Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Yu Jin-hee, Edaily Reporter] SEOUL, South Korea-On June 10, biotech, pharmaceutical, and medical device stocks continued to attract investor attention in South Korea’s equity market. Three companies from the sector-AdBiotech, Peptron, and ROKIT Healthcare-ranked among the day’s top 10 gainers. Most notably, AdBiotech extended its rally by hitting the daily upper limit for a second consecutive trading session, reflecting mounting anticipation over its potential transformation into a next-generation drug developer.

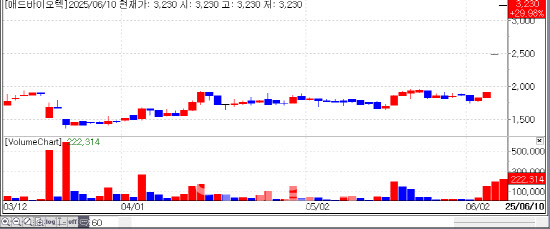

| | Recent stock price trend of AdBiotech. (Source: KG Zeroin MP Doctor) |

|

AdBiotech Soars Again as OQP BioM Emerges as New Controlling Shareholder According to KG Zeroin’s MP Doctor (formerly Market Point), AdBiotech, Peptron, and ROKIT Healthcare posted the highest gains among bio stocks. Shares rose by 29.98% (KRW 3,230), 19.79% (KRW 192,500), and 29.91% (KRW 4,300), respectively.

AdBiotech stole the spotlight with back-to-back upper-limit moves, spurred by news released after the previous day’s close. The announcement revealed a third-party allotment capital increase worth approximately KRW 28 billion, through which OQP BioM will become the company’s new majority shareholder.

This transaction has intensified investor excitement over potential synergies between AdBiotech’s business capabilities and OQP BioM’s Oregovomab, an ovarian cancer immunotherapy currently in late-stage development. Once finalized, the deal will transfer AdBiotech’s control to OQP BioM, which owns 100% of Canaria Bio, the holder of Oregovomab’s intellectual property rights (IPR).

AdBiotech plans to use the newly secured capital to bolster its pipeline, especially by supporting the FLORA-5 Phase 3 clinical trial for Oregovomab under U.S. FDA oversight. OQP BioM previously completed dosing for its primary cohort of 378 patients in the latter half of 2023. Final statistical analysis will commence once 232 patients experience recurrence-a requirement for efficacy analysis.

Since the early stages of the trial, OQP BioM has accumulated long-term data, including an interim analysis conducted in October 2023. Industry observers estimate that, with recurrence rates nearing 50%, meaningful clinical outcomes may now emerge approximately 60 months after the first dosing.

AdBiotech is no stranger to the Oregovomab asset. Back in 2014, while still unlisted, the company invested in Quest PharmaTech and OncoQuest-the parent entities of OQP BioM. The funds contributed at that time were used for Oregovomab’s global Phase 2 trials. After going public on KOSDAQ in 2022, AdBiotech has continued to collaborate with OQP BioM on the ongoing Phase 3 effort.

A company spokesperson emphasized, “This is more than a capital raise-it’s a decision backed by strong business rationale and strategic gain. It will elevate AdBiotech’s presence in the global immuno-oncology arena.”

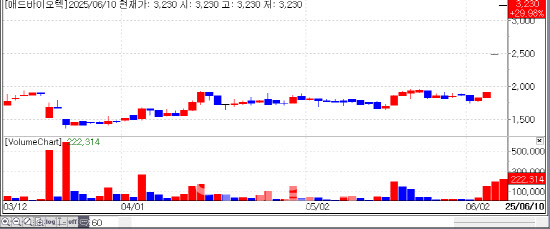

| | Recent stock price trend of Peptron. (Source: KG Zeroin MP Doctor) |

|

Peptron Advances Amid Easing Concerns over Eli Lilly Partnership Peptron also surged as investor concerns over its partnership with Eli Lilly began to ease, bringing its stock closer to the KRW 200,000 threshold. The company had faced a sharp decline on June 4 following news that Eli Lilly entered into a licensing deal worth $870 million (KRW 1.2 trillion) with Camurus, sparking worries that Peptron’s position might be weakened.

In response, Peptron strongly refuted the negative speculation and reaffirmed its ongoing collaboration with Eli Lilly. A company representative stated, “The technology evaluation with Eli Lilly is proceeding smoothly as planned. Also, we can officially confirm that the drug under evaluation with Eli Lilly is not among those covered by the Camurus agreement.”

Peptron signed a platform technology evaluation agreement with Eli Lilly in October 2023. The partnership centers on applying Peptron’s SmartDepot-a long-acting drug delivery platform-to peptide-based drugs owned by Eli Lilly. SmartDepot utilizes biodegradable microspheres to release drugs at a stable concentration over time.

On June 9, Shinhan Investment Corp. released a report supporting Peptron, stating the company maintains a technological edge over its competitors. Analyst Um Minyong wrote, “Camurus was developing a monthly injectable version of semaglutide for Novo Nordisk. Eli Lilly’s deal with Camurus appears to be a strategic move to block rival partnerships rather than a shift away from Peptron.”

The report also highlighted three major weaknesses in Camurus’ platform compared to SmartDepot, reinforcing the belief that Peptron still holds technological superiority.

Lastly, ROKIT Healthcare gained momentum following the disclosure of its presentation results from the 61st ERA (European Renal Association) Congress, held from June 4 to 7. The company showcased its omentum-based regenerative platform for kidney restoration, which aims to promote angiogenesis and suppress fibrosis in damaged renal tissue.

A company official commented, “This presentation served as a key opportunity to share our platform’s scientific credibility and clinical potential with the global academic community. It is drawing attention as a game-changer that could delay dialysis for patients with end-stage renal disease, offering an alternative to transplantation or dialysis.”

![애드바이오텍, 3거래일 연속 上...제넨바이오는 195% 급등[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/06/PS25061200445b.jpg)