[Yu Jin-hee, Edaily Reporter]SEOUL― Dongkook Pharmaceutical CEO Song Joon-ho is shifting focus to new drug development as the company nears the coveted “1 trillion won club”. After establishing a stable growth model over the past three years, Song is now setting the stage for an aggressive push into pharmaceutical innovation.

| | Dongkook Pharmaceutical CEO Song Joon-ho. (Dongkook Pharmaceutical) |

|

Strong Growth in Premium Cosmetics and Medical DevicesAccording to the company’s regulatory filings, Dongkook Pharmaceutical’s cosmetics and other pharmaceutical segments, including the “Celltiran24” brand, saw the highest year-over-year growth as of Q3 2024. Revenue from this sector nearly doubled from 106.5 billion won to 203.2 billion won, marking a 90.8% increase. Its share of total sales also jumped from 23.7% to 33.4%, surpassing the company’s traditional core revenue driver, the oral and gynecological treatment segment (19.3%).

Song’s strategy of diversifying revenue streams has also propelled Dongkook’s medical device business. The company’s healthcare and medical materials segment, including beauty devices, surged from 72.5 billion won in Q3 2021 to 116 billion won last year, reflecting a 60% increase.

The CEO’s focus on premium product strategies and expanded distribution channels has been instrumental in boosting profitability. In a 2023 interview, Song emphasized that strengthening new businesses such as medical aesthetics (pharmaceutical-based beauty products) would be key to achieving the company’s $1 billion revenue target.

With its revenue surpassing 800 billion won in 2023, Dongkook is now on the verge of hitting the 1 trillion won milestone. The company’s steady growth trajectory since Song’s appointment in 2021—when revenue stood at 594.2 billion won—indicates that the goal is within reach.

This year’s outlook remains positive, driven by robust performance in both over-the-counter (OTC) and prescription drug (ETC) segments, alongside growing contributions from the medical aesthetics sector. Investments made under Song’s leadership are also expected to bear fruit, including the acquisitions of beauty device maker Withnics in May 2023 and skincare specialist Rebom Cosmetics in October.

With Rebom Cosmetics’ cGMP-certified (Current Good Manufacturing Practice) facility and existing exports to over 30 countries, Dongkook aims to leverage its technology and distribution channels for global expansion.

| | Dongkook Pharmaceutical Chairman Kwon Ki-beom. (Dongkook Pharmaceutical) |

|

New Drug “Uresco” Targets 20% Market Share in Three YearsSong’s focus on scale and profitability aligns with the vision of Chairman Kwon Ki-beom, the second-generation owner of Dongkook. Kwon has been a strong advocate for new drug development, emphasizing that a pharmaceutical company needs at least 1 trillion won in revenue to support large-scale R&D investments.

However, Dongkook plans to take a phased approach rather than rushing into high-risk innovation. The company will first focus on generics, improved formulations, and synthetic drugs before advancing toward first-in-class treatments.

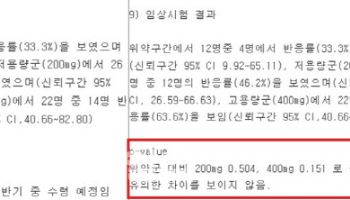

One notable milestone is the recent approval of Uresco, a first-of-its-kind combination drug for benign prostatic hyperplasia (BPH). The drug combines dutasteride and tadalafil, offering dual benefits: reducing prostate size and alleviating lower urinary tract symptoms. Clinical trials across 19 hospitals in South Korea demonstrated Uresco’s superior efficacy compared to single-agent therapies.

According to market research firm UBIST, South Korea’s BPH treatment market is valued at 500 billion won ($375 million), while the global market, as estimated by GlobalData, reached $4.5 billion in 2023.

“There has been only one BPH combination therapy on the Korean market so far—GSK’s Duodart,” said Yoo Gi-woong, head of Dongkook’s development division. “With Uresco, we aim to capture a 20% market share within three years while also expanding into global markets.”

Beyond Uresco, Dongkook is working on a portfolio of improved formulations using its proprietary drug delivery system (DDS). The company is developing a new anti-obesity drug and a treatment for acromegaly, while also preparing to launch DDS-enhanced generics such as Lorelin Depot (prostate cancer therapy) and liposomal amphotericin B (antifungal injection).

As Dongkook Pharmaceutical moves closer to the $1 trillion won revenue mark, Song’s shift toward new drug development signals the company’s ambition to become a global player in the pharmaceutical industry.

![Biosolution Jumps 20% on Trial, Bonus Stock [K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/05/PS25051500332b.jpg)

![[단독]삼천당제약, S-PASS 특허 출원 철회...후속 특허 기술도 없을 가능성↑](https://image.edaily.co.kr/images/vision/files/NP/S/2025/05/PS25051500570b.jpg)

![바이오솔루션 임상 호재, 무증에 20%↑, 루닛 루머에 급락[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/05/PS25051500306b.jpg)