[By Yoo Sung, Head of Bio-Platform Center, Edaily] Samsung Biologics and Celltrion have established themselves as the two undisputed pillars of Korea’s biopharma industry. Every move they make has an outsized impact on the broader sector.

A clear example: as Samsung Biologics achieved major success in contract development and manufacturing (CDMO), a flood of domestic firms rushed into the same business. Likewise, following Celltrion’s blockbuster success in biosimilars, a new wave of Korean companies began exploring opportunities in that space. In effect, new business sectors that were previously nonexistent in K-Bio are now forming vibrant ecosystems built upon the success of these two companies.

With revenues of approximately KRW 4.5 trillion and a market cap of KRW 71 trillion, Samsung Biologics stands as the industry’s behemoth, followed by Celltrion with KRW 3.5 trillion in revenue and a market cap of KRW 34 trillion.

What is becoming increasingly apparent is the convergence of these two companies’ strategic targets. While they once focused on separate pillars, the lines are now blurring.

Samsung Biologics has long relied on CDMO and biosimilar operations (via affiliate Samsung Bioepis) as its twin engines. It is now seeking to accelerate growth through expansion into novel drug development. Meanwhile, Celltrion is executing a strategy to transform into a global biopharma player by building on its biosimilar base, with additional investments in novel drugs and CDMO.

In essence, both firms are now striving for a “second leap” by aligning around the same triad: CDMO, biosimilars, and new drug development.

As their business domains increasingly overlap, a head-to-head showdown seems inevitable. The outcome will determine the future leader in Korea’s biopharma space. For now, Samsung Biologics dominates CDMO, while Celltrion leads in biosimilars.

Risks in Converging Business Models

If both companies can replicate their success across all three domains, they stand a chance of becoming world-class biopharma giants, an outcome that would significantly elevate the global standing of K-Bio.

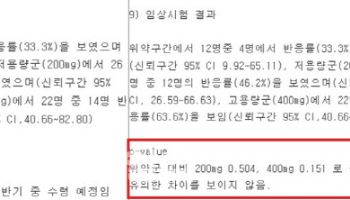

| | Image by ChatGPT |

|

However, a closer look at their strategies reveals fundamental risks and contradictions. Specifically, the nature of these three business pillars is often at odds with one another, raising concerns about whether they can truly coexist within a single company.

Take Samsung Biologics, for example. As a CDMO leader, it naturally has access to a wealth of confidential information from client companies developing new drugs. If Samsung and its affiliate Samsung Bioepis actively expand into the novel drug space, especially with technologies like antibody-drug conjugates (ADCs), clients may worry about potential leaks of proprietary data. This could drive some customers to sever ties.

No matter how promising the new drug market may be, Samsung Biologics, whose core strength lies in CDMO, risks undermining its primary growth engine if it recklessly ventures into this sensitive domain. A wiser strategy would be to maintain a degree of separation from drug development and continue focusing on its existing strengths in CDMO and biosimilars.

Celltrion, on the other hand, has recently ramped up its new drug development efforts, with plans to submit Investigational New Drug (IND) applications for 13 pipeline assets by 2028, leveraging its proprietary antibody technologies.

Yet, Celltrion’s decision to enter the CDMO space via its new subsidiary Celltrion BioSolutions, launched late last year raises questions. The company plans to break ground on a CDMO facility this year.

But how many global pharma companies would entrust their CDMO projects to a direct competitor actively developing novel drugs. This reflects the same conflict of interest that threatens Samsung Biologics if it expands into drug development.

Strategic Recommendation

In light of their existing business foundations, a more prudent approach would be for Samsung Biologics and Samsung Bioepis to focus on CDMO and biosimilars, while Celltrion concentrates on biosimilars and novel drug development. While both CDMO and drug innovation offer immense potential, an overzealous expansion that disregards core competencies could ultimately backfire on both companies.

![Biosolution Jumps 20% on Trial, Bonus Stock [K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/05/PS25051500332b.jpg)

![[단독]삼천당제약, S-PASS 특허 출원 철회...후속 특허 기술도 없을 가능성↑](https://image.edaily.co.kr/images/vision/files/NP/S/2025/05/PS25051500570b.jpg)

![바이오솔루션 임상 호재, 무증에 20%↑, 루닛 루머에 급락[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/05/PS25051500306b.jpg)