Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Kim Saemi, Edaily Reporter] On June 30, the bio-healthcare sector saw a sharp reversal for ABION and its largest shareholder, Telcon RF Pharmaceutical, both of which had previously surged for four consecutive sessions. Meanwhile, Eutilex remained strong on anticipation for Phase 1 clinical trial data of ‘EU307,’ expected to be unveiled in Japan this July. GFC Life Science made a successful debut on the KOSDAQ, doubling its IPO price on the first trading day.

ABION Falls Short of Limit Down After 4-Day Rally According to KG Zeroin’s MP Doctor (formerly MarketPoint), Telcon RF Pharmaceutical hit its lower limit on the day, plunging ₩2,830 (-29.95%) from the previous session. ABION also fell sharply, closing at ₩9,020, down ₩3,820 (-29.75%), narrowly avoiding the daily limit down. This sharp reversal stood in stark contrast to the prior streak of four consecutive limit-up sessions for both stocks.

| | Telcon RF Pharmaceutical and ABION ranked first and second, respectively, among the top losers on the KOSDAQ on the 30th. (Source: KG Zeroin MP Doctor) |

|

The turnaround appears to have been triggered by PharmEdaily’s premium article titled “₩1.8 Trillion License-Out by ABION: Navigating Legal Risks and Deal Details”, which was made freely accessible earlier that morning. The article analyzed ABION’s licensing deal for the antibody drug candidate ABN501, valued at a total of ₩1.8 trillion (approx. $1.3 billion). Concerns emerged over the fact that ABION has not yet received the non-refundable upfront payment-commonly expected immediately after contract signing-which may have weakened investor sentiment.

The article reported that the upfront payment per antibody target was set at $5 million (approx. ₩6.8 billion), with a maximum total of $25 million (₩34.2 billion). However, under the agreement structure, ABION must first enter into a master agreement within 180 days of the June 22 signing, during which time the five candidate antibodies will be validated. Only then will the upfront payment be received, which is likely to happen by the end of the year at the earliest.

An ABION representative clarified, “There seems to be some confusion due to the distinction between the main contract and the master agreement. The main contract defines the rights to the licensed compounds, while the master agreement outlines the detailed structure of the license payment schedule, which can take up to 180 days. This is a standard provision but may have been misunderstood.”

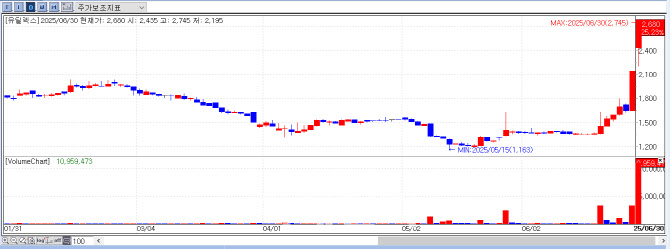

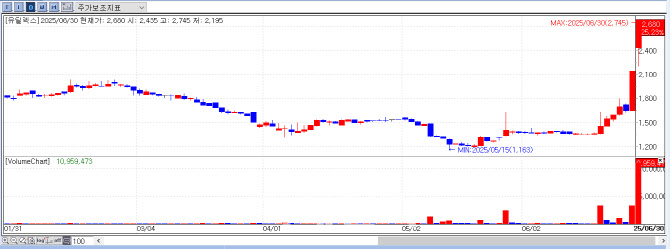

Eutilex Rallies on Phase 1 Data Anticipation for EU307 Shares of Eutilex closed at ₩2,680 on the day, up ₩540 (+25.23%) from the previous session. The momentum appears to have been sustained by PharmEdaily’s premium article, “Unveiling Eutilex’s Solid Tumor CAR-T: Interim Results to Be Presented in Japan Next Month”, which continued to impact trading for the second straight day.

| | Eutilex Stock Price Trend (Source: KG Zeroin MP Doctor) |

|

The article was initially published to PharmEdaily’s premium section on June 22 at 8:40 a.m., and then made publicly available on June 27 at 8:41 a.m. Immediately after the article was made free to access, Eutilex stock soared to the daily upper limit, closing on June 27 at ₩2,140, up ₩491 (+29.78%) from the previous day.

Eutilex plans to present interim Phase 1 results for its CAR-T therapy, EU307-developed for hepatocellular carcinoma?at the Asia-Pacific Primary Liver Cancer Expert (APPLE) meeting in Japan this July. The conference will be held from July 11 to 13 at the Portopia Hotel in Kobe, under the theme “A New Era in Multidisciplinary Treatment for Liver Cancer.”

The open-label Phase 1 trial, which aims to enroll 12 patients, has already completed dosing in about half of the participants. Professor Doyoung Kim of Severance Hospital at Yonsei University, who leads the EU307 clinical trial, is scheduled to present the latest progress at the conference. Eutilex CEO Yeonho Yoo expressed confidence, saying, “We believe the APPLE presentation in July will clearly demonstrate the strength of EU307.”

GFC Life Science Doubles IPO Price on KOSDAQ Debut On its first day trading on the KOSDAQ, GFC Life Science posted a “double,” finishing at ₩32,550 up ₩17,250 (+112.75%) from its IPO price of ₩15,300.

Founded in June 2002, GFC Life Science was previously listed on the Korea Exchange’s KONEX as of December 2022. The transition marks the 100th case of a KONEX-listed company graduating to the KOSDAQ. Through its IPO, the company raised ₩12 billion, of which \8.8 billion will be used for facility expansion and ₩3 billion for debt repayment.

Specializing in innovative cosmetic ingredients based on skin microbiome and exosome technologies, GFC Life Science is widely recognized as a market leader in the skin microbiome sector. Leveraging its expertise in human application testing for cosmetics, the company also provides clinical substantiation services for functional cosmetics and advertising claims.

Recently, GFC Life Science has been venturing into the skin booster market by incorporating advanced biotechnology into its product lines. The company stated, “Our proprietary material development capabilities, based on microbiome and exosome technologies, will further strengthen our presence in the global market.”

![인도, 글로벌 저가 제네릭에서 바이오 허브로 탈바꿈[제약·바이오 해외토픽]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26020700379b.jpg)