Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Yu Jin-hee, Edaily Reporter] SEOUL, South Korea-On July 30, DXVX and Nature Cell stood out in South Korea’s pharmaceutical, biotech, and medical device (hereafter “biotech”) sector. DXVX hit the upper limit on its first-ever license-out deal, while Nature Cell extended its rally to a third consecutive session ahead of a key regulatory decision.

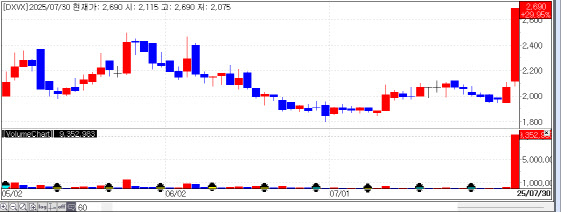

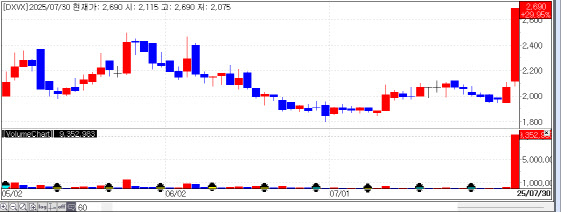

| | Recent stock price trend of DXVX. (Source: KG Zeroin MP Doctor) |

|

DXVX Licenses Out mRNA Cancer Vaccine in $230M Deal According to KG Zeroin’s MP Doctor (formerly Market Point), biotech stocks DXVX, Nature Cell, and Easybio ranked among the top 20 gainers in the Korean stock market on the day. DXVX closed at KRW 2,690, up 29.95% from the previous session. Nature Cell jumped 23.41% to KRW 36,900, and Easybio gained 11.90% to KRW 6,200.

Investors responded strongly to each company’s momentum-driving news. DXVX surged after announcing a major milestone-a license-out deal, considered a hallmark achievement in biotech.

In a disclosure on July 30, DXVX revealed it had signed a license-out and co-development agreement worth approximately KRW 300 billion (about $230 million) with a U.S.-based biotech company for its proprietary messenger RNA (mRNA) cancer vaccine. It is the company’s first global license-out deal since inception.

Under the agreement, DXVX will grant its partner exclusive worldwide rights to its mRNA cancer vaccine patent. In return, the partner will pay development-based milestones totaling around KRW 300 billion, as well as double-digit sales milestones over a period exceeding 15 years following commercialization.

DXVX will remain in charge of research and development, including preclinical studies and Phase 1 to 3 clinical trials, as well as manufacturing for commercialization. The U.S. partner will oversee global regulatory filings and commercialization.

The vaccine reportedly outperformed competing global candidates currently in Phase 2b trials in preclinical models. DXVX is also preparing combination studies with existing antibody therapies and filed a patent last year.

Despite historical challenges in cancer vaccine development-including insufficient efficacy and large-scale trial demands-recent advances in mRNA technology have reinvigorated the field. To date, only three cancer vaccines have been commercialized globally: Merck’s HPV vaccine Gardasil, Dendreon’s prostate cancer vaccine Provenge, and GSK’s Cervarix.

Post-pandemic, mRNA-based cancer vaccines are gaining traction as next-gen therapies. DXVX is also developing other mRNA vaccine platforms for ultra-long-term room-temperature storage, an oral obesity treatment, and a second oncology vaccine candidate, OVM-200.

DXVX CEO Kwon Gyu-chan commented, “We expect this deal to positively influence ongoing discussions on other pipelines.”

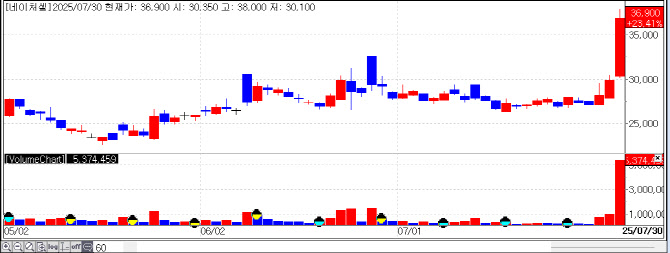

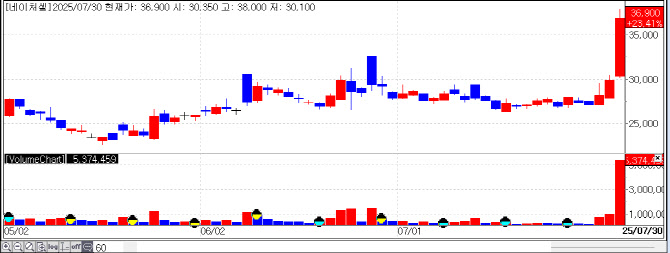

| | Recent stock price trend of Nature Cell . (Source: KG Zeroin MP Doctor) |

|

Nature Cell Climbs as Stem Cell Therapy Awaits MFDS Decision Nature Cell has also captured market attention as it awaits a decision from Korea’s Ministry of Food and Drug Safety (MFDS) on its degenerative arthritis stem cell therapy, JointStem. Since opening at KRW 27,100 on July 28, the stock has risen 36.2% over three sessions, closing July 30 at KRW 36,900.

In April 2023, JointStem faced rejection for approval from MFDS, threatening its domestic prospects. However, the company shifted focus to U.S. clinical trials and is now making a comeback. Currently, its U.S. Phase 2b/3a trial is progressing without issues, restoring market confidence.

The U.S. FDA has designated JointStem both as a Regenerative Medicine Advanced Therapy (RMAT) and a Breakthrough Therapy (BTD). These designations grant expedited review, with RMAT reducing standard review times from 10 to 6 months.

Backed by this progress, Nature Cell reapplied for Korean market approval in March. Approval decisions generally take 3–6 months from filing, though additional steps may extend the timeline. On June 24, the MFDS’s Pharmaceutical Affairs Committee reportedly reviewed the therapy’s efficacy, safety, and approval considerations. Such decisions are typically posted on the public Drug Safety Korea portal within one month of the committee meeting.

Separately, Easybio rallied on optimism that it will benefit from a restructuring of the global livestock supply chain centered around North America. Eugene Investment & Securities cited Easybio as the only KOSPI-listed company poised to gain from this shift. The company specializes in biotech-driven feed additives and related technologies.

An industry insider noted, “The recent rallies in Nature Cell and Easybio reflect speculative sentiment. Investors should keep in mind that a reversal is possible, especially considering Nature Cell’s history of volatility in similar regulatory cycles.”

![Xcell Therapeutics Hits Upper Limit...Celemics·QuadMedicine ↑[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020600366b.jpg)