Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Yu Jin-hee, Edaily Reporter] SEOUL.. “Orphan drugs are not just for portfolio decoration. We will demonstrate a true success story with our in-house developed prostate cancer radiopharmaceutical, 177Lu-Pocuvotide (Lu-177-DGUL). Next month will mark a critical turning point.”

In an interview at the company’s Seoul headquarters on Nov. 12, Kim Kwon, CEO of Cellbion, said the clinical study report (CSR) for the Phase 2 trial of 177Lu-Pocuvotide in patients with metastatic castration-resistant prostate cancer (mCRPC) is expected to be finalized next month.

| | Kim Kwon, CEO of Cellbion.(Source: Cellbion) |

|

Confidence in a Successful Market Debut for 177Lu-Pocuvotide Prostate cancer treatment typically progresses in stages: surgery for early, localized disease → first-line hormone therapy for metastatic cases → second-line taxane chemotherapy when hormone therapy fails → third-line radioligand therapy for refractory patients.

177Lu-Pocuvotide targets prostate-specific membrane antigen (PSMA), which is overexpressed on prostate cancer cell surfaces, and is designed for patients who have not responded to first- or second-line therapies. The drug received orphan drug designation in Korea in 2021 and GIFT (Global Innovative Product Fast Track) designation in 2023.

“Radioligand therapies must combine efficacy, supply infrastructure, and pricing strategy to be commercially viable,” Kim said. “177Lu-Pocuvotide meets these requirements and is well-positioned for a successful debut.”

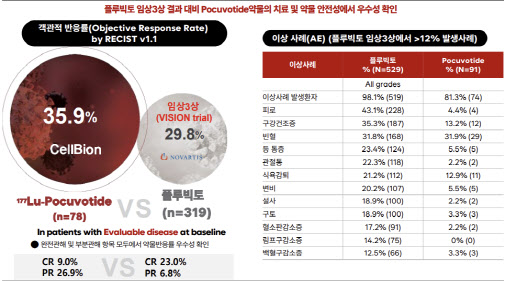

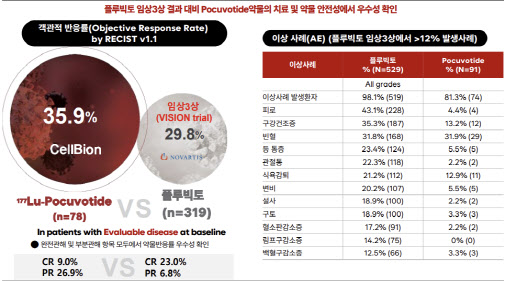

Cellbion’s confidence comes from data. In its Phase 2 trial, the company secured key efficacy and safety outcomes. The study enrolled 91 advanced prostate cancer patients who had not responded to standard therapies; 78 evaluable patients who received at least one dose were analyzed for efficacy.

According to an independent imaging review committee, the objective response rate (ORR) was 35.9% (28 patients) -with complete response (CR) at 8.97% and partial response (PR) at 26.9%. The results surpass those of Novartis’s Pluvicto, which achieved an ORR of 29.8% (CR 6.8%, PR 23.0%) in the global Phase 3 VISION trial when combined with standard therapy.

Safety data also stood out. Xerostomia (dry mouth), a common adverse event in PSMA-targeting radioligand therapies, occurred in 13.2% of patients (12 cases) -far lower than 38.8% reported in the VISION study.

“While the final ORR is lower than the interim 47.6%, it remains sufficient for conditional approval and still outperforms competing products,” Kim said. “Including early dropouts who did not complete all six treatment cycles strengthened statistical conservatism, enhancing the reliability of the findings.”

| | (Source: Cellbion) |

|

Turning Latecomer Disadvantage Into Strength Cellbion aims to overcome its latecomer disadvantage through the unique characteristics of radiopharmaceuticals. Unlike chemical or antibody-based drugs, supply lead time -the total duration from production to patient administration -directly affects treatment efficacy.

The therapeutic isotope Lutetium-177 has a half-life of about 6.7 days, meaning delayed administration after production reduces effectiveness.

“177Lu-Pocuvotide minimizes isotope decay loss through a domestic production and supply system,” Kim explained. “Compared with products manufactured in Europe and shipped by air, ours offers superior hospital accessibility and patient treatment efficiency.”

The company recently began expanding its collaboration with the Institut Pasteur Korea, establishing a GMP-compliant radiopharmaceutical labeling center. It plans to relocate and expand its R&D facility from Seoul National University Bundang Hospital to the Pasteur Korea site in Pangyo, integrating research and production under one roof. The labeling center will serve as a core hub for binding radioactive isotopes to targeting ligands -the final step in radiopharmaceutical production.

Currently, Pluvicto effectively monopolizes the global prostate radioligand therapy market, with out-of-pocket treatment costs in Korea estimated at 40 million won per cycle. Considering an average of six cycles, total patient expenses can exceed 200 million won.

Pluvicto’s global sales reached $1.39 billion (about 2 trillion won) in 2023 and 1.5 trillion won in the first half of 2024 alone.

Cellbion plans to price 177Lu-Pocuvotide at around 27 million won per dose, aiming to ease the burden on patients.

“By lowering cumulative treatment costs per patient and improving supply stability and hospital efficiency, we can still expect more than 20 billion won in domestic sales during the first year,” Kim said.

| | (Source: Cellbion) |

|

Expansion Strategy and Global Partnerships After commercialization in the first half of next year, Cellbion plans to pursue sustainable growth through label expansion and license-out opportunities, addressing the profitability challenges typical of orphan drugs.

Positive clinical outcomes have already accelerated global collaborations. One major initiative is a combination trial with Merck’s immune checkpoint inhibitor Keytruda, targeting mCRPC patients without prior taxane chemotherapy to evaluate safety, efficacy, and pharmacokinetics. Patient dosing is expected within this year.

Industry estimates suggest that third-line therapy patients account for about 10% of all prostate cancer cases, while second- and third-line combined represent 30%. Expanding patient eligibility through the Merck partnership could significantly increase 177Lu-Pocuvotide’s clinical and commercial utility.

With successful Phase 2 data, the technology’s out-licensing value is already estimated at over 1 trillion won.

“Collaboration with Merck not only expands disease stages within prostate cancer but also opens the door to new solid tumor indications such as ovarian cancer,” Kim said. “As combination and expansion data accumulate, we will pursue multiple profitability tracks -including licensing, regional partnerships, and co-development deals.”

He added, “All of this hinges on securing conditional approval for 177Lu-Pocuvotide. With proven efficacy and safety, domestic production infrastructure, and a competitive pricing strategy, we’re ready to cross the final threshold to commercialization.”