lilly and L’Oreal could be expanded.

The clinical study report (CSR) for OLX301A is due later this year. Originally licensed out to Thea Open Innovation in 2019 for KRW 80.7 billion but returned in June 2023, the asset is again drawing heavy investor attention. Olix has stated it will choose whichever strategy,out-licensing or self-development, proves most advantageous. A company official confirmed, “We are reviewing strategic collaborations with global pharmas for OLX301A.”

KoBioLabs: Raising GLP-1 naturally through gut bacteria, not injections KoBioLabs shares gained KRW 1,000 (17.36%) to close at KRW 6,760, buoyed by patent news around its obesity candidate.

The company announced that international patent registration of its obesity-targeted strain Akkermansia muciniphila KBL983 has been decided in the United States the fifth such registration following China, Japan, Russia, and Canada.

KBL983 is a human-derived microbiome strain. Mechanistically, the bacteria stimulate the gut mucosa or L-cells, which in turn increase GLP-1 gene expression, leading to higher secretion of the GLP-1 hormone. This approach prompts the body to produce more GLP-1 naturally, rather than injecting the hormone externally.

Previous studies have shown that proteins secreted by Akkermansia (such as P9) stimulate intestinal cells to boost GLP-1. Elevated GLP-1 levels are linked to appetite suppression, weight reduction, and improved glycemic control.

Unlike GLP-1 injectables, which can trigger rebound weight gain and GI side effects, the strain-based approach maintains metabolic homeostasis with fewer side effects.

A company official commented, “The U.S. is the largest global pharma market and the core arena for innovative therapies. With this registration, we will accelerate global IP protection for KBL983 and expand commercialization and partnership opportunities.”

Geninus: Trading volume surges 1,300%, momentum from contract prospects Geninus rallied on expectations of additional contracts for its spatial-omics AI platform IntelliMed.

Pharm E-Daily’s YouTube channel posted a pre-market video that helped fuel investor sentiment. Shares rose KRW 180 (11.96%) to close at KRW 1,685, with trading volume up 1,309% from the prior day.

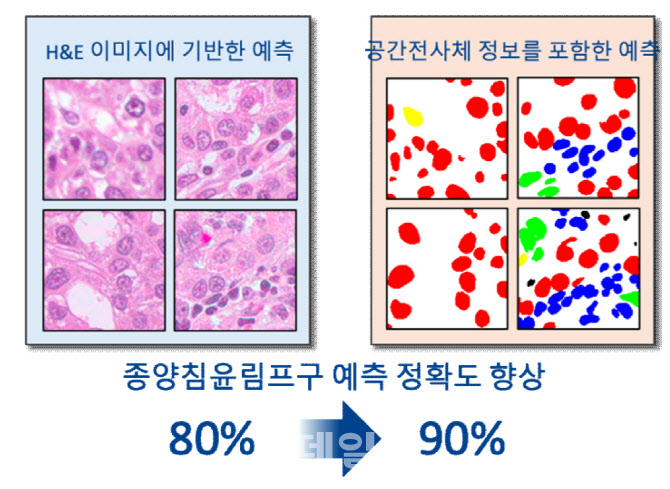

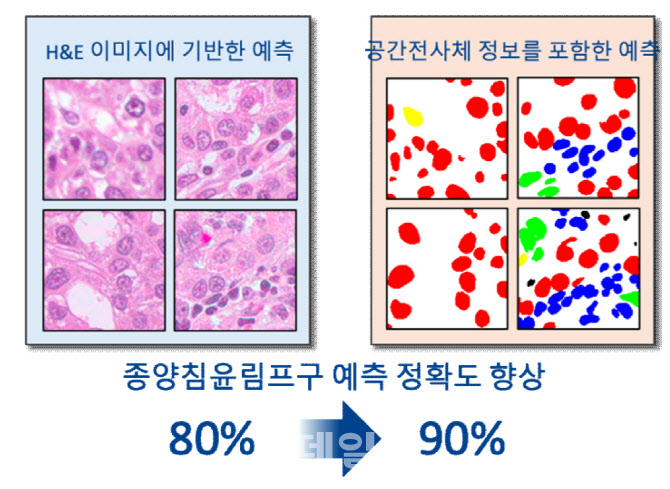

| | On the left is a conventional pathology slide analysis image, and on the right is an IntelliMed cell analysis image. In the IntelliMed analysis, cancer cells, T cells, and others are distinguished by different colors. Using IntelliMed improves the accuracy of predicting tumor-infiltrating lymphocytes from 80% to 90%. (Provided by Geninus) |

|

A company representative explained, “Investor enthusiasm appears tied to expectations of a deal with Ono Pharmaceutical, as well as anticipated project-based results with ABL Bio and a major Company A.” He added, “Rate cuts are also improving investor sentiment across the AI-healthcare sector.”

Geninus has built one of the world’s largest spatial-omics datasets 70 to 100 million cells from 1,000 cancer patients. Leveraging this, the company developed Space Insight for visualization and IntelliMed, which integrates AI.

The system enables precise analysis of how cancer and immune cells interact, particularly predicting lymphocyte infiltration into tumors. Such insights help determine whether drug candidates will work, and in which patients, with greater accuracy and speed.

“IntelliMed can significantly cut time and cost in both preclinical and clinical drug development,” the company stressed.

CEO Woong-Yang Park added, “First-half sales have already nearly matched last year’s full-year revenue of KRW 6.5 billion. With KRW 5.2 billion posted in H1, we are confident in achieving our 2025 full-year target of KRW 15 billion.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)