[Kim Sae-mi, Edaily Reporter] TiumBio is making a concerted effort to achieve global business development milestones this year. The company plans to release Phase 2 clinical trial results for its core pipeline drug, ‘TU2670’(Merigolix), for uterine fibroids in the first half of the year while accelerating discussions on global license-out deals. Additionally, leveraging its expertise in small-molecule and antibody-based drug development, TiumBio aims to generate new research and development (R&D) achievements.

Stock Price Down 59% Over a Year, Urgent Need for L/O MilestonesSince 2022, TiumBio has struggled to secure new licensing deals, affecting its stock performance. Over the past year, the company’s stock price more than halved, reflecting investor disappointment. As of March 6, 2024, TiumBio’s closing price was 3280 won, a 59.2% decline from 8030 won a year earlier.

| | TiumBio’s stock price trend over the past year (Source=Naver Pay Securities) |

|

A company representative said, “It is difficult to pinpoint the exact cause, but internally, there are no issues, and we are obtaining promising (clinical development) results. However, the market seems to have been anticipating business development achievements.”

In 2022, Merigolix was licensed to China’s Hansoh Pharmaceutical for $170 million (approximately 220 billion won). However, TiumBio still retains the U.S. and European rights, making additional technology transfers possible.

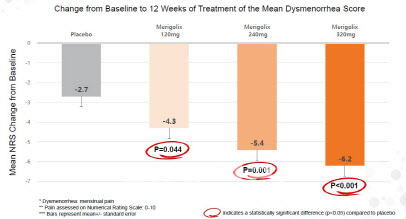

Expectations for a license-out deal peaked last year when TiumBio announced positive Phase 2a clinical results for Merigolix in endometriosis in Europe. The results showed that all dosage groups (120 mg, 240 mg, and 320 mg) demonstrated statistically significant reductions in menstrual pain compared to a placebo.

Additionally, the response rate, which will serve as the primary endpoint for the upcoming Phase 3 trial, also achieved statistical significance compared to a placebo. Secondary endpoints also showed favorable outcomes, confirming both efficacy and high safety and tolerability. According to TiumBio, these results underscore Merigolix’s potential as a best-in-class drug.

| | Merigolix Phase 2 clinical trial stock index (source=TiumBio) |

|

However, despite these encouraging results, no licensing deals have materialized. The company explained, “Potential partners are also interested in the clinical results for uterine fibroids. Once Phase 2 results for this indication are available in the first half of this year, technology transfer discussions will gain further momentum.”

Currently, TiumBio’s domestic partner, Daewon Pharmaceutical, is conducting the Phase 2 clinical trial for Merigolix in uterine fibroids, with results expected as early as this month. Given that the global uterine fibroids market is larger than the endometriosis market, a licensing deal for this indication is expected to be more lucrative.

According to Mordor Intelligence, the global uterine fibroid treatment market is projected to grow from $4.56 billion in 2024 to $6.92 billion in 2029, at a compound annual growth rate (CAGR) of 8.7%. In contrast, the endometriosis treatment market is expected to grow from $1.58 billion in 2024 to $2.8 billion in 2029, at a 12.07% CAGR.

In the second half of the year, TiumBio also plans to release interim results for Phase 2a trial of TU2218, an immuno-oncology drug being tested in combination with Merck(MSD)’s Keytruda. TU2218 targets high-unmet-need cancers, including bile duct cancer, head and neck cancer, and colorectal cancer. The current trial focuses on head and neck cancer and bile duct cancer patients.

Concerns about potential designation as a management-risk stock may have also contributed to the stock price decline. Since TiumBio was listed on the KOSDAQ in November 2019 through a technology-special listing, it must achieve at least 3 billion won in annual revenue from 2024 onward to avoid being classified as a management-risk stock.

To address this, TiumBio decided to merge with Petraon, a cosmetics manufacturing company, in October 2023. Petraon, which generated 4.4 billion won in revenue in 2023, specializes in natural cosmetics OEM/ODM production. This merger is expected to secure a stable revenue base, allowing TiumBio to focus more on drug development.

Expanding Into Bispecific Antibodies and ADCsTiumBio is leveraging its expertise in small-molecule synthetic drugs and biologics to advance into bispecific antibodies and antibody-drug conjugates (ADCs). Since early 2023, the company has established an internal task force (TF) to develop new platforms in these areas, led by CEO Kim Hoon-taek.

The company is initially focusing on antibody drug development. In 2020, TiumBio established Initium Therapeutics, a subsidiary in Boston, dedicated to monoclonal and bispecific antibody R&D. While TiumBio has traditionally focused on small-molecule drugs, Initium Therapeutics specializes in antibody-based drug development.

Recently, TiumBio launched a bispecific antibody project (NBX003) to improve upon Hemlibra, a treatment for hemophilia A. In June 2023, the company also announced interim Phase 1b results for TU2218, which inhibits both TGF-β (transforming growth factor-beta) and VEGF (vascular endothelial growth factor) pathways that suppress immune response in cancer.

A company representative said, “We aim to develop innovative biologics based on a deep understanding of disease and drug mechanisms.”

Another key focus for TiumBio is ADC (antibody-drug conjugate) drug development, an area that requires expertise in both synthetic and biologic drug development. ADCs consist of an antibody linked to a cytotoxic payload via a linker.

TiumBio emphasized, “ADC is a field that bridges small-molecule and biologic drugs. Since we have expertise in both areas, we believe combining our strengths will lead to significant achievements.”

The company has decided to join the global ADC development trend by working on a new platform that can accommodate diverse payloads. Notably, while most Korean bioventures focus on ADC-based cancer treatments, TiumBio is targeting rare diseases.

A company official said, “CEO Kim has clearly expressed that TiumBio will focus on developing ADC drugs for rare diseases rather than cancer. While it is still in the early research stages, ADC will be positioned as our next-generation development priority.”