Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

[Yu Jin-hee, Edaily Reporter] SEOUL- Global pharmaceutical Merck(MSD) has identified the potential of radiotherapy drugs and initiated collaboration with Cellbion, raising expectations that their clinical trial cooperation and supply agreement may lead to the commercialization of a combination therapy. If realized, Cellbion’s corporate value is expected to rise significantly.

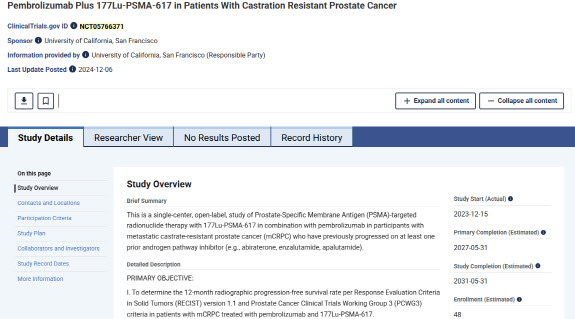

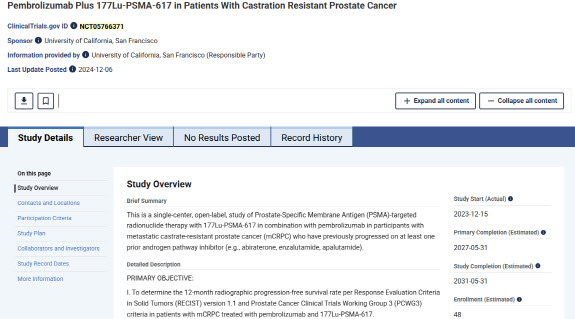

| | (Screenshot of the U.S. National Institutes of Health (NIH) Clinical Trial Registry) |

|

◇Merck Identifies Expanded Indication Potential in Keytruda-Pluvicto Clinical Trials

According to the U.S. National Institutes of Health (NIH) clinical trial registry, the University of California, San Francisco(UCSF) is conducting a Phase 2 investigator-initiated clinical trial on the combination of Merck’s immunotherapy drug Keytruda(pembrolizumab) and Novartis’s radiopharmaceutical prostate cancer treatment Pluvicto(77Lu-PSMA-617). The study aims to evaluate the safety and efficacy of the combination therapy in patients with metastatic castration-resistant prostate cancer(mCRPC).

Earlier Phase 1 trial data indicated significant outcomes. Results showed an objective response rate(ORR) of 56%, a median progression-free survival(mPFS) of 6.9 months, and an overall survival(mOS) of 28.2 months among patients who received optimal treatment schedules. ORR measures the proportion of patients experiencing measurable tumor reduction.

Similar findings emerged from a study at Peter MacCallum Cancer Centre in Australia. The study, which examined the safety and efficacy of Pluvicto(six doses) and Keytruda in mCRPC patients, reported a PSA reduction of 50% or more (PSA50-RR) in 76% of the 37 participants, significantly higher than monotherapy. The median mPFS was 11.2 months, and the median OS was 17.8 months. No new safety concerns were identified in either the U.S. or Australian trials.

Merck reportedly supplied Keytruda for these trials, providing context for its clinical trial collaboration and supply agreement with Cellbion on February 4. While details of the agreement were not disclosed, investor curiosity has grown.

Revelations that Merck was aware of the U.S. and Australian trial results clarify the nature of the collaboration. The partnership appears to extend beyond clinical cooperation, aiming for the commercialization of a combination therapy using Keytruda and Cellbion’s mCRPC radiopharmaceutical Lu-177-DGUL.

Keytruda remains Merck’s flagship product, generating $29.5 billion in sales last year of the company’s total revenue. It is widely used to treat over 20 types of cancer, including gastric cancer, esophageal cancer, and triple-negative breast cancer.

Despite Keytruda’s success, Merck has struggled to expand its indication for prostate cancer. A 2022 study on mCRPC patients failed to meet primary endpoints, and a 2023 study on metastatic hormone-sensitive prostate cancer (mHSPC) did not achieve statistical significance, leading to its discontinuation.

| | (Cellbion) |

|

◇Billion-Dollar Revenue Potential if Combination Therapy is Commercialized

The prostate cancer market remains highly attractive. According to the International Agency for Research on Cancer, prostate cancer accounted for 7.3% of all new cancer cases worldwide in 2022 (1.5 million cases), making it the fourth most common cancer after lung cancer (12.4%), breast cancer in women (11.6%), and colorectal cancer (9.6%).

Market research firm Global Information (GI) estimates that the prostate cancer treatment market will grow from $14.8 billion in 2022 to $28.4 billion by 2030. If Merck and Cellbion demonstrate efficacy for their combination therapy and successfully commercialize it, industry experts predict multi-billion-dollar revenue potential.

The Phase 2 clinical trials for Lu-177-DGUL in South Korea, a key factor in the partnership, have also shown promise. According to an independent imaging assessment committee, Lu-177-DGUL achieved an ORR of 47.5% among 61 patients, surpassing Pluvicto’s previous Phase 3 results, which reported an ORR of 29.8% in a study of 319 patients. Cellbion has enrolled 91 patients in its Phase 2 trial, with 73 classified as the final analysis group.

Cellbion plans to complete the Phase 2 trial for Lu-177-DGUL in the first half of this year and launch the product around October. The non-reimbursed supply price is reportedly set at 27 million KRW ($20,000). The South Korean Ministry of Food and Drug Safety has designated Lu-177-DGUL as the 11th Global Innovative Fast-Track Drug and an orphan drug, allowing it to receive conditional marketing approval upon successful Phase 2 results without requiring a Phase 3 trial.

Cellbion expects domestic sales of Lu-177-DGUL to reach approximately 37 billion KRW ($28 million) in 2026. The company is also pursuing technology exports, given that Pluvicto became a blockbuster drug within two years of its FDA approval in 2022. Industry projections suggest billion-dollar technology export deals are possible. Pluvicto’s 2023 sales reached $980 million.

Industry analysts suggest that long-term revenue could be secured through further development of combination therapies with Merck for prostate cancer. One industry expert stated, “With viable alternatives available, Merck has no reason to choose a competitor’s product, such as Novartis’s, for combination therapy with Keytruda. Depending on the results of Lu-177-DGUL’s Phase 2 trial, Cellbion will have multiple commercialization opportunities to consider.”

![i-Sens Soars 23% on EU CGM Expansion [K-bio pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021300327b.jpg)

![냉탕 온탕 오간 에이프릴바이오…실적 호조에 로킷·휴젤 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021200275b.jpg)