팜이데일리 프리미엄 기사를 무단 전재·유포하는 행위는 불법이며 형사 처벌 대상입니다.

이에 대해 팜이데일리는 무관용 원칙을 적용해 강력히 대응합니다.

[Kim Jinsoo, Edaily Reporter] HLB Therapeutics saw its stock price rise as expectations build for the imminent topline results from its Phase 3 trial for neurotrophic keratitis (NK) treatment ‘RGN-259.’ Meanwhile, Genomictree’s stock also gained following a milestone payment linked to the completion of a clinical trial for a colorectal cancer diagnostic product it had licensed out.

Adbiotech, which had hit the daily upper limit for three consecutive sessions, initially surged again but failed to maintain the streak, as its stock price declined sharply just before market close.

| | Recent stock price trend of HLB Therapeutics. (KG Zeroin’s MP Doctor) |

|

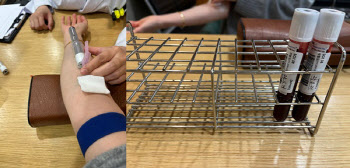

HLB Therapeutics Set to Announce Phase 3 Results This Month According to KG Zeroin’s MP Doctor (formerly MarketPoint), HLB Therapeutics’ stock closed at 9,220 KRW on the day, up 10.82%. The rise is attributed to investor anticipation of the upcoming topline data for ‘RGN-259,’ an NK treatment being developed by HLB’s U.S. subsidiary, ReGenTree.

HLB Therapeutics stated that RGN-259 is currently in Phase 3 trials in both Europe (SEER-3) and the U.S. (SEER-2). In the European trial, the final patient completed drug administration in March 2025, and the study is now in the final data analysis stage. The topline data from the European Phase 3 trial is expected to be released within this month.

RGN-259 is based on Thymosin Beta-4, a naturally occurring peptide in the human body. It is known to cause minimal immune response and has been reported as safe for long-term use.

Currently, the only approved treatment for NK is ‘Oxervate’ from the Italian pharmaceutical company Dompe. However, Oxervate must be stored frozen and requires application more than six times a day, making it inconvenient for patients. Additionally, the annual cost is around $110,000, placing a financial burden on patients. In contrast, RGN-259 can be refrigerated and requires administration five times a day, offering greater convenience.

If the Phase 3 results are favorable, RGN-259 is considered to have strong competitiveness against current therapies, potentially increasing the chances of licensing deals with global pharmaceutical firms.

A HLB Therapeutics representative commented, “The European trial has completed patient enrollment and is now in the ‘data freeze’ stage for final review,” adding, “We are in ongoing discussions with major pharma companies regarding licensing deals.”

The NK market in the U.S. alone includes over 60,000 patients, with the market size projected to grow to approximately $2 billion by 2032.

Genomictree Receives KRW 1 Billion Milestone Payment Genomictree’s stock rose after announcing it had received a KRW 1 billion (approx. $730,000) milestone payment following the completion of a clinical trial for its colorectal cancer in vitro diagnostic (IVD) product in China. The stock initially rose 11.85% during the day before closing 5.76% higher at 13,780 KRW.

To enter the Chinese market, Genomictree signed a KRW 6 billion technology transfer deal in May 2021 with Shandong Lukang Haoliyou, a joint venture between Orion Holdings and China’s Lukang Pharmaceutical. Genomictree had already received KRW 2 billion upfront in 2021.

Shandong Lukang Haoliyou built production infrastructure in China and began clinical trials in 2023, which concluded in January 2025. Based on the trial results, the company has submitted a manufacturing approval application to China’s National Medical Products Administration (NMPA). The milestone was triggered by successful completion of these clinical trials.

A Genomictree official noted, “If final manufacturing approval is granted in China, we will receive an additional KRW 1 billion milestone,” adding that, depending on sales performance by the partner company, Genomictree could earn up to KRW 2 billion in additional milestone payments along with royalties.

Adbiotech’s Consecutive Daily Upper Limit Ends at Three Days Adbiotech’s stock initially hit the daily upper limit again, following a three-day streak, but fell sharply before market close, ending the day up 7.51% at 4,510 KRW and closing the streak at three days.

The recent rally in Adbiotech’s stock is attributed to a change in its largest shareholder. On June 9, the company announced a third-party allocation capital increase of around KRW 28 billion, through which OqpbioM (OqpM) is expected to become the new largest shareholder.

OqpM is a biotech company developing the ovarian cancer immunotherapy ‘Oregovomab’ and holds 100% equity in CanariaBio, the company that owns the intellectual property (IP) for the therapy. Adbiotech’s stock surge reflects market anticipation surrounding the global commercialization potential of Oregovomab.

However, some caution that risks remain. CanariaBio previously received a recommendation to halt global Phase 3 trials for Oregovomab, resulting in capital impairment and delisting risk. Additionally, executives from CanariaBio and OqpM have been indicted for allegedly manipulating stock prices and gaining over KRW 700 billion in unjust profits related to the clinical issues of Oregovomab.

![HLB Therapeutics Surges on RGN-259 Anticipation[K-bio pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/06/PS25061300432b.jpg)