Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Yu Jin-hee, Edaily Reporter] On the 14th, the South Korean stock market‘s bio sector(including pharmaceuticals and medical devices) entered a consolidation phase following a high growth rally.

Investors’ sentiment shifted toward “mid-risk, high return” stocks backed by solid revenue streams. Notably, Samyang Biopharm and U2Bio stood out, showcasing resilience amidst the broader sector‘s stagnation.

| | Recent stock price trend of Samyang Biopharm. (Source: KG Zeroin MP Doctor) |

|

Samyang Biopharm: Leveraging Global Dominance in Sutures for New Drug Development According to KG Zeroin MP DOCTOR, Samyang Biopharm, Alpha AI, and U2Bio were featured on the “Top 40 Gainers” list in the domestic bio market. Their stock prices surged by 12.97% (closing at 62,700 won), 11.76% (1,900 won), and 10.56% (6,070 won), respectively, all recording double-digit growth.

Experts predict a divergence between companies with solid capital and proprietary technology versus those merely riding market themes. The surge in Samyang Biopharm and U2Bio suggests that “stability” is becoming a crucial metric for evaluation.

Samyang Biopharm was officially relaunched as an independent corporation on November 1st last year after being spun off from its parent company, Samyang Holdings. Beyond the prestige of being a conglomerate subsidiary, it is firmly rooted in consistent profitability.

Revenue Growth 112.5B won (2022) → 122.7B won (2023) → 138.2B won (2024). Operating Profit Significant jump from 9.2B won to 19.5B won over the same period. This growth is driven by its biodegradable surgical sutures, which hold the No. 1 global market share.

Expanding its horizons, the company is now focusing on its new drug pipeline, including: SYP-2246 (Preventive Vaccine), SYP-2135 (Anti-cancer), SYP-2136 (Gene therapy for liver disease), mRNA treatment for Idiopathic Pulmonary Fibrosis (IPF) using its proprietary gene delivery platform, ’SENS‘.

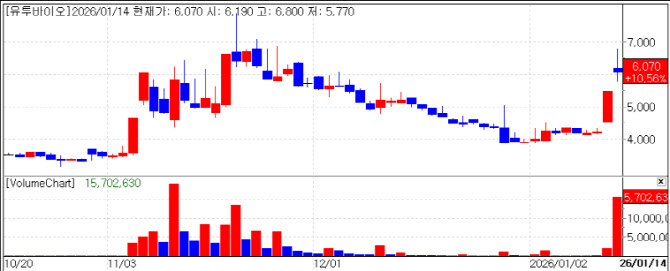

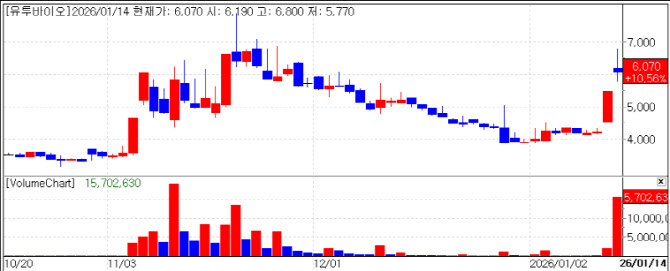

| | Recent stock price trend of U2Bio. (Source: KG Zeroin MP Doctor) |

|

U2Bio Rebounds Through Digital Healthcare Alliance with Daewoong Medical IT solution firm U2Bio has secured a powerful growth engine through a strategic share swap with Daewoong Pharmaceutical. On the 13th, Daewoong Pharm decided to transfer 564,745 treasury shares (approx. 12.1B won) to U2Bio.

In return U2Bio issued 2,388,278 new shares through a third-party allocation. Following the transaction, Daewoong Pharm will become the second-largest shareholder (14.99%), following SOCAR founder Lee Jae-woong (31.56%).

Furthermore, U2Bio’s stock price leaped 43.67% over two trading days (13th–14th) following an MOU with Broad CNS to build an “AI-integrated medical platform.” Industry analysts believe the combination of Daewoong‘s global network and U2Bio’s IT solutions will strengthen their dominance in the digital healthcare market.

In contrast, experts remain skeptical about Alpha AI. Despite rebranding from ‘Solco’ to ‘Alpha AI’ in July 2025 to align with the AI trend, its main products remain implants and heating mats. Analysts warn that without concrete AI business models or research outcomes, the current price surge poses a risk of heavy selling pressure.

Hong Soon-jae, CEO of BioBook, advised, “Investors must strictly distinguish between companies with substantive partnerships like U2Bio, and those creating hype through simple name changes. The key is to monitor where the company‘s actual investment is being directed.”

![2% Royalty Shock at Alteogen Ripples Through Korean Biotech[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012200181b.jpg)

!['2% 로열티'가 무너뜨린 신뢰…알테오젠發 바이오株 동반 하락[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012201091b.jpg)