Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Yu Jin-hee, Edaily Reporter] SEOUL-Biotech names tied to license-out narratives outperformed on Nov. 6, underscoring how technology-transfer headlines can move Korea’s healthcare stocks across pharma, biotech and med-device.

According to KG Zeroin’s MP Doctor (formerly Market Point), four healthcare names-U2Bio, STCube, Ildong Holdings and Toolgen-made the market’s top-20 gainers. They closed up 29.83% (6,050 won), 15.18% (9,790 won), 14.29% (13,440 won) and 13.62% (734,000 won), respectively.

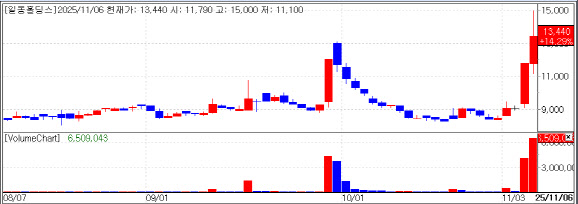

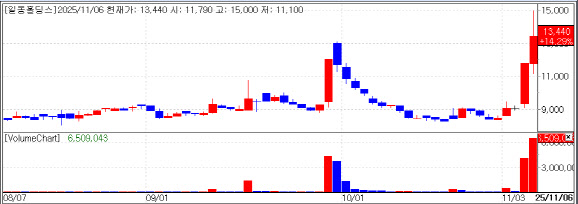

| | Recent stock price trend of Ildong Holdings. (Source: KG Zeroin MP Doctor) |

|

Ildong Holdings stood out. After hitting the daily limit up on Nov. 5, the stock rose by double digits again on Nov. 6, and investors say upside remains if its “possibility” turns into reality-potentially unlocking additional equity value.

The focus is on “ID110521156,” an obesity/diabetes candidate from subsidiary Ildong Pharmaceutical. The investigational therapy is a small-molecule, oral GLP-1 receptor agonist (GLP-1 RA) designed to maintain effective plasma exposure for more than 18 hours without tissue accumulation, enabling once-daily, long-term dosing, the company says. Compared with peptide GLP-1 injectables, Ildong cites advantages in pharmacology, manufacturing efficiency and cost, and patient convenience.

In a Phase 1 study completed last month, the candidate produced up to 13.8% weight loss over four weeks, with no serious adverse events tied to common GLP-1 issues such as gastrointestinal disturbances or hepatotoxicity, according to the company. Ildong presented the program and held partnering meetings at “BIO-Europe 2025” in Vienna, Austria.

“We’re actively promoting our core pipelines, including ID110521156, on the global stage,” an Ildong Pharmaceutical official said, adding that the company aims to raise corporate value through license-out and other global commercialization routes while pushing follow-on development.

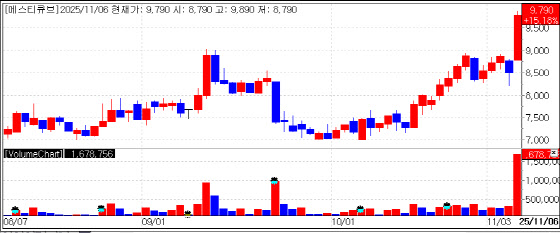

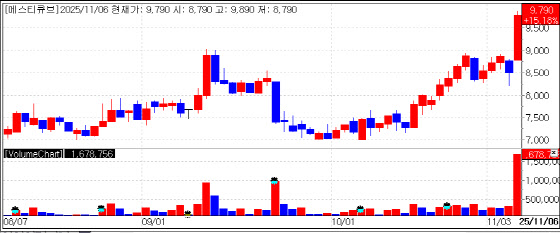

| | Recent stock price trend of STCube. (Source: KG Zeroin MP Doctor) |

|

STCube’s gains echoed similar expectations. The company will present at the Society for Immunotherapy of Cancer (SITC) 2025 meeting in Maryland, Nov. 7–9 (local time), highlighting metastatic colorectal cancer data for its anti-BTN1A1 checkpoint inhibitor nelmastobart and new research on BTN1A1 as an immuno-oncology target.

The presentation includes initial Phase 1b/2 data (Phase 1b) and an interim look at an investigator-initiated study. It will be the first disclosure of clinical results for nelmastobart in combination with TAS-102 (trifluridine/tipiracil) and bevacizumab, drawing investor attention. SITC is among the field’s most closely watched global meetings.

BTN1A1 is a checkpoint protein STCube says it independently discovered as a next-generation target to complement PD-1/PD-L1. The company is running Phase 2 studies in colorectal and non-small cell lung cancers. “From basic research to Phase 2, our BTN1A1 platform has accumulated scientific validity and global competitiveness,” an STCube official said, calling the upcoming readouts a “strategic catalyst” for talks with global pharmas, including potential license-out.

Gene-editing firm Toolgen delivered tangible progress. On Nov. 6, it signed a CRISPR-Cas9 technology-license agreement with domestic biotech Abinogen. Under the deal, Abinogen secured rights to develop and commercialize gene-edited poultry for multiple purposes using CRISPR-Cas9. It plans to integrate the system into its germ-cell editing platform to speed high-value poultry breeds and yolk-derived therapeutic proteins. Toolgen expects an upfront payment and running royalties tied to future sales.

“This agreement showcases CRISPR-Cas9’s versatility,” a Toolgen official said, adding the company will continue to validate the platform’s value through concrete outcomes.

Separately, U2Bio’s rally on Nov. 6 was driven not by fundamentals but by a control dispute between founder/CEO Kim Jin-tae and top shareholder NDS. As of that day, NDS held 30.13% (3,401,096 shares), while Kim-after a joint-ownership pact was dissolved-held 12.87% (1.3 million shares)