[NA Eun-kyung, Edaily Reporter] On the 21st, Korean pharma, biotech and healthcare stocks with platform technologies that can improve the convenience of once-weekly obesity drugs, including oral formulations and long-acting injectables, drew strong interest in the local market. Inventage Lab climbed after disclosing that it had expanded a co-development and research agreement with Boehringer Ingelheim, with shares rebounding from an intraday low of 62,100 won to finish at 70,000 won. D&D Pharmatech set a new 52-week high after Pfizer, which acquired its partner Metsera, reiterated its commitment to developing oral obesity drugs. Caregen also gained 14.7 percent ahead of phase 1 data for a new drug for wet age-related macular degeneration.

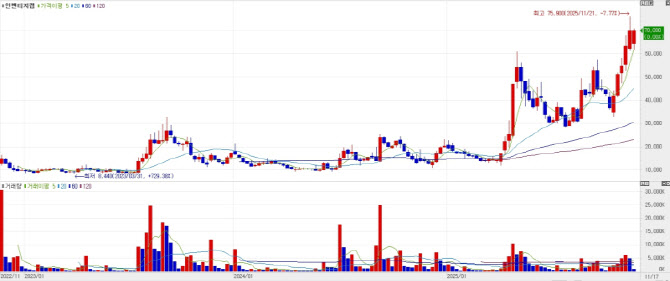

Inventage Lab rises on expanded Boehringer Ingelheim deal  | | Inventage Lab briefly hit a 52-week high of 75,900 won on the 21st after announcing an expansion of its co-development research with Boehringer Ingelheim (Source: KG Zeroin MP Doctor. |

|

According to KG Zeroin‘s MP Doctor market data service, Inventage Lab traded lower throughout the morning session, at one point falling 6.8 percent from the previous day’s close of 66,600 won. The stock then began to rebound in the afternoon and spiked after 3:17 p.m., when the company disclosed an additional contract with Boehringer Ingelheim. Inventage Lab ended the day at 70,000 won, up 5.1 percent from the previous close.

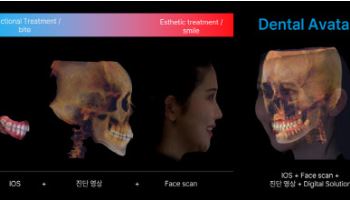

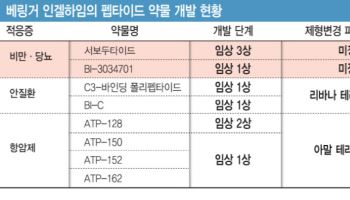

The newly disclosed agreement follows a September 2023 deal to jointly research and develop long-acting injectable formulations of peptide candidates. Industry observers believe the peptide targeted by Inventage Lab‘s drug delivery system, or DDS, technology is likely related to obesity or diabetes among Boehringer Ingelheim’s peptide drug candidates in development.

The contract is structured as a material transfer agreement, or MTA, under which the two parties exchange materials and explore feasibility before entering into a full licensing contract. An MTA does not itself guarantee a license-out deal. However, because Boehringer Ingelheim has added more molecules to the joint development program based on the earlier collaboration, the market is interpreting the latest agreement as a positive signal for a future technology-out transaction.

After the disclosure, Edaily published an analysis titled “Inventage Lab signs second MTA with Boehringer Ingelheim, deal size at least 1.5 trillion won if finalized,” estimating the potential value of a licensing contract by examining Boehringer Ingelheim‘s list of peptide drug candidates and its previous formulation-change partnerships.

“For a Korean biotech venture, it can sometimes be more advantageous to license out to a latecomer like Pfizer or Boehringer Ingelheim, which needs to catch up quickly with leaders, rather than to companies such as Novo Nordisk or Eli Lilly that already have strong obesity and diabetes pipelines,” one industry official said. “Big pharma companies often acquire potential rival technologies early in order to block future competition, so technologies that face less internal competition can actually have a higher probability of reaching commercialization.”

Pfizer reiterates focus on oral obesity drugs, spotlight on D&D Pharmatech D&D Pharmatech touched 99,000 won during the session, setting a new 52-week high. The stock, which had traded in the upper 90,000 won range, closed at 94,300 won, up 6.3 percent from the previous day.

The rally is seen as being driven by comments from Pfizer chief financial officer David Denton at the Jefferies Global Healthcare Conference 2025, held in London on the 19th local time. Asked by Jefferies analyst Akash Tewari whether Pfizer still has interest in developing oral small-molecule obesity drugs, Denton replied that it does. He highlighted that Metsera, which Pfizer recently acquired, has several preclinical oral drug candidates and added that Pfizer will continue to explore a range of options, including additional mergers and acquisitions of Chinese pharma and biotech companies, in order to supplement Metsera’s assets.

When Pfizer acquired Metsera, a partner of D&D Pharmatech, it agreed to contingent value right, or CVR, payments tied to three milestones: initiation of a phase 3 trial of MET-097i plus MET-233i combination therapy, approval of MET-097i monotherapy by the US Food and Drug Administration, and FDA approval of the MET-097i plus MET-233i combination. Both MET-097i and MET-233i are long-acting injectable obesity drugs designed to extend dosing intervals and are not the compounds D&D Pharmatech licensed to Metsera. D&D Pharmatech shares initially lost momentum after Pfizer announced the Metsera acquisition.

With Pfizer again underscoring its commitment to oral obesity drugs, however, investor attention is returning to D&D Pharmatech. The reason is that Metsera‘s oral obesity drug candidates use D&D Pharmatech’s Oral Link technology.

If Pfizer were to acquire another Chinese pharma or biotech company with its own oral obesity platform, as Denton suggested could be an option, that could pose a risk to D&D Pharmatech. The company remains confident, however, that Oral Link is technologically ahead of rival platforms.

“In the peptide oral obesity space, there are only three players that currently have candidates in pivotal trials, namely Novo Nordisk, Viking Therapeutics and Metsera, and among them Metsera is the only one that enables peptide absorption in the small intestine,” D&D Pharmatech chief executive Lee Seul-gi said in a previous interview with Edaily.

Caregen nears phase 1 data for macular degeneration drug Caregen, which expects to receive the clinical study report for phase 1 trials of its wet age-related macular degeneration, or wAMD, treatment candidate CG-P5 by the end of this month, closed at 78,200 won, up 14.7 percent from the previous session. “Investors appear to be pricing in expectations ahead of the scheduled receipt of the US phase 1 CSR for CG-P5 later this month,” a Caregen official said.

Caregen is preparing to move directly into phase 2 development even as it keeps the door open for an out-licensing deal. If phase 1 is successful, the company plans to expand the indication to dry age-related macular degeneration in phase 2 and to run combination studies with Eylea, the anti-VEGF therapy co-marketed by Regeneron Pharmaceuticals of the United States and Bayer AG of Germany that is currently the most widely used macular degeneration treatment. Eylea generated about 13.6 trillion won in global sales last year.

GlobalData estimates that the global market for wet age-related macular degeneration treatments was worth 6.7 billion dollars, or roughly 9.9 trillion won, in 2023. Age-related macular degeneration is classified as either dry or wet, with dry AMD accounting for about 90 percent of cases. If CG-P5‘s indication is extended to dry AMD, the target market could become significantly larger.

“Our goal for CG-P5 is to obtain Breakthrough Therapy Designation, or BTD,” a Caregen official said. “It is true that we have received and are reviewing technology-out proposals, but for now we are focusing on preparing for phase 2 with BTD as the main objective.”

BTD applications can be filed any time before completion of phase 2 trials, although companies commonly apply based on phase 2 data. A drug that receives BTD can establish strategic development guidelines from an early stage of clinical development through frequent meetings with the FDA and can benefit from shorter review timelines. Historically, roughly 33 percent of drugs with BTD have ultimately won approval from the FDA, which makes the pathway relatively attractive for developers.

![Big pharma interest lifts Inventage Lab·D&D Pharmatech to 52-week highs[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/11/PS25112400107b.jpg)

![빅파마가 찜한 韓 비만약 제형변경 기술에 기대감 증폭[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/11/PS25112400106b.jpg)

![글로벌 최초 시총 1조달러 돌파 앞둔 제약사는?[제약·바이오 해외토픽]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/11/PS25112200105b.jpg)